filmov

tv

Infinite Banking Explained - Becoming Your Own Banker

Показать описание

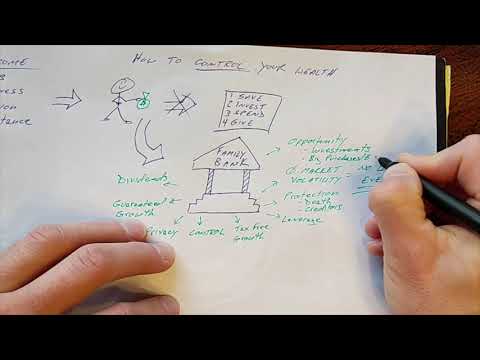

Infinite banking also known as becoming your own banker is a sales concept using whole life insurance that seeks to eliminate the use of banking institutions. Why pay interest to a bank when you can pay it back to yourself? Better yet, you can recycle your money an infinite amount of times! This is how we get the sales concept of infinite banking.

Sounds great in theory, but does it actually work using whole life?

Maybe the better question is does it work BETTER than other banking alternatives?

Is whole life the best vehicle for this velocity of money infinite banking idea?

There are tons of mistruths surrounding this infinite banking or becoming your own banker concept.

Made popular by the likes of Nelson Nash and Pamela Yellen this video aims to tackle one of the most common Becoming your own banker illustrations of buying cars through your life insurance policy loans versus using the traditional banking channels.

The Infinite Banking Concept explained

Infinite Banking Explained - Becoming Your Own Banker

Infinite Banking Explained in 12 Minutes by a 'Recovering CPA'

The Infinite Banking System Explained (Full Breakdown!)

Nelson Nash Explains Infinite Banking

The Infinite Banking Concept EXPLAINED! And How To Get Started | Chris Naugle

Infinite Banking Concept Explainer Cartoon [What is it and how does it work?]

Infinite Banking Concept Explained - Full Explanation - Becoming Your Own Banker

This Is Nelson Nash: The Creator of The Infinite Banking Concept

Infinite Banking: Secrets to Becoming Your Own Banker #beyourownbank #infinitebanking

Infinite Banking Concept EXPLAINED - Be Your Own Bank!

Why Infinite Banking is a SCAM!

Get RICH by Becoming Your Own BANK (Infinite Banking Concept)

Infinite Banking Concept Explained

Becoming Your Own Banker | Unleash the Power of the Infinite Banking Concept

Infinite Banking Concept Explained (Honest and Unbiased)

How I lost $534,000 Through Infinite Banking - The Chris Naugle

Becoming Your Own Banker: Part 30 - Infinite Banking Process Explained

Infinite Banking Explained: How to Become Your Own Bank and Build Wealth #infinitebanking

The Infinite Banking Concept, Explained

How to use Whole Life Insurance to Get Rich (Become your own Bank)

The Infinite Banking Concept Explained

What is the INFINITE BANKING Concept? #velocitybanking #IBC

Become Your Own Bank | Infinite Banking Explained

Комментарии

0:04:27

0:04:27

0:29:19

0:29:19

0:12:04

0:12:04

0:21:22

0:21:22

0:10:24

0:10:24

0:23:07

0:23:07

0:04:41

0:04:41

0:13:48

0:13:48

1:02:06

1:02:06

0:48:02

0:48:02

0:05:37

0:05:37

0:09:17

0:09:17

0:11:05

0:11:05

0:24:50

0:24:50

0:51:30

0:51:30

0:27:02

0:27:02

0:40:28

0:40:28

0:21:36

0:21:36

0:01:48

0:01:48

0:00:16

0:00:16

0:10:54

0:10:54

0:06:45

0:06:45

0:05:15

0:05:15

0:49:24

0:49:24