filmov

tv

Interest Rates, Bond Prices & Bond Yield | Economy | By Sivakumar Sir | UPSC | Rau's IAS

Показать описание

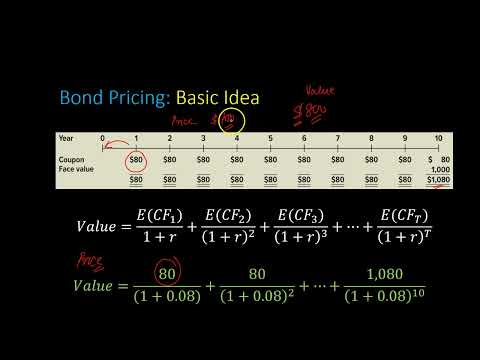

Bonds have an inverse relationship to interest rates. When the cost of borrowing money rises (when interest rates rise), bond prices usually fall, and vice-versa.

Most bonds pay a fixed interest rate that becomes more attractive if interest rates fall, driving up demand and the price of the bond.

Conversely, if interest rates rise, investors will no longer prefer the lower fixed interest rate paid by a bond, resulting in a decline in its price.

Yield of a bond is the ratio of interest earned to price of the bond, when the price of bond rises, the yield reduces and vice-versa.

---------------

🎯Watch more videos of Sivakumar Sir

--------------

🎯Economics Optional Batches

---------------

🎯 RAU’S IAS ONLINE FOR UPSC/IAS - ELEARN

-----------------

🎯Connect with Rau’s IAS Study Circle

-----------------

🎯 Go To Website

----------------

#InterestRates #BondPrices #BondYield #basicsofeconomics #Economy #indianeconomy #RausIAS #UPSC #currentaffairs #rauias #conceptsofeconomy #indianeconomy #ias #currentaffairs #economicsoptional #neer #reer #economics #economycurrentaffairs #economicsoptional #economics

Most bonds pay a fixed interest rate that becomes more attractive if interest rates fall, driving up demand and the price of the bond.

Conversely, if interest rates rise, investors will no longer prefer the lower fixed interest rate paid by a bond, resulting in a decline in its price.

Yield of a bond is the ratio of interest earned to price of the bond, when the price of bond rises, the yield reduces and vice-versa.

---------------

🎯Watch more videos of Sivakumar Sir

--------------

🎯Economics Optional Batches

---------------

🎯 RAU’S IAS ONLINE FOR UPSC/IAS - ELEARN

-----------------

🎯Connect with Rau’s IAS Study Circle

-----------------

🎯 Go To Website

----------------

#InterestRates #BondPrices #BondYield #basicsofeconomics #Economy #indianeconomy #RausIAS #UPSC #currentaffairs #rauias #conceptsofeconomy #indianeconomy #ias #currentaffairs #economicsoptional #neer #reer #economics #economycurrentaffairs #economicsoptional #economics

Комментарии

0:02:48

0:02:48

0:03:07

0:03:07

0:13:16

0:13:16

0:05:17

0:05:17

0:03:04

0:03:04

0:04:45

0:04:45

0:04:47

0:04:47

0:07:48

0:07:48

0:05:12

0:05:12

0:03:47

0:03:47

0:18:56

0:18:56

0:07:18

0:07:18

0:03:55

0:03:55

0:15:28

0:15:28

0:06:42

0:06:42

0:02:47

0:02:47

0:54:28

0:54:28

0:05:19

0:05:19

0:15:37

0:15:37

1:08:37

1:08:37

0:04:59

0:04:59

0:10:26

0:10:26

0:06:44

0:06:44

0:02:31

0:02:31