filmov

tv

ENTRY FILTERS | #1 Tool For Better Trading Systems | Turn Good Strategies Into GREAT Strategies

Показать описание

You can turn good systematic trading strategies into GREAT systematic trading strategies. You can build strategies that look more like hedge fund caliber trading systems...and stand a much better chance of generating big trading profits in real time. In this video, Dave Whitcomb, CFA, Head of Research for Peak Trading Research, walks you through the #1 tool that you can use to improve the profitability of your trading systems.

0:02 Turn Good Strategies Into Great Strategies

1:48 Trade Setup Ideas

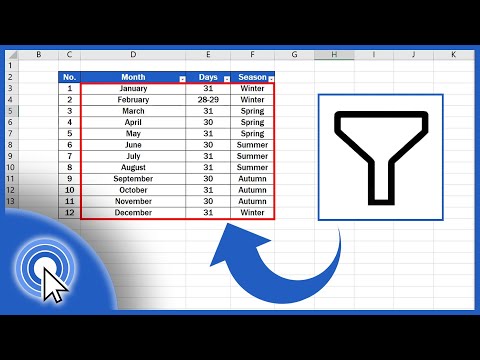

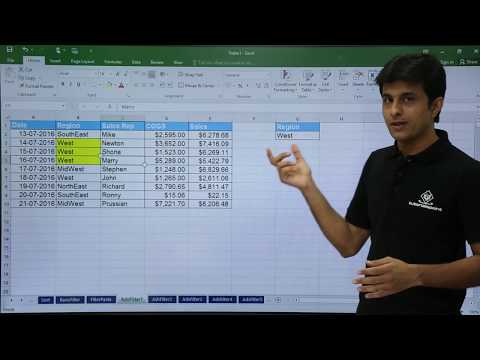

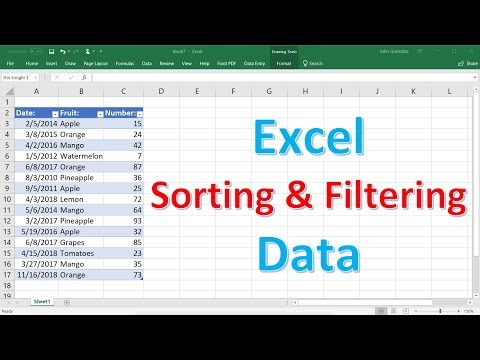

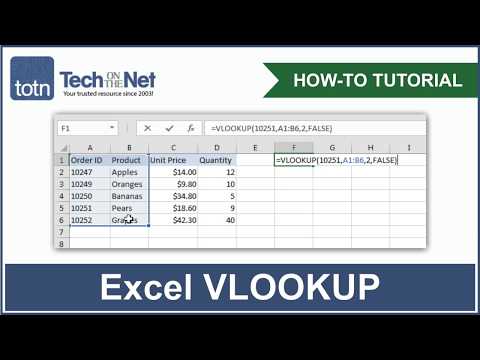

2:40 Adding Filters with Four Simple Steps

2:59 Simple BreakOut Strategy for Heating Oil

3:56 Step One: Add Peak Filter Script

4:44 Step Two: Test the Entry Filters

5:10 Step Three: Move the Filters to the Strategy

7:44 Step Four: Remove the Filter Script

8:31 Strategy Performance

8:40 Is This Optimization?

9:30 Strategy Also Works In: Heating Oil, Gold, Platinum, Crude Oil

--

Are you looking for Commodity Market Insights and Profitable Systematic Trading Strategies?

Then you’ve come to the right place.

Welcome to the Peak Trading Research YouTube Channel.

Dave Whitcomb, CFA, Head of Research, is your channel host.

This channel is for beginner, intermediate, and expert traders looking to profit from Systematic Trading Insights across Agriculture, Energy, and Metals commodity futures markets.

Are you looking for algorithmic trading for beginners, quantitative trading basics, or the best trading systems for 2022? Read more about that right below this video information.

To learn more about the services Peak Trading Research offers, check out the links below:

For Peak’s industry-leading quantitative commodity research:

For the world’s largest library of community-built trading systems:

Follow Peak Trading Research on LinkedIn:

Follow Dave Whitcomb on LinkedIn:

-

Peak Trading Research is a leading research provider in commodity markets. Peak’s research combines deep commodity trading experience with proprietary technology to offer you unparalleled insights into Agriculture, Energy, and Metals commodity markets.

With Peak’s trusted expertise in commodity futures markets, you’ve come to the right place to make smart, profitable trades. Our Peak Trading Research YouTube channel covers commodity trading strategies, algorithmic trading options, and futures trading systems. We’ll deep dive into these subjects during our explanatory videos.

Are you a beginner and really want to start from the foundations? We’ve got you covered. Dave will explain everything about futures and commodities from A to Z.

Or are you searching for the best trading software? Trying to choose between Tradestation and Multicharts? Everything you need to know is right here.

Or if you’re an expert trader looking to learn more about specific markets and algorithmic strategies, we’ve got detailed videos to help you too.

And now, a few suggestions for you to watch:

Recently, we published a mini-series about the Commitment of Traders (COT) Reports: COT 101, How the COT Works, and How to Trade COT Information. Watch the videos here:

Are you looking for a trading strategy for the Sugar futures market? Dave will give you a complete walk-through in this video:

-

Didn’t find what you are looking for? Leave a comment under this video with the subject you are looking for, what you’d like to learn, AND subscribe so you don’t miss the next video:

-

0:02 Turn Good Strategies Into Great Strategies

1:48 Trade Setup Ideas

2:40 Adding Filters with Four Simple Steps

2:59 Simple BreakOut Strategy for Heating Oil

3:56 Step One: Add Peak Filter Script

4:44 Step Two: Test the Entry Filters

5:10 Step Three: Move the Filters to the Strategy

7:44 Step Four: Remove the Filter Script

8:31 Strategy Performance

8:40 Is This Optimization?

9:30 Strategy Also Works In: Heating Oil, Gold, Platinum, Crude Oil

--

Are you looking for Commodity Market Insights and Profitable Systematic Trading Strategies?

Then you’ve come to the right place.

Welcome to the Peak Trading Research YouTube Channel.

Dave Whitcomb, CFA, Head of Research, is your channel host.

This channel is for beginner, intermediate, and expert traders looking to profit from Systematic Trading Insights across Agriculture, Energy, and Metals commodity futures markets.

Are you looking for algorithmic trading for beginners, quantitative trading basics, or the best trading systems for 2022? Read more about that right below this video information.

To learn more about the services Peak Trading Research offers, check out the links below:

For Peak’s industry-leading quantitative commodity research:

For the world’s largest library of community-built trading systems:

Follow Peak Trading Research on LinkedIn:

Follow Dave Whitcomb on LinkedIn:

-

Peak Trading Research is a leading research provider in commodity markets. Peak’s research combines deep commodity trading experience with proprietary technology to offer you unparalleled insights into Agriculture, Energy, and Metals commodity markets.

With Peak’s trusted expertise in commodity futures markets, you’ve come to the right place to make smart, profitable trades. Our Peak Trading Research YouTube channel covers commodity trading strategies, algorithmic trading options, and futures trading systems. We’ll deep dive into these subjects during our explanatory videos.

Are you a beginner and really want to start from the foundations? We’ve got you covered. Dave will explain everything about futures and commodities from A to Z.

Or are you searching for the best trading software? Trying to choose between Tradestation and Multicharts? Everything you need to know is right here.

Or if you’re an expert trader looking to learn more about specific markets and algorithmic strategies, we’ve got detailed videos to help you too.

And now, a few suggestions for you to watch:

Recently, we published a mini-series about the Commitment of Traders (COT) Reports: COT 101, How the COT Works, and How to Trade COT Information. Watch the videos here:

Are you looking for a trading strategy for the Sugar futures market? Dave will give you a complete walk-through in this video:

-

Didn’t find what you are looking for? Leave a comment under this video with the subject you are looking for, what you’d like to learn, AND subscribe so you don’t miss the next video:

-

Комментарии

0:10:40

0:10:40

0:07:10

0:07:10

0:00:17

0:00:17

0:02:51

0:02:51

0:01:49

0:01:49

0:07:41

0:07:41

0:21:31

0:21:31

0:00:20

0:00:20

0:13:29

0:13:29

0:02:58

0:02:58

0:08:56

0:08:56

0:07:24

0:07:24

0:06:27

0:06:27

0:04:15

0:04:15

0:06:22

0:06:22

0:07:00

0:07:00

0:02:05

0:02:05

0:08:20

0:08:20

0:08:13

0:08:13

0:09:52

0:09:52

0:10:56

0:10:56

0:11:22

0:11:22

0:00:13

0:00:13

0:00:15

0:00:15