filmov

tv

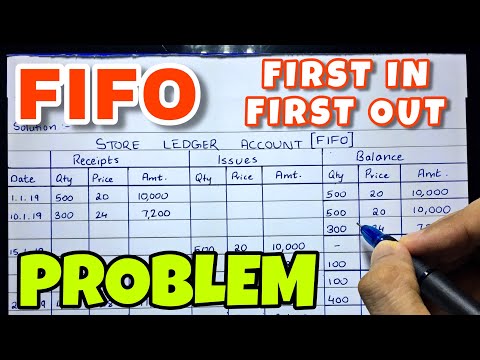

First In First Out (FIFO) inventory method

Показать описание

Inventory cost accounting using the FIFO method. The acronym FIFO stands for First In First Out.

⏱️TIMESTAMPS⏱️

00:00 FIFO acronym explained

00:35 FIFO definition

00:46 FIFO example

01:53 FIFO inventory valuation

04:41 FIFO and COGS

05:57 FIFO accounting summary

I first came across this term when working in a supermarket as a teenager: when replenishing stock, you need to make sure the oldest inventory is in the front and the newest inventory is in the back, so the oldest inventory gets sold first and you avoid getting stuck with obsolete inventory that has gone past the expiry date. The next time I came across #FIFO was when working as a junior cost accountant in manufacturing finance at a plastics factory. In that context, First In First Out (FIFO) is an accounting fiction in #costaccounting that is a major determinant of Cost Of Goods Sold and Gross Profit. If cost per unit goes up over time, and selling price stays flat, you make the highest profit per unit in the earlier periods, as you apply the fiction of “selling the oldest inventory first”.

Let’s work through an example of FIFO. We will do the inventory accounting using the First In First Out method for a hypothetical company called Toy Giraffe Inc. As the name suggests, this is a company buying and selling toy giraffes.

FIFO, First In First Out, is an accounting fiction in cost accounting that is a major determinant of Cost Of Goods Sold and Gross Profit. If cost per unit goes up over time, and selling price stays flat, you make the highest profit per unit in the earlier periods, as you apply the fiction of “selling the oldest inventory first”.

Related videos:

FIFO adjustment from standard costing

LIFO inventory accounting

FIFO vs LIFO example

Philip de Vroe (The Finance Storyteller) aims to make strategy, finance and leadership enjoyable and easier to understand. Learn the business and #accounting vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better stock market investing decisions. Philip delivers #financetraining in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

⏱️TIMESTAMPS⏱️

00:00 FIFO acronym explained

00:35 FIFO definition

00:46 FIFO example

01:53 FIFO inventory valuation

04:41 FIFO and COGS

05:57 FIFO accounting summary

I first came across this term when working in a supermarket as a teenager: when replenishing stock, you need to make sure the oldest inventory is in the front and the newest inventory is in the back, so the oldest inventory gets sold first and you avoid getting stuck with obsolete inventory that has gone past the expiry date. The next time I came across #FIFO was when working as a junior cost accountant in manufacturing finance at a plastics factory. In that context, First In First Out (FIFO) is an accounting fiction in #costaccounting that is a major determinant of Cost Of Goods Sold and Gross Profit. If cost per unit goes up over time, and selling price stays flat, you make the highest profit per unit in the earlier periods, as you apply the fiction of “selling the oldest inventory first”.

Let’s work through an example of FIFO. We will do the inventory accounting using the First In First Out method for a hypothetical company called Toy Giraffe Inc. As the name suggests, this is a company buying and selling toy giraffes.

FIFO, First In First Out, is an accounting fiction in cost accounting that is a major determinant of Cost Of Goods Sold and Gross Profit. If cost per unit goes up over time, and selling price stays flat, you make the highest profit per unit in the earlier periods, as you apply the fiction of “selling the oldest inventory first”.

Related videos:

FIFO adjustment from standard costing

LIFO inventory accounting

FIFO vs LIFO example

Philip de Vroe (The Finance Storyteller) aims to make strategy, finance and leadership enjoyable and easier to understand. Learn the business and #accounting vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better stock market investing decisions. Philip delivers #financetraining in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

Комментарии

0:06:38

0:06:38

0:11:00

0:11:00

0:04:13

0:04:13

0:05:12

0:05:12

0:01:49

0:01:49

0:02:03

0:02:03

0:10:33

0:10:33

0:15:57

0:15:57

0:16:27

0:16:27

0:08:38

0:08:38

0:11:15

0:11:15

0:07:34

0:07:34

0:05:31

0:05:31

0:15:12

0:15:12

0:06:32

0:06:32

0:06:23

0:06:23

0:01:22

0:01:22

0:09:12

0:09:12

0:40:05

0:40:05

0:11:36

0:11:36

0:04:38

0:04:38

0:03:46

0:03:46

0:24:41

0:24:41

0:05:25

0:05:25