filmov

tv

Revenue Recognition. Intermediate Accounting

Показать описание

In this session, I explain revenue recognition. Revenue recognition is a generally accepted accounting principle (GAAP) that identifies the specific conditions in which revenue is recognized and determines how to account for it. Typically, revenue is recognized when a critical event has occurred, and the dollar amount is easily measurable to the company.

#CPAEXAM #intermediateaccounting#accountingstudent

#CPAEXAM #intermediateaccounting#accountingstudent

Revenue Recognition Principle in TWO MINUTES!

Revenue Recognition For Long Term Contracts | Percentage Of Completion | Intermediate Accounting

Intermediate Accounting: Revenue Recognition Lecture (6a)

Revenue Recognition. Intermediate Accounting

Revenue Recognition - Intermediate Accounting Chapter 18

Revenue recognition explained

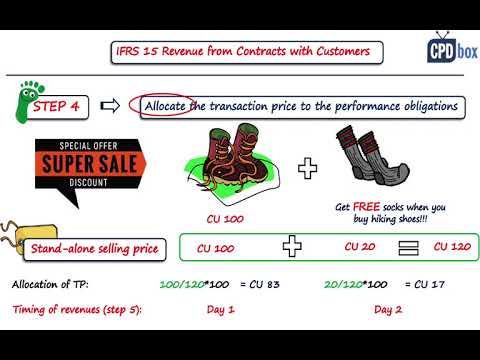

5-step Model for Revenue Recognition under IFRS 15 + Example + Journal entries

IFRS 15 Revenue from contract with customer | Revenue recognition | Intermediate accounting | Part 1

Intermediate Accounting: Revenue Recognition Problems (6b)

Financial Accounting 101: Revenue Recognition Principle - Accrual Accounting Basis

Chapter 4 5 step revenue recognition

Chapter#6 Revenue Recognition

Revenue Recognition ASC 606 Explained via Example

Revenue Recognition

Intermediate Financial Accounting, Revenue recognition for long term Contracts, IFRS 15, #exitexam

IFRS 15 Revenue from Contracts with Customers summary - applies in 2024

AS 9 in ENGLISH - Revenue Recognition - CA Intermediate

AS 9 | Revenue Recognition | Revision in 10 Mints | CA Inter Advanced Accounting | CA Jai Chawla

IFRS 15 Revenue from contract with customer | Revenue recognition | Intermediate accounting | Part 3

Revenue Recognition

Revenue Recognition Concept

CPA Explains Revenue Recognition Under GAAP Rule | With Examples

Accrued revenue vs deferred revenue

ACC 3310 - Chapter 6 Part 1 - Revenue Recognition Concepts

Комментарии

0:02:48

0:02:48

0:09:37

0:09:37

1:12:35

1:12:35

0:19:45

0:19:45

0:18:23

0:18:23

0:07:54

0:07:54

0:10:03

0:10:03

0:27:12

0:27:12

1:26:43

1:26:43

0:04:09

0:04:09

0:19:58

0:19:58

1:22:03

1:22:03

0:09:57

0:09:57

0:56:18

0:56:18

0:47:13

0:47:13

0:18:24

0:18:24

0:23:01

0:23:01

0:11:23

0:11:23

0:32:25

0:32:25

0:11:47

0:11:47

0:02:31

0:02:31

0:08:39

0:08:39

0:04:34

0:04:34

1:02:19

1:02:19