filmov

tv

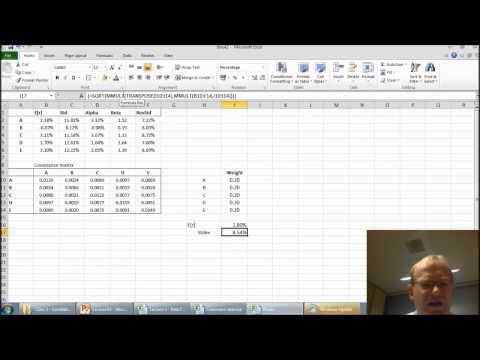

Portfolio of four assets: Optimization with Solver

Показать описание

#portfolioanalysis

Optimizing a portfolio of multiple assets in Excel using Solver

Optimizing a portfolio of multiple assets in Excel using Solver

Portfolio of four assets: Optimization with Solver

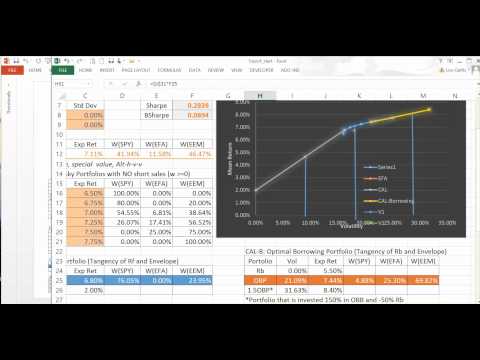

Calculating the Optimal Portfolio in Excel | Portfolio Optimization

Portfolio Optimization with 4 Stocks - Part 1

Four Stock Portfolio and Graphing Efficient Portfolio Frontier

Portfolio Optimization Seven Security Example with Excel Solver

Portfolio Optimization in Excel: Step by Step Tutorial

Portfolio of four assets: Variance-Covariance Matrix

Portfolio Optimization using Solver in Excel

The Shocking Financial Secrets of the Japanese Revealed

The Asset Investment Portfolio Optimization Problem

The Power of Portfolio Optimization

Mulplei Asset Portfolio Problem: optimization

Portfolio Optimization with 4 Stock Part 2

Modern Portfolio Concepts Part 4: Portfolio Optimization with MPT

Math 4.03 Portfolio Optimization with 3 assets using Excel Solver

Portfolio Optimization using five stocks in excel | FIN-ED

Minimum Variance Portfolio in Excel: Multi-asset case

Math 4.02 Portfolio optimization with 2 assets using Excel

Portfolio Optimization

Optimal portfolios with Excel Solver

Portfolio Optimization with 4 Stock - Part 3 - Adding CML Line

Portfolio Optimization in Excel Using Solver

FinMod 4 Portfolio Optimization

9. Portfolio Optimization using five stocks in excel: CALCULATING COVARIANCE MATRIX

Комментарии

0:15:53

0:15:53

0:08:46

0:08:46

0:15:02

0:15:02

0:35:01

0:35:01

0:17:10

0:17:10

0:15:07

0:15:07

0:13:33

0:13:33

0:17:02

0:17:02

0:11:53

0:11:53

0:06:43

0:06:43

0:10:18

0:10:18

0:06:33

0:06:33

0:07:42

0:07:42

0:34:52

0:34:52

0:31:12

0:31:12

0:17:36

0:17:36

0:13:09

0:13:09

0:20:42

0:20:42

0:27:02

0:27:02

0:06:22

0:06:22

0:15:02

0:15:02

0:21:51

0:21:51

0:52:38

0:52:38

0:07:13

0:07:13