filmov

tv

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) | Explained with Example

Показать описание

In this lesson, we explain the coupon rate, current yield, and yield to maturity (YTM). We go through the coupon rate formula, current yield formula, and the yield to maturity formula. We also explain the difference between the face value and the market value of the bond and their relationship to the coupon rate, current yield, and yield to maturity (YTM). We go through examples of calculating the coupon rate, current yield, and the yield to maturity (YTM). We also show how to calculate the yield to maturity using excel.

Check out other straightforward examples and business-related topics on our channel.

We also offer one-on-one tutorials at reasonable rates as well as other accounting and tax services. Email us and/or visit our website or FaceBook page for more info.

Connect with us:

Check out other straightforward examples and business-related topics on our channel.

We also offer one-on-one tutorials at reasonable rates as well as other accounting and tax services. Email us and/or visit our website or FaceBook page for more info.

Connect with us:

Coupon Rate vs Yield To Maturity

A bond's coupon vs. current yield vs. yield to maturity: StreetSmarts

Coupon Rate vs Yield for a Bond: A Simple Explanation for Kids and Beginners

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) | Explained with Example

Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate

A Bond's Coupon vs. Current Yield vs. Yield to Maturity

How does yield-to-maturity work?

Bond Prices Vs Bond Yield | Inverse Relationship

ACCA - FM Revision Game Plan (03)

Bond Coupon Rate vs Yield

Current Yield and How it is Related to Yield to Maturity

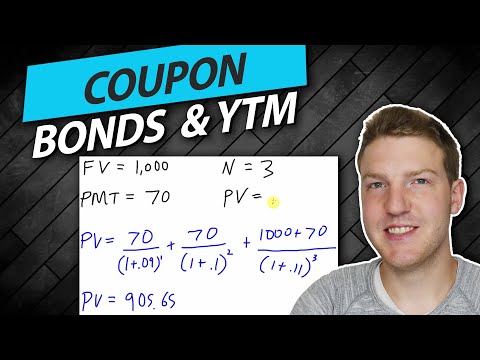

Calculate Yield to Maturity of a Coupon Bond in 2 Minutes

Why Bond Yields Are a Key Economic Barometer | WSJ

Coupon Rate Vs. Yield To Maturity

Computing the Current Yield of a Bond

What does Coupon Rate mean?

What does yield mean? | Marketplace Whiteboard

Difference in Yield to Maturity and Coupon Rate of Bond| Why Yield and coupon rate are not same

What is Yield to Maturity? | How to Calculate YTM? | CA Rachana Ranade

Coupon Rate Vs YTM

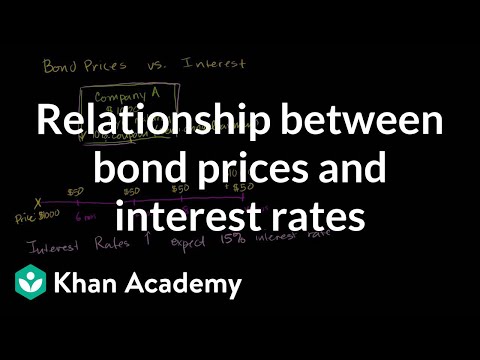

Relationship between bond prices and interest rates | Finance & Capital Markets | Khan Academy

Current Yield vs Capital Gain Yield for Each Bond Type

Coupon rate vs Yield - Corporate bond

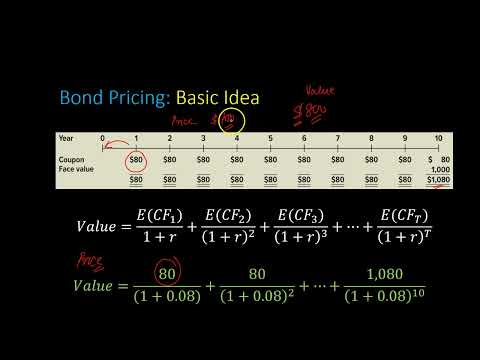

Bond Prices And How They Are Related To Yield to Maturity (YTM)

Комментарии

0:00:29

0:00:29

0:03:47

0:03:47

0:02:01

0:02:01

0:23:42

0:23:42

0:00:36

0:00:36

0:03:53

0:03:53

0:02:23

0:02:23

0:04:45

0:04:45

2:34:56

2:34:56

0:01:01

0:01:01

0:11:57

0:11:57

0:02:05

0:02:05

0:05:17

0:05:17

0:00:38

0:00:38

0:05:38

0:05:38

0:01:56

0:01:56

0:02:21

0:02:21

0:10:28

0:10:28

0:16:34

0:16:34

0:00:38

0:00:38

0:13:16

0:13:16

0:03:25

0:03:25

0:06:20

0:06:20

0:15:37

0:15:37