filmov

tv

Y1 17) Indirect Tax and Elasticity (Consumer, Producer and Government Evaluation)

Показать описание

Y1 17) Indirect Tax and Elasticity (Consumer, Producer and Government Impacts). Video covering Indirect Tax and Elasticity (Consumer, Producer and Government Evaluation)

Y1 17) Indirect Tax and Elasticity (Consumer, Producer and Government Evaluation)

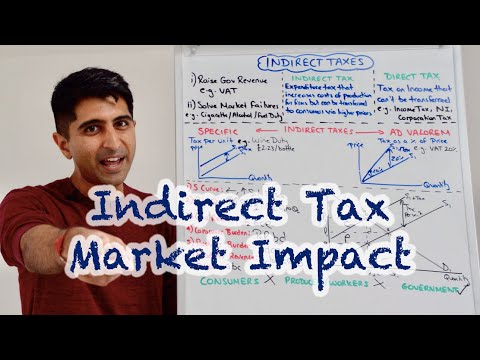

Y1 16) Indirect Tax - Full Market Impact

Indirect Tax + Tax Incidence

Indirect Tax

Indirect Taxes - Elasticities | Economics Revision

Indirect Taxes - Evaluating Indirect Taxes | Economics Revision

Indirect Tax: Definition & Diagram

Indirect Taxes and PED | 60 Second Economics | A-Level & IB

Y1/IB 27) Indirect Taxation and Deadweight Welfare Loss

Y1/IB 16) Indirect Taxation - Market Impact

AS Economics Intervention #2: Incidence of an indirect tax

Indirect Taxes - Key Analysis Diagrams I A-Level and IB Economics

Economics: Indirect Taxes and Consumer & Producer Surplus

Indirect Taxes and Consumer Surplus I A Level and IB Economics

Indirect Tax

IB economics - indirect taxes

Indirect Tax: Evaluation

Indirect Taxes and Producer Surplus I A Level and IB Economics

AS Economics - Indirect Taxes and Subsidies

Price elasticity of demand and indirect taxes

Revision on Indirect Taxes

Indirect Taxes - Key Evaluation Arguments I A Level and IB Economics

Indirect Taxation

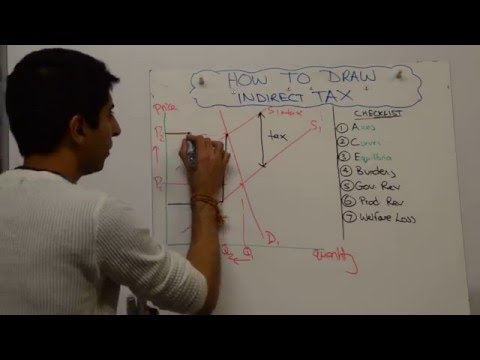

Indirect Taxes: Intro and Diagrams

Комментарии

0:05:28

0:05:28

0:10:13

0:10:13

0:12:51

0:12:51

0:08:06

0:08:06

0:05:19

0:05:19

0:08:13

0:08:13

0:08:22

0:08:22

0:00:53

0:00:53

0:05:20

0:05:20

0:07:55

0:07:55

0:07:34

0:07:34

0:06:40

0:06:40

0:12:20

0:12:20

0:06:20

0:06:20

0:20:03

0:20:03

0:01:52

0:01:52

0:16:33

0:16:33

0:07:44

0:07:44

0:38:35

0:38:35

0:12:44

0:12:44

0:06:28

0:06:28

0:13:48

0:13:48

0:27:12

0:27:12

0:18:17

0:18:17