filmov

tv

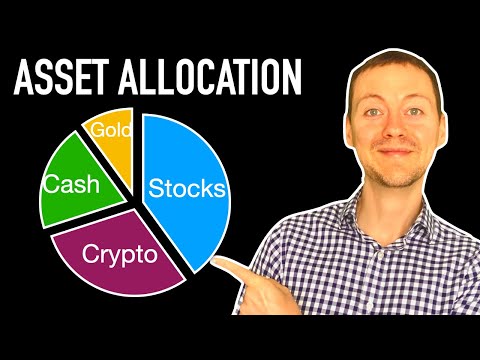

REVEALING My Investment Portfolio Allocation | What Have I Been Investing Into 2022

Показать описание

I've been buying into stocks from the commodities and travel sector. I've also dollar cost averaged into china stocks and etherum ETH.

So what exactly has Josh Tan invested into his portfolio for 2022?

0:00 Introduction

0:47 China equities

JPMorgan China A fund and SYFE China portfolio.

1:39 Bonds

Bond funds and SIA retail bond. This forms part of my emergency cash and remaining ammunition to invest.

2:50 Asian and global equities

Asian equities allocation are even bigger than US equities because of my view on valuations.

3:20 Crypto assets

ETHEREUM forms the bulk of this. My dollar cost averaging to GEMINI has recently ended.

I have it staked in HODLNAUT.

4:44 SG REITS

Ive Ascott Trust which I've reviewed before and in SYFE reit+ portfolio.

5:45 Other Singapore stocks

✅ Why you do NOT need to spend thousands on investment courses?

LEARN HOW to research into stocks and identify multi-baggers (at least in Josh Tan's way). Course price at $37 only. NEW 2022 BONUS MODULE ADDED and UNLIMITED re-access given with this new structure for future revision.

All sales will be donated away via JOSH TAN BURSARY for needy students

7:00 Commodity stocks

I've palm oil stocks and oil and gas upstream small cap stocks.

#whattoinvest #investment

*******

🔥 JOIN our MEMBERS channel TODAY

TIER #3 "LETS MAKE A DIFFERENCE " and TIER #2 "PRIVATE INVESTMENT VIDEO"

Will UNLOCK ALL VIDEOS especially those with VALUE/Momentum matrix on certain stocks!

TIER #1 Support our channel tier will unlock ONLY the cryptocurrency videos

All proceeds will be donated away via JOSH TAN BURSARY for needy students or towards promoting financial literacy.

- FASTEST WAY TO GET RICH

- NOT ENOUGH INCOME TO HAVE CHILDREN?

- HOME PRICES GETTING CRAZY? WILL YOU SUPPORT PROPERTY COOLING MEASURES?

✅ ENGAGE Josh Tan on a fee for financial planning to build towards for your retirement!

*******

We do not make any recommendations on whether a security is a buy/sell as every investor has different investment goals and risk profiles. The presentation of ideas from Josh Tan and TheAstuteParent are strictly for education purposes. You are advised to perform independent research yourself or seek a qualified financial adviser. We will not be liable for any losses directly or indirectly from the material. Some of the referral links in the video summary are products and services personally used by Josh Tan and they may pay an affiliate commission or referral bonus.

It is not an endorsement of the product unless explicitly stated and we will not be liable for any losses. The content in this video and any promotions mentioned is accurate as of the posting date.

*******

About Josh Tan:

Josh holds a degree in Accounting from NTU. In 2016, he co-founded the financial education website TheAstuteParent to provide detailed insurance plan analysis and financial planning tips.

As a ChFC Charterholder, Josh has agreed to be bounded by the ChFC®/S Code of Ethics. This includes, among others, acting in a professional manner when it comes to conducting due diligence on primary and secondary sources of investment-related data, and articulating his investment opinions based on his research and beliefs. Based on his research and analysis, he highlighted his beliefs and opinions, and illustrated the concept of time value of money, as of the time of the video.

Learn more on financial planning and insurance concepts, visit

✅ ENGAGE Josh Tan on a fee for financial planning to build towards for your retirement!

So what exactly has Josh Tan invested into his portfolio for 2022?

0:00 Introduction

0:47 China equities

JPMorgan China A fund and SYFE China portfolio.

1:39 Bonds

Bond funds and SIA retail bond. This forms part of my emergency cash and remaining ammunition to invest.

2:50 Asian and global equities

Asian equities allocation are even bigger than US equities because of my view on valuations.

3:20 Crypto assets

ETHEREUM forms the bulk of this. My dollar cost averaging to GEMINI has recently ended.

I have it staked in HODLNAUT.

4:44 SG REITS

Ive Ascott Trust which I've reviewed before and in SYFE reit+ portfolio.

5:45 Other Singapore stocks

✅ Why you do NOT need to spend thousands on investment courses?

LEARN HOW to research into stocks and identify multi-baggers (at least in Josh Tan's way). Course price at $37 only. NEW 2022 BONUS MODULE ADDED and UNLIMITED re-access given with this new structure for future revision.

All sales will be donated away via JOSH TAN BURSARY for needy students

7:00 Commodity stocks

I've palm oil stocks and oil and gas upstream small cap stocks.

#whattoinvest #investment

*******

🔥 JOIN our MEMBERS channel TODAY

TIER #3 "LETS MAKE A DIFFERENCE " and TIER #2 "PRIVATE INVESTMENT VIDEO"

Will UNLOCK ALL VIDEOS especially those with VALUE/Momentum matrix on certain stocks!

TIER #1 Support our channel tier will unlock ONLY the cryptocurrency videos

All proceeds will be donated away via JOSH TAN BURSARY for needy students or towards promoting financial literacy.

- FASTEST WAY TO GET RICH

- NOT ENOUGH INCOME TO HAVE CHILDREN?

- HOME PRICES GETTING CRAZY? WILL YOU SUPPORT PROPERTY COOLING MEASURES?

✅ ENGAGE Josh Tan on a fee for financial planning to build towards for your retirement!

*******

We do not make any recommendations on whether a security is a buy/sell as every investor has different investment goals and risk profiles. The presentation of ideas from Josh Tan and TheAstuteParent are strictly for education purposes. You are advised to perform independent research yourself or seek a qualified financial adviser. We will not be liable for any losses directly or indirectly from the material. Some of the referral links in the video summary are products and services personally used by Josh Tan and they may pay an affiliate commission or referral bonus.

It is not an endorsement of the product unless explicitly stated and we will not be liable for any losses. The content in this video and any promotions mentioned is accurate as of the posting date.

*******

About Josh Tan:

Josh holds a degree in Accounting from NTU. In 2016, he co-founded the financial education website TheAstuteParent to provide detailed insurance plan analysis and financial planning tips.

As a ChFC Charterholder, Josh has agreed to be bounded by the ChFC®/S Code of Ethics. This includes, among others, acting in a professional manner when it comes to conducting due diligence on primary and secondary sources of investment-related data, and articulating his investment opinions based on his research and beliefs. Based on his research and analysis, he highlighted his beliefs and opinions, and illustrated the concept of time value of money, as of the time of the video.

Learn more on financial planning and insurance concepts, visit

✅ ENGAGE Josh Tan on a fee for financial planning to build towards for your retirement!

Комментарии

0:08:20

0:08:20

0:25:55

0:25:55

0:15:04

0:15:04

0:24:02

0:24:02

0:14:08

0:14:08

0:19:10

0:19:10

0:09:48

0:09:48

0:08:20

0:08:20

0:57:03

0:57:03

0:10:27

0:10:27

0:07:05

0:07:05

0:11:48

0:11:48

0:05:46

0:05:46

0:21:12

0:21:12

0:20:32

0:20:32

0:42:02

0:42:02

0:13:08

0:13:08

0:12:01

0:12:01

0:10:34

0:10:34

0:15:56

0:15:56

0:12:39

0:12:39

0:09:07

0:09:07

0:12:38

0:12:38

0:21:13

0:21:13