filmov

tv

How Does FIFO or LIFO Work Selling Stocks | FIFO VS LIFO Stock Market

Показать описание

How Does FIFO or LIFO Work Selling Stocks | FIFO VS LIFO Stock Market

Here is the link to Nerd Wallet calculator:

So if you are watching this video you are wondering if you should use the FIFO or LIFO method for selling a portion of your portfolio. Well in this video I'll cover FIFO vs LIFO with regards to short term and long term shares as well as the 2 combined. I'll cover the FIFO method for selling stock and the LIFO method for selling stocks to help you save money. The LIFO method for selling stocks is one that gets passed up a lot because it is not commonly thought about. I'll show you how FIFO versus LIFO is not to be taken lightly.

FIFO LIFO trading equities will help you be more financially fluent. If you haven't seen the LIFO and FIFO explained yet, watch the video to get great content.

Hope this helps Wealth Giants,

Ryan

Intro Credit to ONdraid from panzoid

Follow me on:

Here is the link to Nerd Wallet calculator:

So if you are watching this video you are wondering if you should use the FIFO or LIFO method for selling a portion of your portfolio. Well in this video I'll cover FIFO vs LIFO with regards to short term and long term shares as well as the 2 combined. I'll cover the FIFO method for selling stock and the LIFO method for selling stocks to help you save money. The LIFO method for selling stocks is one that gets passed up a lot because it is not commonly thought about. I'll show you how FIFO versus LIFO is not to be taken lightly.

FIFO LIFO trading equities will help you be more financially fluent. If you haven't seen the LIFO and FIFO explained yet, watch the video to get great content.

Hope this helps Wealth Giants,

Ryan

Intro Credit to ONdraid from panzoid

Follow me on:

Accounting For Beginners #11 / Fifo and Lifo Inventory / Basics

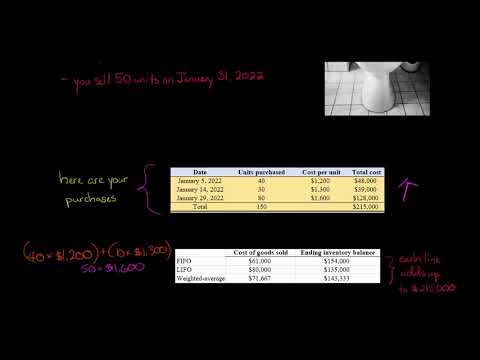

Understanding FIFO, LIFO, and Average Cost Methods for Inventory

FIFO vs LIFO example

FA31 - Inventory - FIFO, LIFO, Weighted Average Explained

How Does FIFO or LIFO Work Selling Stocks | FIFO VS LIFO Stock Market

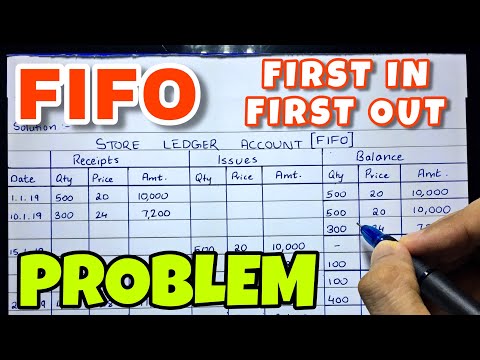

FIFO Method (First In First Out) Store Ledger Account- Problem - BCOM / BBA - By Saheb Academy

First In First Out (FIFO) | Inventory Cost Flows

LIFO FIFO INVENTORY in less than 4 minutes!

Inventory Valuation, Periodic Inventory System, FIFO, LIFO and Weighted Average

FIFO vs. LIFO vs. Weighted Average Cost

cost of goods sold fifo or lifo in excel

LIFO Method (Last In First Out) Store Ledger Account- Problem - BCOM / BBA - By Saheb Academy

How to Calculate LIFO Inventory (Step By Step)

Use FIFO or LIFO with investment accounts?

FIFO vs LIFO

Differences between LIFO and FIFO.

FIFO & LIFO method || inventory management

Why FIFO, LIFO or AVCO is needed?

excel inventory management | fifo and lifo formula

INVENTORY VALUATION (FIFO & WEIGHTED AVERAGE) - PART 1

What is FIFO & LIFO in Supply Chain #supplychain

Module 7, Video 2 - Inventory - FIFO, LIFO, Weighted Average - Problem 7-2A

What is the difference between FIFO and LIFO? - Cracking the Java Coding Interview

First In First Out (FIFO) inventory method

Комментарии

0:05:25

0:05:25

0:10:40

0:10:40

0:10:59

0:10:59

0:11:59

0:11:59

0:06:57

0:06:57

0:15:57

0:15:57

0:11:00

0:11:00

0:03:29

0:03:29

0:17:12

0:17:12

0:06:38

0:06:38

0:11:05

0:11:05

0:21:52

0:21:52

0:06:53

0:06:53

0:05:36

0:05:36

0:05:17

0:05:17

0:02:09

0:02:09

0:03:13

0:03:13

0:01:00

0:01:00

0:05:07

0:05:07

0:40:05

0:40:05

0:00:28

0:00:28

0:11:35

0:11:35

0:01:00

0:01:00

0:06:38

0:06:38