filmov

tv

New Tax Regime vs Old Tax Regime: Which Is Better? | Economy | UPSC

Показать описание

April Batch Starts on 16th April | Hurry, Enroll Now!

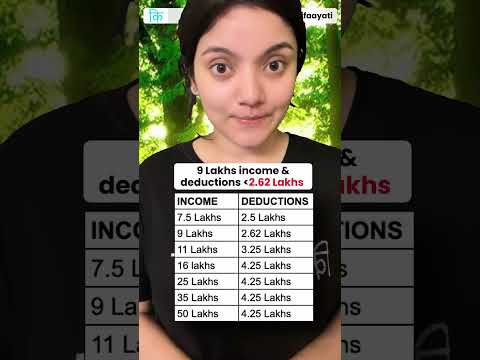

In this video, compare the old and new tax regimes to determine which is more beneficial for taxpayers and the economy. Analyze key differences, advantages, and disadvantages of each system. Explore the impact of tax reforms on individual taxpayers, businesses, and the overall economy. Prepare effectively for UPSC examinations with comprehensive insights into taxation policies and economic implications.

Batch Starting on 13th April 2024 | Daily Live Classes at 6:00 PM

UPSC IAS Live GS Foundation 2025 P2I Hindi Batch 5

बैच 15 अप्रैल 2024 से शुरू हो रहा है | बैच का समय शाम 6:00 बजे

UPSC IAS Live GS Foundation 2025 P2I English Batch 5

Batch Starting on 19th April 2024 | Daily Live Classes at 6:00 PM

UPSC IAS Long Term P2I Foundation LIVE 2026 Batch 5

Batch Starting on 20th April 2024 | Daily Live Classes at 6:00 PM

UPSC IAS Live SIP+ Last Batch 2024

Batch Started on 13th March'2024 | Class Timing - 11:00 AM

UPSC IAS Prelims to Interview ( P2I) 2024 Live Advanced Batch 6

Batch Started on 16th November 2023 | Daily Live Classes at 6:30 PM

(PSIR, Sociology, History, Geography, Pub Ad, Anthropology, Mathematics)

Set of 18 - General Studies books

UPSC IAS (Mains) PSIR Optional Live 2025 (Comprehensive) April Batch

Batch Starting on 15th April, 2024 | Class Timing -1:00 PM

UPSC IAS (Mains) Sociology Optional Live 2025 (Comprehensive) April Batch

Batch Starting on 30th April, 2024 | Class Timing -1:00 PM

Uttar Pradesh PSC (Pre + Mains) Live Foundation Saksham Batch

Batch Starting on 12th April 2024 | Daily Live Classes at 6:00 PM

Bihar PSC (Pre + Mains) Live Foundation Saksham Batch

Batch Starting on 12th April 2024 | Daily Live Classes at 6:00 PM

Vipan Sir Courses - Courses to help you gain an edge with MCQs preparation

Buy our Best Selling UPSC CSE Books

From Online Stores

StudyIQ App/Store

Amazon

Flipkart

📌 Connect with [Our Social Media Platform] :

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

#STUDYIQ #STUDYIQIAS #STUDYMATERIAL #LATEST #HINDI #STUDYIQLATEST

Комментарии

0:11:02

0:11:02

0:13:35

0:13:35

0:12:34

0:12:34

0:12:38

0:12:38

0:11:53

0:11:53

0:05:24

0:05:24

0:00:44

0:00:44

0:00:47

0:00:47

0:15:28

0:15:28

0:01:00

0:01:00

0:15:14

0:15:14

0:00:52

0:00:52

0:00:20

0:00:20

0:01:01

0:01:01

0:01:01

0:01:01

0:08:04

0:08:04

0:10:48

0:10:48

0:00:59

0:00:59

0:06:41

0:06:41

0:44:04

0:44:04

0:00:45

0:00:45

0:01:01

0:01:01

0:01:30

0:01:30

0:01:00

0:01:00