filmov

tv

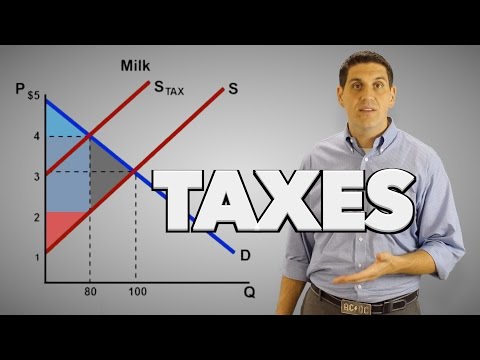

Microeconomics: Excise Tax Effect on Equilibrium

Показать описание

This video shows an example of a sales tax and its effect on equilibrium.

Taxes on Producers- Micro Topic 2.8

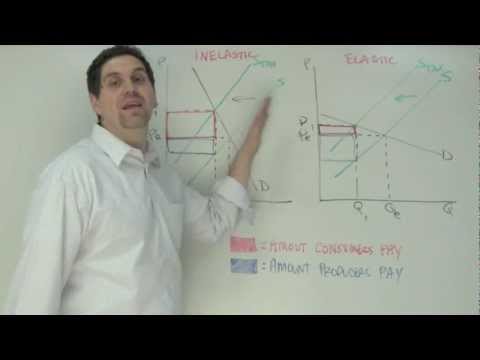

How to calculate Excise Tax and determine Who Bears the Burden of the Tax

Microeconomics: Excise Tax Effect on Equilibrium

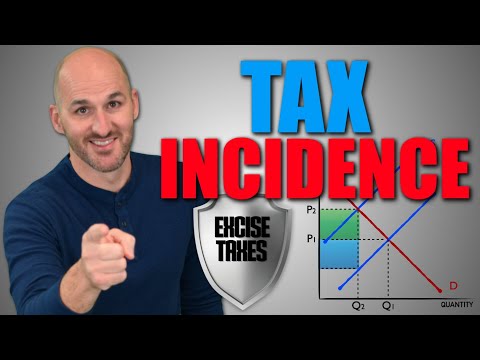

Micro Unit 6, Question 12- Tax Incidence (Excise Tax)

Micro: Unit 1.5 -- Excise Taxes and Tax Incidence

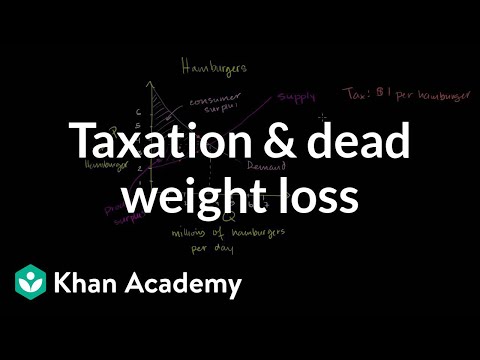

Taxation and dead weight loss | Microeconomics | Khan Academy

Taxes

The Economic Effect of Taxes

Taxes on Buyers and Sellers

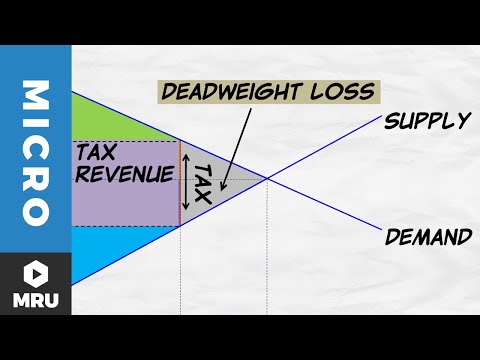

Tax Revenue and Deadweight Loss

Excise tax and sales tax

equilibrium price and tax revenue after the imposition a per unit tax from Demand & Supply func...

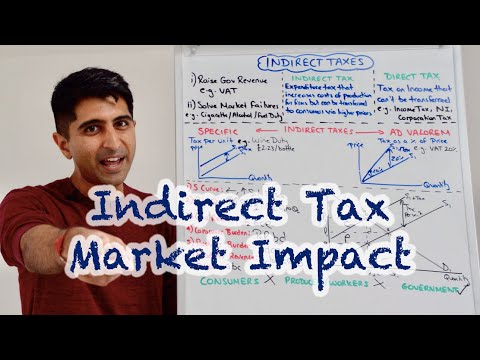

Y1 16) Indirect Tax - Full Market Impact

Excise Tax, Intermediate Microeconomics, No Calculus

Intro Econ: Tax on Goods (Excise Tax)

7.11 The Welfare Effect of a Tax

Government Intervention- Micro Topic 2.8

Y1 17) Indirect Tax and Elasticity (Consumer, Producer and Government Evaluation)

Chapter 2 - Effects of Tax on Demand and Supply Curve

Excise Tax Practice

Realizing Excise Taxes arent hard - Microeconomics

The Effects of a Per Unit Tax - Inelastic Demand

Affect of Excise Tax on Supply Curve | Class 12 Microeconomics Producer Behaviour and Supply

The effect of taxes on supply and demand

Комментарии

0:05:58

0:05:58

0:06:25

0:06:25

0:03:39

0:03:39

0:02:12

0:02:12

0:14:56

0:14:56

0:09:06

0:09:06

0:03:08

0:03:08

0:14:52

0:14:52

0:15:14

0:15:14

0:11:31

0:11:31

0:13:59

0:13:59

0:16:04

0:16:04

0:10:13

0:10:13

0:11:40

0:11:40

0:07:52

0:07:52

0:05:33

0:05:33

0:07:14

0:07:14

0:05:28

0:05:28

0:02:49

0:02:49

0:04:32

0:04:32

0:00:32

0:00:32

0:12:41

0:12:41

0:04:12

0:04:12

0:05:02

0:05:02