filmov

tv

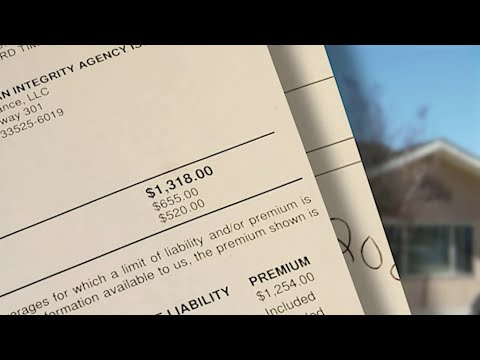

Many Florida homeowners likely to see property insurance rate increase

Показать описание

Details affecting local, regional and national news events of the day are provided by the News Channel 8 Team as well as updates on weather and traffic.

Many Florida homeowners likely to see property insurance rate increase

Many Florida homeowners hit with higher insurance premiums

No more fines for South Florida homeowner whose neighbor complained about plants, rocks

Flood insurance rates increase for many Florida homeowners as new FEMA calculations kick in

Changes in Florida's homeowners insurance could cost everyone, expert says

Florida woman receives $36K homeowners insurance bill

Homeowner insurance rates are going through the roof

Florida warns of chaos for homeowners if 17 property insurance companies have ratings downgraded

Florida homeowners face soaring property insurance rates

Florida homeowners pay nearly 3x national average for homeowners insurance

🤔🏠 Florida Homeowners Insurance Crisis Explained

Here’s how rising reinsurance rates are impacting Florida’s homeowners

3 'Need to Knows'about Florida Homeowners Insurance - check it out!💰🏠💸

Florida homeowners may see insurance rates go up

Homeowners Insurance in Florida

Citizens Property Insurance has over one million policies for Florida homeowners: Why it's not ...

Citizens Insurance looming rate hike affects hundreds of thousands of Florida homeowners

The Weekly: Florida's homeowners insurance crisis

Homeowners face soaring insurance rates

Florida homeowners scramble as another major insurer exits

Two Florida Homeowner insurance companies look for major rate increase

Will House Bill 59 Protect Homeowners from HOAs - Part 2

Florida homeowners abandon insurance amid skyrocketing rates

Squatters Taking Over AMERICA! Florida Takes a Hard Stance to Protect Homeowners #squatter

Комментарии

0:02:23

0:02:23

0:03:18

0:03:18

0:01:54

0:01:54

0:03:33

0:03:33

0:02:28

0:02:28

0:02:27

0:02:27

0:02:27

0:02:27

0:03:04

0:03:04

0:02:36

0:02:36

0:03:21

0:03:21

0:06:27

0:06:27

0:03:25

0:03:25

0:00:59

0:00:59

0:02:40

0:02:40

0:00:53

0:00:53

0:02:30

0:02:30

0:02:38

0:02:38

0:18:51

0:18:51

0:02:26

0:02:26

0:02:39

0:02:39

0:03:22

0:03:22

0:00:58

0:00:58

0:02:10

0:02:10

0:00:20

0:00:20