filmov

tv

From Paying EMIs to Earning 76k Passive Income in JUST 5 Years?

Показать описание

Join us as we explore the inspiring journey of Dhirendra Kumar, a Chartered Accountant from Mumbai, as he gets candid about overcoming a personal and financial crises to achieve success. Learn how he manages a 4 crore real estate portfolio, earning 75k in passive income monthly, and gain insights into his views on the importance of passive income, choosing between commercial and residential properties, and his idea of financial independence.

0:00 - Introduction

0:55 - Salary Growth

1:18 - Why was Passive Income necessary?

3:03 - How He Cleared Majority of Loans?

4:55 - Why ULIPs are bad investments?

5:49 - Working in Qatar

7:35 - Passive Income & Real Estate

8:55 - Investing in Commercial Properties

9:38 - Equity vs Real Estate?

10:03 - Commercial vs Residential Under-construction Properties

12:00 - Combining Equity & Real Estate

13:58 - Portfolio Allocation

14:38 - Expenses & Being Net Debt Free

15:44 - What He Learned?

From Paying EMIs to Earning 76k Passive Income in JUST 5 Years?

From Paying EMIs to ₹ 90,000 Passive Income

Is ALL your SALARY going into EMIs?! Become DEBT-FREE! | Ankur Warikoo Hindi

Does your salary go in just EMIs? | Money Psychology

How Banks Earn From No-Cost EMIs - Explained #moneymindset #money #nocostemi

Investing vs Loan Repayment | 2022 | CA Rachana Ranade

How much of your income should go towards EMIs? Why?

A Smart Way to Buy Smartphone: Earn Interest instead of paying EMIs | Buy MacBook

Missed Your Home Loan EMI Payment? Do This Next.

Buying a PROPERTY for PASSIVE INCOME

Get OUT of LOAN and DEBT! | Repay Loans quickly 2023! | Ankur Warikoo Hindi

How to RE-PAY LOANS Quickly? | Ankur Warikoo #shorts

Regular Income from Mutual Funds by SWP #investing #investment #mutualfund #swp #monthlyincome

0% Interest EMIs - GOOD or BAD?

Legal Lines || If you can't pay loan emis.. don't worry.. see this full videos

Don't Pay Many EMIs | Benefits of Debt Consolidation in Tamil | Yuvarani

Are EMIs Eating Up Your Salary? Discover How to Become Debt-Free!

Interest-free loan! #LLAShorts 371

7 Simple Steps To Become Debt Free | Money Series | Venu Kalyan Business & Life Coach

What happens when you don't pay your EMIs regularly?

Loans jaldi repay kariye! | Pay off debt faster! | Ankur Warikoo Hindi

Full Payment or EMIs? Which one should YOU prefer? | Personal Finance 2023 Ankur Warikoo Hindi

Should You Transfer Your Home Loan?

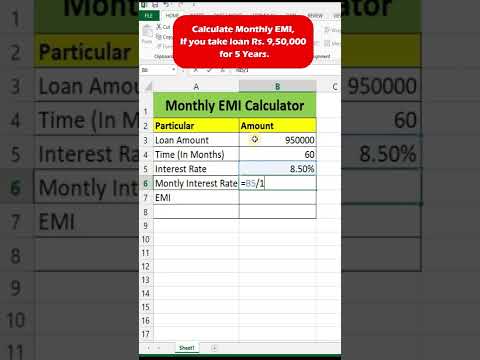

Calculate Monthly EMI for your loan amount🤩🤩

Комментарии

0:16:58

0:16:58

0:17:28

0:17:28

0:28:10

0:28:10

0:13:55

0:13:55

0:01:00

0:01:00

0:17:15

0:17:15

0:08:16

0:08:16

0:00:55

0:00:55

0:00:55

0:00:55

0:00:45

0:00:45

0:19:37

0:19:37

0:00:42

0:00:42

0:00:47

0:00:47

0:01:00

0:01:00

0:06:30

0:06:30

0:07:59

0:07:59

0:01:43

0:01:43

0:01:00

0:01:00

0:24:33

0:24:33

0:00:13

0:00:13

0:17:47

0:17:47

0:13:49

0:13:49

0:00:42

0:00:42

0:00:34

0:00:34