filmov

tv

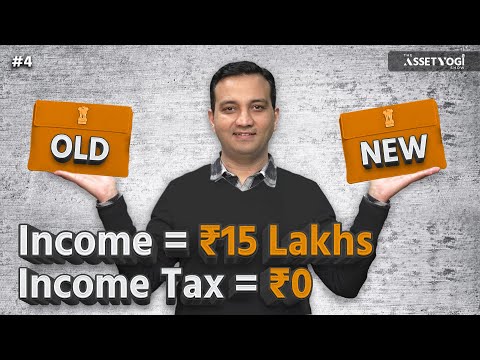

Comparison of Old Tax Regime v/s New Tax regime

Показать описание

People are always confused with 2 tax regimes being active now! Which one to choose? What kind of rules are there in both? How much to save? etc. etc.!

Proper tax savings being done will always make old tax regime as beneficial for most of people. In case you are going with new tax regime, no need to showcase any kind of savings! But again, you might loose more tax becuase of that. Always do savings to save your tax today and to secure your future tomorrow !

Proper tax savings being done will always make old tax regime as beneficial for most of people. In case you are going with new tax regime, no need to showcase any kind of savings! But again, you might loose more tax becuase of that. Always do savings to save your tax today and to secure your future tomorrow !

Comparison of Old Tax Regime v/s New Tax regime

Old v/s New Tax Regime Explained | Money Psychology

New Income Tax Slab 2023-24 | New Tax Regime vs Old Tax Regime [with Calculator]

New Tax Regime vs Old Tax regime Which is Better? Income Tax Calculation Examples

Old vs New Regime | Which is better? Tax Saving Options | Income Tax Planning Guide 2024

Old Vs New Tax Regime (Part 1)

Old Tax Regime vs New Tax Regime with Updated Calculator

Live comparison: Old vs New Tax regime

Best Tax Regime according to your salary | Old vs New Tax Regime , Which one saves you more money?

New Vs Old Tax Regime Malayalam | E filing Malayalam AY 2024-25 |CA Subin VR

2024 Income Tax Saving and Tax Planning Guide | New vs Old Regime | Assetyogi Show #4

New Tax Regime vs old Tax Regime - Budget 2023 | How to choose | with Excel Calculator - AY 24-25

Old vs New Income Tax Malayalam -CA Subin VR

Old vs New Income Tax Regime: How Are They Different?

New Income Tax Slabs 2024-25 | New Tax Regime vs Old Tax Regime Calculation | Budget 2024 Analysis

Old vs New Tax Regime 2024: Which is Better? #incometax #tamil #newregime #newtaxregime

2024 Income TAX Saving Tips | Old vs New Tax Regime with Calculation

Income tax Deductions for Salaried Employees | Tax Planning Guide | Old vs New Tax Regime

New Tax Regime vs Old Tax Regime 2023 | Old Tax Regime vs New Tax Regime Comparsion

Old vs new tax regime: Which one should YOU choose? | Old vs new tax regime 2023

Calculate INCOME TAX for 2024! | Ankur Warikoo Hindi

New Income Tax Slabs 2024 | Old vs New Income Tax Calculation ? |Salary Wise Tax | New Tax Regime

#TaxmannWebinar | Personal Tax Regime – Old vs New

How to Pay Zero Tax in 2024 | Old Vs New Income Tax Regime

Комментарии

0:00:20

0:00:20

0:12:34

0:12:34

0:13:35

0:13:35

0:11:53

0:11:53

0:12:38

0:12:38

0:08:04

0:08:04

0:08:37

0:08:37

0:00:37

0:00:37

0:15:28

0:15:28

0:05:24

0:05:24

0:22:57

0:22:57

0:19:01

0:19:01

0:13:13

0:13:13

0:02:04

0:02:04

0:11:02

0:11:02

0:15:14

0:15:14

0:12:14

0:12:14

0:18:30

0:18:30

0:14:08

0:14:08

0:13:30

0:13:30

0:18:31

0:18:31

0:10:28

0:10:28

1:20:42

1:20:42

0:16:25

0:16:25