filmov

tv

How to prepare a Journal Entry: Examples & More

Показать описание

00:00 Introduction

00:18 What is a Journal Entry?

01:23 How do you write a journal entry?

03:17 What are some journal entry examples?

07:24 What are journal entry systems?

08:27 Automating journal entries Recap

Today’s video is all about journal entries – what they are and how to prepare them. We’ll also show you a few examples of common journal entries a business might make and discuss how modern businesses use automation to make preparing and approving journal entries easier.

What is a journal entry?

Essentially, a journal entry is a way to record or correct a transaction in a company’s accounting system.

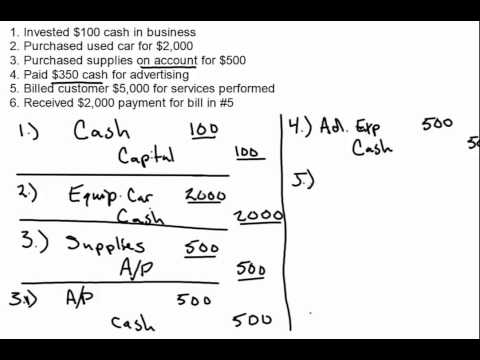

For centuries, virtually every business has been using double-entry accounting as the standard for its accounting cycle – a bookkeeping method in which every transaction has two sides: a debit and a credit.

The three main principles of double entry-accounting (or, a T-account) are:

There are always (at least) two entries for every transaction: a debit and a credit.

Asset accounts and expense accounts increase with a debit, while liability and income accounts increase with a credit.

Debits and credits in a journal entry must be equal – that’s what we mean by saying the trial balance is in balance.

For example, when a business purchases office supplies, the posts a journal entry to increase the Office Supplies Expense account by the cost of the office supplies (a debit) and decrease its Cash flow account by the same amount (a credit).

How do you write a journal entry?

Preparing a journal entry involves three basic steps:

Step 1: Determine what kind of journal entry you need to make

First, you need to determine the type of journal entry you need to make. There are two types of journal entries:

Adjusting entries are typically made at the end of a period to allocate income statements and expenses to that period. Some examples include prepaid expenses, unearned revenues, and accrued expenses. Adjusting journal entries can also be used to correct errors.

Recurring entries are recorded on a periodic basis – monthly, quarterly or annually. One example is recording depreciation every month.

Step 2: Gather information needed to prepare the journal entry

Once you know what type of accounting journal entry you need, you are ready to gather the information needed to make the journal entry. Every journal entry has five components:

The date of the transaction – you need to date the transaction in the period you want it to show up in the financial statements. For example. If you’re recording depreciation for the first quarter of 2021, your transaction date would be March 31, 2021.

The names of the accounts impacted and the account number, if applicable

The amounts to be credited and debited

A reference number identify the above transaction (if you use accounting software, it may automatically assign a reference number for you)

A description of the transaction – this helps you remember why you made the journal entry if you later need to review or correct it.

Step 3: Record the journal entry

Once you have all of the information you need, it’s time to record the journal entry. The actual process for entering your journal entry will depend on the accounting software you use.

Automating journal entries

For centuries, accountants did their bookkeeping with paper and pencil, recording business transactions in specialized journals and ledgers. For example, a company would record sales in a sales journal and payroll in a payroll journal. At the end of the period, the bookkeeper would summarize those financial transactions in a general ledger. Journal entries were the only way to enter data into a company’s financial records.

While the examples we provided in this video are relatively simple, modern companies can have hundreds or thousands of transactions every month or even every day. Imagine how easy it would be to transpose a number, make an addition or subtraction error, or accidentally record a transaction to the wrong account. It would be impossible to handle that volume manually with any level of efficiency, accuracy, or security.

That’s why modern accounting software includes a journal entry system. An automated journal entry system saves time, reduces the amount of duplicate work an accounting department has to do, and makes it easier for the Accounting Manager or Controller to review and approve journal entries. Transactions like the examples we’ve provided in this video are automatically entered into the correct accounts as invoices are credited, customer payments are processed, and bills are paid.

Accountants still make a few journal entries – mostly to:

To adjust accruals, prepaid expenses or unearned revenues at the end of a period

Record non-cash transactions like depreciation and amortization

Make adjustments to ensure the company’s financials follow Generally Accepted Accounting Principles.

Комментарии

0:06:53

0:06:53

0:08:30

0:08:30

0:04:47

0:04:47

0:06:49

0:06:49

0:09:40

0:09:40

0:06:59

0:06:59

0:06:50

0:06:50

0:06:14

0:06:14

0:28:24

0:28:24

0:07:51

0:07:51

0:02:41

0:02:41

0:11:35

0:11:35

0:45:07

0:45:07

0:06:37

0:06:37

0:00:27

0:00:27

0:00:58

0:00:58

0:22:25

0:22:25

0:10:30

0:10:30

0:09:05

0:09:05

0:49:49

0:49:49

0:30:57

0:30:57

0:36:34

0:36:34

0:02:45

0:02:45

0:14:14

0:14:14