filmov

tv

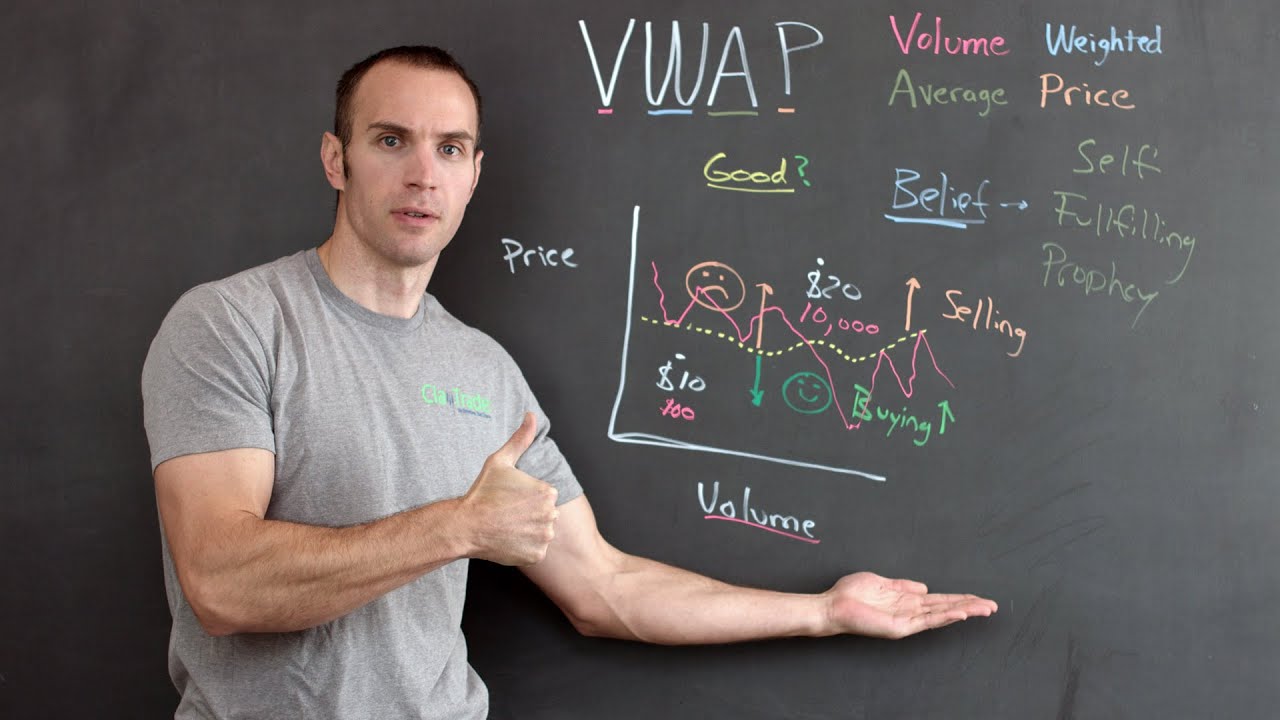

Why I Started Using This Day Trading Indicator (the best!)

Показать описание

Whether you are day trading or swing trading, when it comes to what technical indicators to use, there are many to choose from. This can be a very overwhelming challenge for beginning traders who are just getting started in the stock market; however, it does not need to be. I have been trading stocks for over a decade and the one secret I've discovered is that "less is more". You do not need to have dozens of technical indicators in order to be a successful trader. With all that being said, I have recently started using a new indicator that I have found to be extremely helpful. The Volume Weighted Average Price (VWAP) indicator has been around for a long time, yet, I just started to use it (with great success). What is the VWAP? How does it work? I discuss this along with my reasoning for deciding to use what many other traders consider the best technical indicator to use within a day trading strategy.

START WITH WHY BY SIMON SINEK | ANIMATED BOOK SUMMARY

Why I Started Using This Day Trading Indicator (the best!)

Simon Sinek | Start with WHY to inspire action (Super Quick Version)

Start a fire with an apple and a broken empty lighter 🍎🔥

2 simple hand gestures to start using

10 Tips To Get You Started with DaVinci Resolve!

Start Using This Machine if you want Bigger BICEPS

This is your sign to start using gold-leaf in your artwork 🙌 #art #shorts #arabiccalligraphy

How to jump start using your NOCO Boost GB40

The best time to start using English is ... now!

Start training with me today 💪

Use This Trick to Start Your Kia from Your Keyfob | McGrath Kia

PUNCH NEEDLE FOR BEGINNERS | EVERYTHING YOU NEED TO GET STARTED WITH PUNCH NEEDLE RIGHT AWAY

Getting Started with Duo Security (with voiceover)

How to jump start using your NOCO Boost GB70

How to Use HondaLink Remote Start

Getting Started With Hugging Face in 15 Minutes | Transformers, Pipeline, Tokenizer, Models

Get started with Google Analytics

#Shorts: Getting Started with the G-SHOCK GA110

1: Get Started Using Photoshop | How To Use Photoshop | Photoshop For Beginners | Photoshop Tutorial

Stop Beginning Your Speeches with Good Morning and Thank You and Start with This Instead

How Do I Get Started with the Ring App? | Ask Ring

Video Tutorial: Getting Started with Chromebook

How to Use Remote Engine Start

Комментарии

0:03:40

0:03:40

0:13:43

0:13:43

0:02:51

0:02:51

0:00:34

0:00:34

0:00:31

0:00:31

0:09:21

0:09:21

0:00:19

0:00:19

0:00:24

0:00:24

0:00:37

0:00:37

0:00:55

0:00:55

0:00:37

0:00:37

0:00:17

0:00:17

0:19:53

0:19:53

0:00:30

0:00:30

0:00:32

0:00:32

0:00:43

0:00:43

0:14:49

0:14:49

0:08:49

0:08:49

0:01:00

0:01:00

0:16:25

0:16:25

0:02:43

0:02:43

0:01:35

0:01:35

0:02:50

0:02:50

0:02:02

0:02:02