filmov

tv

Medicare Supplement Plans With Extra Benefits

Показать описание

Call Us: 800-847-9680

Medicare Supplement Plans with Extra Benefits

Most people know that Medicare Advantage Plans often come with extra benefits like dental, vision and hearing coverage for example.

But did you know that some Medicare supplement insurance policies come with similar extra benefits as well?

Yep, some do.

That is what this video is about. I am going to go over some of the more common added benefits… from the ones I like the least, to the ones I like the most.

There are three tiers of extra benefits some Medicare supplement insurance companies provide. I describe each in this video. I save the best for last.

#MedigapSeminars #medigap #medicareinsurance #medicaresupplement

Medicare Supplement Plans with Extra Benefits

Most people know that Medicare Advantage Plans often come with extra benefits like dental, vision and hearing coverage for example.

But did you know that some Medicare supplement insurance policies come with similar extra benefits as well?

Yep, some do.

That is what this video is about. I am going to go over some of the more common added benefits… from the ones I like the least, to the ones I like the most.

There are three tiers of extra benefits some Medicare supplement insurance companies provide. I describe each in this video. I save the best for last.

#MedigapSeminars #medigap #medicareinsurance #medicaresupplement

Medicare Supplement Plans With Extra Benefits

Do I need a Medicare Supplement Plan?

The Best Medicare Supplement Plans in 2024

Medicare Plan G vs Plan N (New Info!)

Is Plan G The Best Medicare Supplement Plan? The Pros and Cons of Plan G

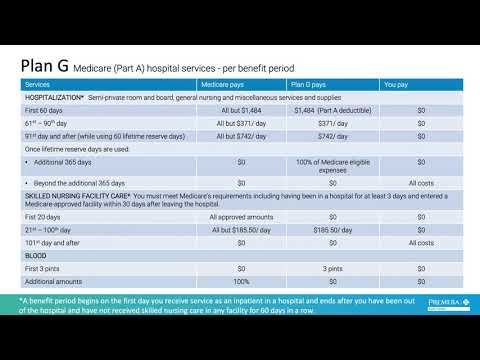

Plan G vs. Plan F Medicare Supplement -Which is the better choice?

Medicare Advantage Plans vs. Medicare Supplement Plans: Which is Better?

Medicare Supplemental Insurance - Best Medicare Supplement Plans for 2023

Medicare OR Medicare Advantage What's BEST for YOU?

Best Medicare Supplement Plans for 2024 - Top 3 Plans!

Do I Need a Medicare Supplement Plan? | Truth about Medigap

Medicare Advantage Plan Reviews ⭐️ (from real people)

Best Medigap Plan 2024 - What Medicare Supplement to Choose 2024

Best Medicare Supplement Plans

Medicare Supplement Plan F (2019) - Is it Worth the Extra Cost?

Medigap Extra Benefits

Medicare Supplement Out-of-Pocket Maximum

Aetna Medicare Supplement Plans

5 Things Medicare Doesn't Cover (and how to get them covered)

Best Medicare Supplement Plan 2024 - Best Medigap Plan 2024

Blue Cross Blue Shield Medicare Supplement Review

Cigna Medicare Supplement Insurance

Premera Medicare Supplement plan overview 2022

What are the Best Medicare Supplemental Plans?

Комментарии

0:12:27

0:12:27

0:07:46

0:07:46

0:10:22

0:10:22

0:12:28

0:12:28

0:14:34

0:14:34

0:07:22

0:07:22

0:08:28

0:08:28

0:20:19

0:20:19

0:07:53

0:07:53

0:12:53

0:12:53

0:05:30

0:05:30

0:10:23

0:10:23

0:23:29

0:23:29

0:26:33

0:26:33

0:04:24

0:04:24

0:01:00

0:01:00

0:15:04

0:15:04

0:05:19

0:05:19

0:10:17

0:10:17

0:16:37

0:16:37

0:06:18

0:06:18

0:06:21

0:06:21

0:04:34

0:04:34

0:09:19

0:09:19