filmov

tv

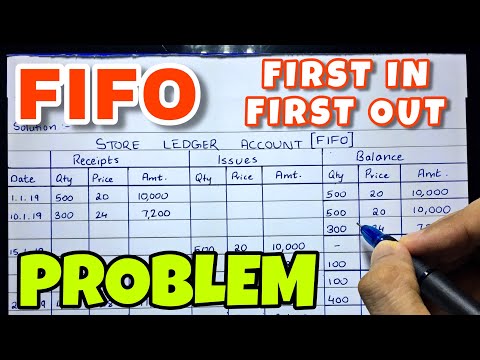

First In First Out (FIFO) | Inventory Cost Flows

Показать описание

In this video you'll learn about Inventory Cost Flow Assumptions. There are three of these:

▪ FIFO - First In First Out

▪ LIFO - Last In First Out

▪ AVCO - Weighted Average Cost Method

This accounting tutorial focusses on FIFO. You'll discover how the First In First Out method works and get to practice using it with an example. This episode is part of a mini-series exploring Inventory in Accounting. You can find the link to the whole playlist here ⬇️

⏱️TIMESTAMPS

00:00 - Intro

01:02 - When do we need Inventory Cost Flow Assumptions?

02:09 - What are Inventory Cost Flow Assumptions?

02:19 - The three assumptions: FIFO, LIFO and AVCO

02:41 - How FIFO works (First In First Out)

03:01 - Accounting with FIFO - Example

04:02 - Step 1: Draw an Inventory Cost Flow Table

04:19 - Step 2: Enter what you know

06:09 - Step 3: Fill in the blanks

09:00 - Step 4: Cost of Goods Sold and Closing Inventory

09:42 - Advantages of FIFO

10:08 - FIFO vs LIFO vs AVCO

10:20 - Disadvantage of FIFO

🔝 CLOUD ACCOUNTING SOFTWARE

🔎FAQ

🚶FOLLOW ME ON

🎬LEARN ACCOUNTING BASICS FOR FREE

________________________

DISCLAIMER

Some of the links above are affiliate links, where I earn a small commission if you click on the link and purchase an item. You are not obligated to do so, but it does help fund these videos in hopes of bringing value to you!

________________________

#accounting #accountingbasics #accountingstuff

Комментарии

0:11:00

0:11:00

0:06:38

0:06:38

0:05:12

0:05:12

0:01:49

0:01:49

0:08:38

0:08:38

0:04:13

0:04:13

0:15:57

0:15:57

0:10:33

0:10:33

0:02:03

0:02:03

0:02:36

0:02:36

0:08:24

0:08:24

0:11:59

0:11:59

0:11:15

0:11:15

0:01:57

0:01:57

0:03:48

0:03:48

0:05:31

0:05:31

0:10:57

0:10:57

0:00:50

0:00:50

0:00:16

0:00:16

0:03:46

0:03:46

0:09:12

0:09:12

0:06:23

0:06:23

0:00:15

0:00:15

0:05:28

0:05:28