filmov

tv

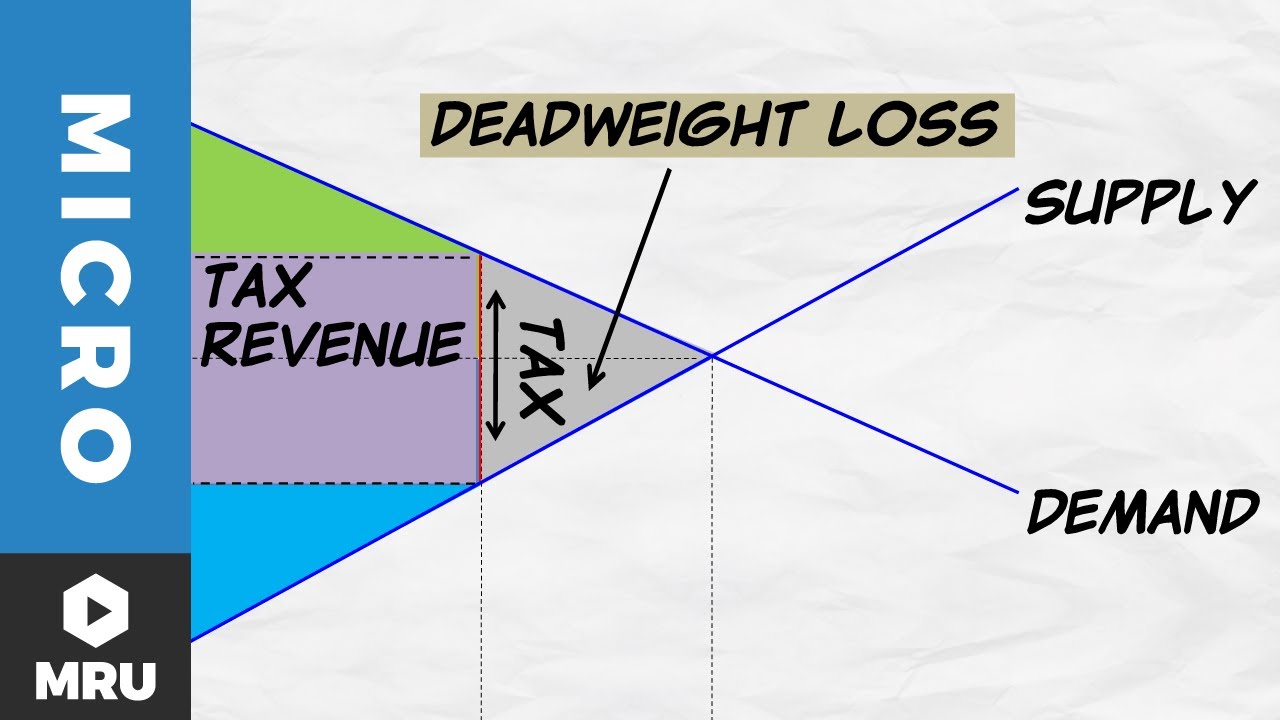

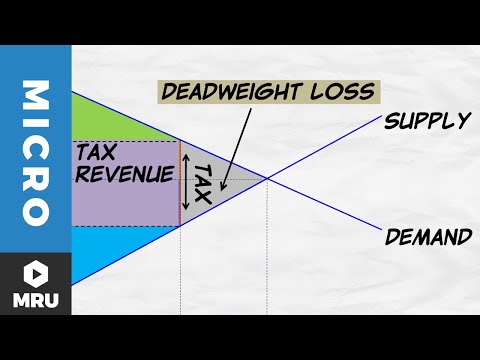

Tax Revenue and Deadweight Loss

Показать описание

Why do taxes exist? What are the effects of taxes? We discuss how taxes affect consumer surplus and producer surplus and discuss the concept of deadweight loss at length. We’ll also look at a real-world example of deadweight loss: taxing luxury yachts in the 1990s.

00:00 Introduction

00:30 The Effects of a Tax

04:16 Explaining Deadweight Loss

07:26 Deadweight Loss and Elasticity

09:30 Taxing Yachts – A Good Idea?

00:00 Introduction

00:30 The Effects of a Tax

04:16 Explaining Deadweight Loss

07:26 Deadweight Loss and Elasticity

09:30 Taxing Yachts – A Good Idea?

Tax Revenue and Deadweight Loss

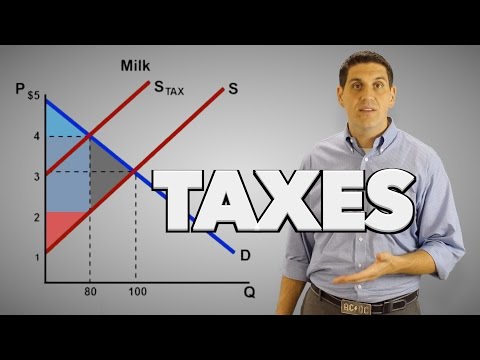

Taxes on Producers- Micro Topic 2.8

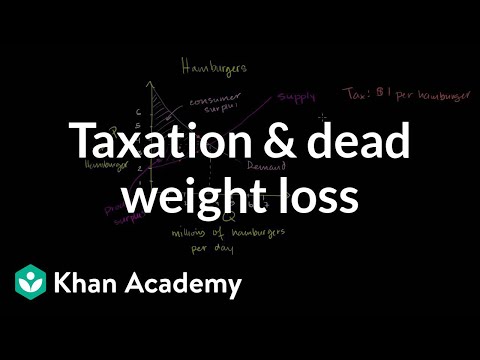

Taxation and dead weight loss | Microeconomics | Khan Academy

Taxes on CONSUMERS | Part 1 | Tax Revenue and Deadweight Loss of Taxation | Think Econ

Taxes on PRODUCERS | Part 1 | Tax Revenue and Deadweight Loss of Taxation | Think Econ

Office Hours: Reviewing Tax Revenue, Incidence, and Deadweight Loss

What Is Deadweight Loss?

Understanding Deadweight Loss and Tax Revenue | Microeconomics

Chp 6 4 Deadweight Loss and Tax Revenue

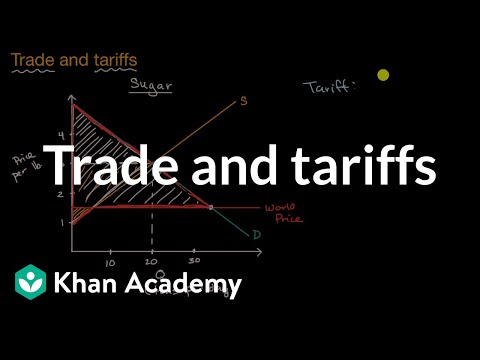

Trade and tariffs | APⓇ Microeconomics | Khan Academy

Taxes

Microeconomics Practice Problem - The Algebra of Taxes, Government Revenue, and Deadweight Loss

Micro: Unit 1.6 -- Consumer Surplus, Producer Surplus, and Deadweight Loss

Taxation, Market Impact, and Deadweight Loss - Microeconomics 2.09 - Unit 2 - Supply and Demand

Consumer and Producer Surplus- Micro Topic 2.6 (Holiday Edition)

Taxes on PRODUCERS | Part 2 | Tax Revenue and Deadweight Loss of Taxation | Think Econ

IB Economics | Deadweight Loss Due To A Specific Tax

Understanding the Deadweight Loss of Taxation | Microeconomics

How to calculate Excise Tax and determine Who Bears the Burden of the Tax

Tax revenue and deadweight loss

Deadweight Loss and Tax Revenue

Taxes on CONSUMERS | Part 2 | Tax Revenue and Deadweight Loss of Taxation | Think Econ

Consumer/Producer Surplus & Deadweight Loss

Taxes and Dead Weight Loss

Комментарии

0:11:31

0:11:31

0:05:58

0:05:58

0:09:06

0:09:06

0:03:06

0:03:06

0:03:12

0:03:12

0:08:02

0:08:02

0:03:23

0:03:23

0:05:34

0:05:34

0:03:41

0:03:41

0:07:05

0:07:05

0:03:08

0:03:08

0:22:09

0:22:09

0:13:45

0:13:45

0:18:54

0:18:54

0:05:05

0:05:05

0:04:43

0:04:43

0:04:46

0:04:46

0:05:01

0:05:01

0:06:25

0:06:25

0:11:31

0:11:31

0:05:04

0:05:04

0:05:39

0:05:39

0:05:34

0:05:34

0:15:08

0:15:08