filmov

tv

Was MMT Right About Inflation? | Stephanie Kelton (The Deficit Myth)

Показать описание

LIKE CHATTING ECON WITH ME?

△ I have a private Discord server for Senior and Chief economist Patrons / members.

Otherwise I sometimes hang out in two Discord servers:

MAIN CHANNEL:

Timestamps:

0:00 - introduction

1:24 - is MMT still relevant?

4:05 - Biden stimulus package

6:42 - the Covid inflation spike

19:18 - Biden's unpopular economy

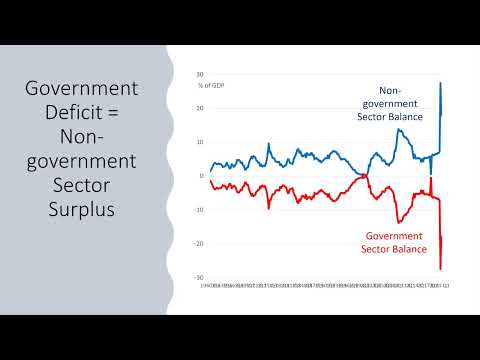

27:07 - government is no household

29:10 - Northern Europe's Deficit Obsession

31:52 - MMT on Inflation post Covid

36:17 - inflation targeting government

38:57 - role of the central bank

42:10 - monetary policy induced disinflation?

46:16 - higher rates more inflation?

57:53 - government cb cooperation

1:00:14 - The UK experience

1:04:00 - MMT outside the USA

1:07:20 - wrapping up

Guest:

Host: Dr. Joeri Schasfoort @Money & Macro

Professor Stephanie Kelton

Was MMT Right About Inflation? | Stephanie Kelton (The Deficit Myth)

Was Modern Monetary Theory Right About Inflation? | Unlearning Economics

Modern Monetary Theory Explained - Is MMT Right or Wrong?

Prof. Antony Davies: Modern Monetary Theory is Wrong - Here's why

The MMT Inflation Controversy | Unlearning Economics

How Money Works | MMT, Inflation, and Taxes

Debunking 4 Myths About Inflation | Robert Reich

MMT Kritik, Gegenargumente und die Inflation

What is Actually Causing Inflation? A Deep Dive (ft. @unlearningeconomics9021)

MMT: Inflation Is The Constraint To Government Deficits

Milton Friedman on Keynesian Economics

MMT Is Misunderstood | Warren Mosler

✨How Modern Monetary Theory (MMT) Predicted The 2008 Financial Crisis✨ft. Yeva Nersisyan #podcast...

The Problem with the “Inflation Reduction” Act

What Causes Inflation - MMT & Python - Machine Learning

Was ist die Modern Monetary Theory (MMT)? (deutsch)

The Deficit Myth: The Biggest Lie In Politics

Will MMT punish working people with tax rises if there is inflation?

Inflation - economic policy and MMT.

Inflation & MMT - When Will Inflation Stop

Randy Wray: Should We Blame MMT for High Inflation?

Inflation aus Sicht der Modern Monetary Theory (MMT)

Professor Randall Wray - Modern Monetary Theory in the Time of Inflation

Economic Collapse: Stephanie Kelton's MMT: Revolution or Disaster?

Комментарии

1:07:52

1:07:52

0:06:24

0:06:24

0:21:59

0:21:59

0:05:30

0:05:30

0:04:39

0:04:39

0:04:06

0:04:06

0:02:53

0:02:53

0:12:24

0:12:24

0:58:57

0:58:57

0:03:17

0:03:17

0:04:49

0:04:49

1:46:59

1:46:59

0:01:00

0:01:00

0:00:56

0:00:56

0:22:34

0:22:34

0:07:46

0:07:46

0:34:26

0:34:26

0:07:57

0:07:57

0:07:12

0:07:12

0:25:29

0:25:29

0:45:21

0:45:21

0:08:41

0:08:41

1:34:02

1:34:02

0:07:00

0:07:00