filmov

tv

Building a Mortgage Calculator in Excel with Amortization Table

Показать описание

In this video, we're going to build a rudimentary Mortgage Amortization Table for you to practice your Excel skills as well as have a powerful tool to use in your home purchase decision-making process.

Mortgage Calculator: A Simple Tutorial (template included)!

Building a Mortgage Calculator in Excel with Amortization Table

How to Create a Mortgage Calculator With Microsoft Excel :Tutorial

Create a Java Mortgage Payment Calculator - Full Tutorial

Build a Mortgage Calculator by Numpy in Colab

How To Calculate Your Mortgage Payment

Building a Mortgage Calculator in C++ | Small Coding Project

Build Your Own Mortgage Calculator Plugin with ChatGPT A Step by Step Guide

💰Loan Officers - Get Unlimited Free Leads & Free AI-Powered CRM/POS/LOS🚀Earn up to 275BPS Commis...

BUILD YOUR OWN MORTGAGE CALCULATOR in Google Sheets | STEP BY STEP

DIY mortgage calculator in 60 sec

Create a Mortgage Payment Calculator in Excel

Building a Loan Calculator With Excel

How To Create an Amortization Table In Excel

Building a Mortgage Calculator UI

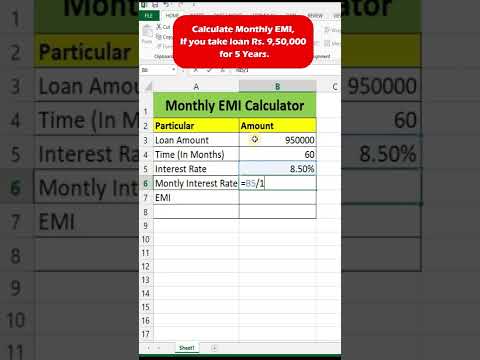

Calculate Monthly EMI for your loan amount🤩🤩

Self Build Mortgages: How They Work! Explained | Mortgages On Paper

Construction Loans: What They Are and How They Work (IN DETAIL)

Excel Mortgage Calculator | Extra Payments

Do This To Pay Off Your Mortgage Faster & Pay Less Interest

Practical JavaScript Build A Mortgage Calculator - Javascript Project

Creating a mortgage calculator with the Calculated Fields Form WordPress plugin from scratch.

Payoff your Mortgage FAST!

How to Add a Mortgage Calculator to Your Real Estate Website

Комментарии

0:07:47

0:07:47

0:25:18

0:25:18

0:03:47

0:03:47

0:12:39

0:12:39

0:06:57

0:06:57

0:05:10

0:05:10

0:17:49

0:17:49

0:05:07

0:05:07

0:22:58

0:22:58

0:15:35

0:15:35

0:01:00

0:01:00

0:08:09

0:08:09

0:33:14

0:33:14

0:11:01

0:11:01

0:00:42

0:00:42

0:00:34

0:00:34

0:04:10

0:04:10

0:20:10

0:20:10

0:07:17

0:07:17

0:10:56

0:10:56

0:04:16

0:04:16

0:03:49

0:03:49

0:00:59

0:00:59

0:09:28

0:09:28