filmov

tv

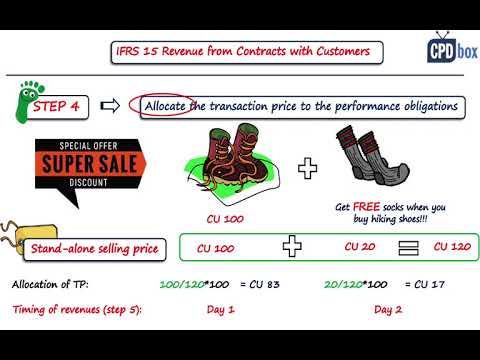

5-step Model for Revenue Recognition under IFRS 15 + Example + Journal entries

Показать описание

How to apply 5-step model? This example deals with the typical telecom contract where the customer gets free mobile phone if he signs up for 12-month plan of network services.

Journal entries included!

------

#ifrs #IFRS15 #ifrsaccounting

Journal entries included!

------

#ifrs #IFRS15 #ifrsaccounting

5-step Model for Revenue Recognition under IFRS 15 + Example + Journal entries

Mastering IFRS 15: The 5-Step Model for Revenue Recognition Explained with Examples

IFRS 15 Revenue from Contracts with Customers summary - applies in 2024

Revenue recognition explained

CMA Part 1 | Lesson 2-1: 5 Step Model of Revenue Recognition (IFRS 15) | CMA Free Lessons (English)

Overview of IFRS 15 The Five Step Model for Revenue Recognition

ACCA I Financial Reporting I IFRS 15 Revenue Recognition | 5 Step Process

Revenue Recognition Five Step Process

Webinar: Understand the 5 Step model of revenue recognition full

CA Final | FR | Ind AS 115 | 5 Steps to Recognise Revenue | CA Suraj Lakhotia

ASC 606 Simplified: Understanding Revenue Recognition in 3 Minutes

5 steps model of Ind as 115| #5stepsmodel #revenuerecognition #indas #charteredaccountant

Revenue Recognition ASC 606 Explained via Example

IFRS 15 - 5 Step Revenue Recognition Example [2018]

IFRS 15: 5 Step Revenue Model Example

M11: HKFRS 15 - Brief introduction to 5 steps model for revenue recognition (HKICPA)

IFRS 15 Revenue Recognition | Introduction to Five steps approach

IFRS 15_ REVENUE RECOGNITION FROM CONTRACT WITH CUSTOMERS_ 5 STEP MODEL

5-step Model under IFRS 15? How? #ifrs #ifrsaccounting #ifrs15 #shorts

The fundamentals of IFRS 15

IFRS 15: Revenue from Contracts with Customers (Part 1)

PFRS 15 - Revenue Recognition - Contracts with Customers: 5 Step Process

Ind As 115- Revenue Recognition-5 step model basics

China’s Five-step Model Framework for Revenue Recognition (Daxue Talks 127)

Комментарии

0:10:03

0:10:03

0:07:21

0:07:21

0:18:24

0:18:24

0:07:54

0:07:54

0:29:16

0:29:16

0:54:03

0:54:03

0:51:13

0:51:13

0:02:17

0:02:17

1:24:31

1:24:31

0:16:02

0:16:02

0:02:35

0:02:35

0:05:17

0:05:17

0:09:57

0:09:57

0:15:21

0:15:21

0:12:37

0:12:37

0:19:29

0:19:29

0:35:45

0:35:45

0:38:55

0:38:55

0:01:00

0:01:00

0:02:44

0:02:44

0:51:32

0:51:32

0:18:37

0:18:37

0:02:52

0:02:52

0:10:11

0:10:11