filmov

tv

Taxes on Producers- Micro Topic 2.8

Показать описание

I explain excise taxes any show what happens to consumer surplus, producer surplus, and deadweight loss as a result of a tax. Make sure to watch the section about tax incidence and who pays the majority of a tax.

Taxes on Producers- Micro Topic 2.8

Taxation and dead weight loss | Microeconomics | Khan Academy

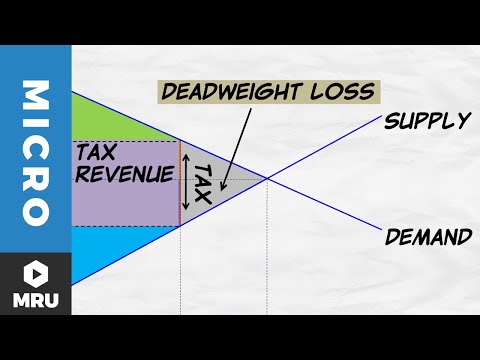

Tax Revenue and Deadweight Loss

Markets: Consumer and Producer Surplus- Micro Topic 2.6

How to calculate Excise Tax and determine Who Bears the Burden of the Tax

Micro: Unit 1.5 -- Excise Taxes and Tax Incidence

Consumer and Producer Surplus- Micro Topic 2.6 (Holiday Edition)

Micro Unit 6, Question 12- Tax Incidence (Excise Tax)

Y1 16) Indirect Tax - Full Market Impact

Government Intervention- Micro Topic 2.8

Taxes

Identifying tax incidence in a graph | APⓇ Microeconomics | Khan Academy

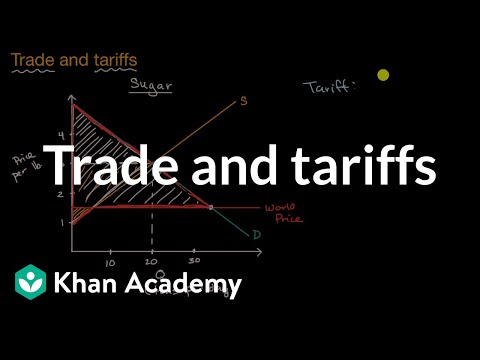

Trade and tariffs | APⓇ Microeconomics | Khan Academy

How to calculate Excise Tax and the Impact on Consumer and Producer Surplus

Taxes for factoring in negative externalities | Microeconomics | Khan Academy

Micro: Unit 1.6 -- Consumer Surplus, Producer Surplus, and Deadweight Loss

The Complete AP Guide to Taxes and Government Policies | AP Micro Struggle 2.8

Micro Chapter 6 Taxes

Y1 8) Consumer and Producer Surplus

Percentage tax on hamburgers | Microeconomics | Khan Academy

supply and demand with tax

Price Ceilings and Floors- Micro Topic 2.8

Microeconomics- Everything You Need to Know

International Trade- Micro Topic 2.9

Комментарии

0:05:58

0:05:58

0:09:06

0:09:06

0:11:31

0:11:31

0:10:04

0:10:04

0:06:25

0:06:25

0:14:56

0:14:56

0:05:05

0:05:05

0:02:12

0:02:12

0:10:13

0:10:13

0:07:14

0:07:14

0:03:08

0:03:08

0:05:47

0:05:47

0:07:05

0:07:05

0:08:55

0:08:55

0:05:45

0:05:45

0:13:45

0:13:45

0:11:58

0:11:58

0:12:52

0:12:52

0:08:54

0:08:54

0:05:40

0:05:40

0:06:22

0:06:22

0:04:34

0:04:34

0:28:55

0:28:55

0:06:11

0:06:11