filmov

tv

Current Yield and How it is Related to Yield to Maturity

Показать описание

In this video, I explain what is meant by a bond's current yield and how it is related to its yield to maturity (YTM). In the process I also explain why, as long a bond's YTM remains constant, the price of a premium bond will consistently fall and why the price of a discount bond will consistently rise as they both approach maturity.

Students will particularly find this video useful in understanding parts of Chapter 8 (Interest Rates and Bond Valuation) of Corporate Finance (13th Edition) by Ross, Westerfield, Jaffe and Jordan.

Students will particularly find this video useful in understanding parts of Chapter 8 (Interest Rates and Bond Valuation) of Corporate Finance (13th Edition) by Ross, Westerfield, Jaffe and Jordan.

Current Yield and How it is Related to Yield to Maturity

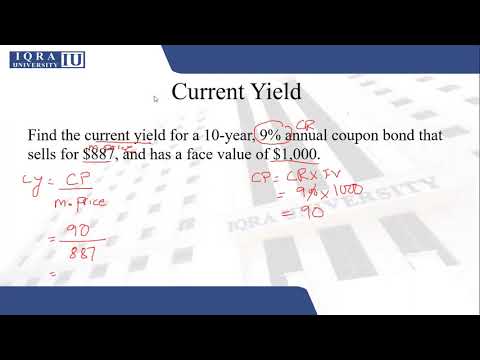

Computing the Current Yield of a Bond

Current yield for the SIE exam and Series 7 exam ( super fast) #shorts

Types of Yield: Current Yield & Yield to Maturity

A bond's coupon vs. current yield vs. yield to maturity: StreetSmarts

Analysis of Investment - Current Yield

Securities Exam MATH MADE EASY Current Yield with Suzy Rhoades

Current Yield is very testable. This test prep vendor question is outrageous.

What does yield mean? | Marketplace Whiteboard

Why Bond Yields Are a Key Economic Barometer | WSJ

Coupon Rate vs Yield To Maturity

How does yield-to-maturity work?

Intro to Investing In Bonds - Current Yield, Yield to Maturity, Bond Prices & Interest Rates

A Bond's Coupon vs. Current Yield vs. Yield to Maturity

Coupon Rate vs Current Yield vs Yield to Maturity (YTM) | Explained with Example

Current Yield is TESTABLE! What an Investment Pays DIVIDED by What is Cost (Current Market Price)

What Is The Yield Of A Bond? - SmarterWithMoney

Unit 7.4-1 || Bond Valuation || Bond yields || Current yield

Current Yield vs Capital Gain Yield for Each Bond Type

Aula 18 - Yield to Maturity, Current Yield and Coupon Rate

Video #7 :- Current Yield

Macro Minute -- Bond Prices and Interest Rates

The Yield Curve Hasn’t Been Inverted this Long Since 1929… (It Won’t End Well)

Current yield in fundamentals of investment | Bond Yield | Bond current yield calculation |

Комментарии

0:11:57

0:11:57

0:05:38

0:05:38

0:00:58

0:00:58

0:03:27

0:03:27

0:03:47

0:03:47

0:00:49

0:00:49

0:10:42

0:10:42

0:09:32

0:09:32

0:02:21

0:02:21

0:05:17

0:05:17

0:00:29

0:00:29

0:02:23

0:02:23

0:36:20

0:36:20

0:03:53

0:03:53

0:23:42

0:23:42

0:03:30

0:03:30

0:02:22

0:02:22

0:10:01

0:10:01

0:03:25

0:03:25

0:05:14

0:05:14

0:07:20

0:07:20

0:02:48

0:02:48

0:05:42

0:05:42

0:11:38

0:11:38