filmov

tv

New Tax Regime vs Old Tax Regime 2023 In Telugu - Which Is Better | Tax Saving Tips |With Calculator

Показать описание

Courses on Personal Finance

ffreedom App is India's No1 Livelihood Education platform featuring 960+ video courses on Personal Finance, Business & Farming taught by super successful people from respective fields. Join over 1 crore learners from India who are on their mission to increase their income by 10 times.

New Tax Regime vs Old Tax Regime 2023 In Telugu - Which Is Better | Tax Saving Tips |With Calculator

#newtaxregime #newtaxregime2023 #newtax #budget2023highlights #budget #budget2023news

Old v/s New Tax Regime Explained | Money Psychology

New Income Tax Slab 2023-24 | New Tax Regime vs Old Tax Regime [with Calculator]

Comparison of Old Tax Regime v/s New Tax regime

New Income Tax Slabs 2024-25 | New Tax Regime vs Old Tax Regime Calculation | Budget 2024 Analysis

Old vs New Regime | Which is better? Tax Saving Options | Income Tax Planning Guide 2024

New Tax Regime vs Old Tax regime Which is Better? Income Tax Calculation Examples

Old Vs New Tax Regime (Part 1)

New Tax Regime vs Old Tax Regime: Which Is Better? | Economy | UPSC

New Tax Regime vs Old Tax Regime 2024-25 | Explainer | Money9 English

Old Tax Regime Vs New Tax: What's The Best For Salaried Employees?

New Tax Regime vs Old Tax Regime 2024-25 | Income Tax New vs Old Tax Regime Which is Better 2023-24

Old vs New Tax Regime 2024: Which is Better? #incometax #tamil #newregime #newtaxregime

Old Vs New Tax Regime (Part 2)

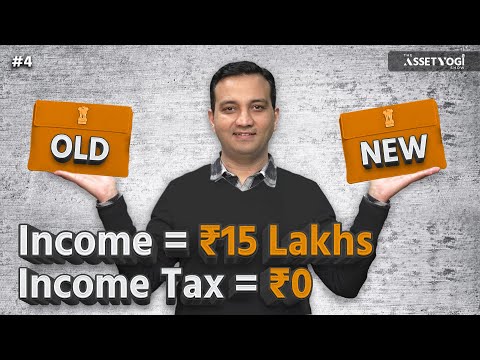

2024 Income Tax Saving and Tax Planning Guide | New vs Old Regime | Assetyogi Show #4

Live comparison: Old vs New Tax regime

Best Tax Regime according to your salary | Old vs New Tax Regime , Which one saves you more money?

Old vs new tax regime: Which one should YOU choose? | Old vs new tax regime 2023

2024 Income TAX Saving Tips | Old vs New Tax Regime with Calculation

New Tax Regime vs Old Tax Regime 2023 In Telugu - Which Is Better | Tax Saving Tips |With Calculator

Old Tax Regime Vs New Tax Regime

Old Tax Regime vs. New Tax Regime: Complete Income Tax Calculation & Savings Guide

New Tax Regime vs old Tax Regime - Budget 2023 | How to choose | with Excel Calculator - AY 24-25

New Tax Regime vs Old Tax Regime | Which is better? | Union Budget 2023 | UPSC

Old Tax Regime vs New Tax Regime with Updated Calculator

Комментарии

0:12:34

0:12:34

0:13:35

0:13:35

0:00:20

0:00:20

0:11:02

0:11:02

0:12:38

0:12:38

0:11:53

0:11:53

0:08:04

0:08:04

0:14:37

0:14:37

0:05:52

0:05:52

0:05:34

0:05:34

0:10:27

0:10:27

0:15:14

0:15:14

0:05:02

0:05:02

0:22:57

0:22:57

0:00:37

0:00:37

0:15:28

0:15:28

0:13:30

0:13:30

0:12:14

0:12:14

0:16:59

0:16:59

0:08:23

0:08:23

0:44:04

0:44:04

0:19:01

0:19:01

0:19:38

0:19:38

0:08:37

0:08:37