filmov

tv

Old Vs New Tax Regime? Which one to choose?

Показать описание

Convey News App

Convey Simulator App

Subscribe To Our Convey Pitchers Newsletter.

Withdraw all the knowledge you need.

FREE Stock Market Crash Course Youtube Series

**********************************************

Start investing with Upstox!

Join Us On Telegram

**********************🙏🏻**********************

Other Channels Convey by FinnovationZ for Different Region of People:

✔ Convey World for Stock Market & related-information in English:

✔ Convey Marathi for stock market news and updates in Marathi,:

**********************🙏🏻**********************

✔ Become a Member of Convey, Join our YouTube Memberships:

You can follow us on 👉🏻 Social Media handles for more content

Join this channel to get access to perks:

Convey Simulator App

Subscribe To Our Convey Pitchers Newsletter.

Withdraw all the knowledge you need.

FREE Stock Market Crash Course Youtube Series

**********************************************

Start investing with Upstox!

Join Us On Telegram

**********************🙏🏻**********************

Other Channels Convey by FinnovationZ for Different Region of People:

✔ Convey World for Stock Market & related-information in English:

✔ Convey Marathi for stock market news and updates in Marathi,:

**********************🙏🏻**********************

✔ Become a Member of Convey, Join our YouTube Memberships:

You can follow us on 👉🏻 Social Media handles for more content

Join this channel to get access to perks:

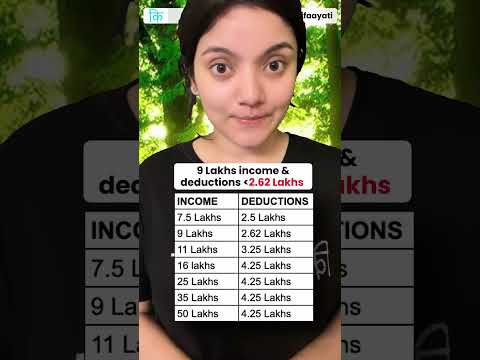

Which is the best tax regime for you? | Money Psychology

Comparison of Old Tax Regime v/s New Tax regime

New Income Tax Slab 2023-24 | New Tax Regime vs Old Tax Regime [with Calculator]

Old vs New Regime | Which is better? Tax Saving Options | Income Tax Planning Guide 2024

Old Vs New Tax Regime (Part 1)

Best Tax Regime according to your salary | Old vs New Tax Regime , Which one saves you more money?

New Tax Regime vs Old Tax Regime SIMPLIFIED

New Income Tax Slabs 2024-25 | New Tax Regime vs Old Tax Regime Calculation | Budget 2024 Analysis

New Tax Regime vs Old Tax regime Which is Better? Income Tax Calculation Examples

New Vs Old Tax Regime Malayalam | E filing Malayalam AY 2024-25 |CA Subin VR

2024 Income TAX Saving Tips | Old vs New Tax Regime with Calculation

Old vs new tax regime: Which one should YOU choose? | Old vs new tax regime 2023

Old Tax Regime Vs New Tax: What's The Best For Salaried Employees?

New Tax Regime vs Old Tax Regime: Which Is Better? | Economy | UPSC

New Tax Regime vs Old Tax Regime 2023 In Telugu - Which Is Better | Tax Saving Tips |With Calculator

Old vs New Tax Regime 2024: Which is Better? #incometax #tamil #newregime #newtaxregime

Old Tax vs New Tax Regime | Which Is More Beneficial After Budget 2023?

New Income Tax Slabs 2024 | Old vs New Income Tax Calculation ? |Salary Wise Tax | New Tax Regime

Old Vs New Tax Regime? Which one to choose?

Old vs New Income Tax Malayalam -CA Subin VR

Income tax Deductions for Salaried Employees | Tax Planning Guide | Old vs New Tax Regime

2024 Income Tax Saving and Tax Planning Guide | New vs Old Regime | Assetyogi Show #4

New tax regime | How to save income tax in FY24

Old vs New Tax regime with calculations | Calculate Income tax for 2024

Комментарии

0:12:34

0:12:34

0:00:20

0:00:20

0:13:35

0:13:35

0:12:38

0:12:38

0:08:04

0:08:04

0:15:28

0:15:28

0:00:47

0:00:47

0:11:02

0:11:02

0:11:53

0:11:53

0:05:24

0:05:24

0:12:14

0:12:14

0:13:30

0:13:30

0:05:34

0:05:34

0:14:37

0:14:37

0:16:59

0:16:59

0:15:14

0:15:14

0:06:41

0:06:41

0:10:28

0:10:28

0:01:00

0:01:00

0:13:13

0:13:13

0:18:30

0:18:30

0:22:57

0:22:57

0:10:48

0:10:48

0:24:00

0:24:00