filmov

tv

FIFO vs LIFO example

Показать описание

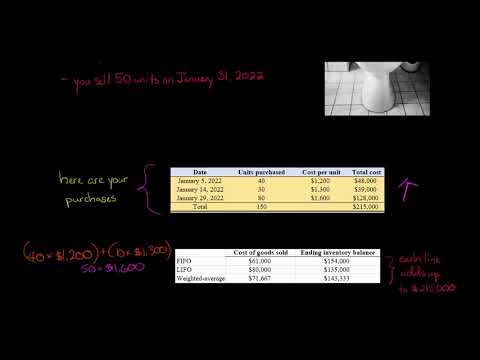

Inventory cost accounting using the FIFO method versus using the LIFO method. The acronym FIFO stands for First In First Out. The acronym LIFO stands for Last In First Out. Both #FIFO and #LIFO are #costaccounting fictions that can lead to very different numbers of Cost Of Goods Sold and Gross Profit. Let’s work through a visual as well as a numerical example of FIFO versus LIFO.

⏱️TIMESTAMPS⏱️

00:00 FIFO vs LIFO

00:24 FIFO vs LIFO example

01:33 How do FIFO and LIFO work

03:04 FIFO vs LIFO inventory accounting

05:31 FIFO LIFO and COGS

09:14 FIFO vs LIFO summary

Related videos:

FIFO inventory accounting

FIFO adjustment from standard costing

LIFO inventory accounting

Philip de Vroe (The Finance Storyteller) aims to make strategy, finance and leadership enjoyable and easier to understand. Learn the business and #accounting vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better stock market investing decisions. Philip delivers #financetraining in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

⏱️TIMESTAMPS⏱️

00:00 FIFO vs LIFO

00:24 FIFO vs LIFO example

01:33 How do FIFO and LIFO work

03:04 FIFO vs LIFO inventory accounting

05:31 FIFO LIFO and COGS

09:14 FIFO vs LIFO summary

Related videos:

FIFO inventory accounting

FIFO adjustment from standard costing

LIFO inventory accounting

Philip de Vroe (The Finance Storyteller) aims to make strategy, finance and leadership enjoyable and easier to understand. Learn the business and #accounting vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better stock market investing decisions. Philip delivers #financetraining in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

Комментарии

0:10:59

0:10:59

0:05:25

0:05:25

0:01:31

0:01:31

0:05:36

0:05:36

0:06:39

0:06:39

0:06:38

0:06:38

0:11:00

0:11:00

0:17:26

0:17:26

0:11:59

0:11:59

0:02:09

0:02:09

0:05:17

0:05:17

0:06:56

0:06:56

0:00:56

0:00:56

0:04:08

0:04:08

0:06:57

0:06:57

0:13:40

0:13:40

0:10:40

0:10:40

0:01:00

0:01:00

0:08:59

0:08:59

0:09:06

0:09:06

0:00:54

0:00:54

0:06:50

0:06:50

0:07:50

0:07:50

0:02:15

0:02:15