filmov

tv

When Should You Help Your Adult Children and When Do You Let Them Learn?

Показать описание

When Should You Help Your Adult Children and When Do You Let Them Learn?

Let’s make sure you’re on the path to financial success - then help you stay there!

The Money Guy Show takes the edge off of personal finance. We’re financial advisors that believe anyone can be wealthy! First, LEARN smart financial principles. Next, APPLY those principles! Then watch your finances GROW!

We can’t wait to see you accomplish your goals and reach financial freedom! New shows every week on YouTube and your favorite podcast app. Thanks for coming along on the journey with us.

Let’s make sure you’re on the path to financial success - then help you stay there!

The Money Guy Show takes the edge off of personal finance. We’re financial advisors that believe anyone can be wealthy! First, LEARN smart financial principles. Next, APPLY those principles! Then watch your finances GROW!

We can’t wait to see you accomplish your goals and reach financial freedom! New shows every week on YouTube and your favorite podcast app. Thanks for coming along on the journey with us.

How long should your naps be? - Sara C. Mednick

This tool will help improve your critical thinking - Erick Wilberding

After watching this, your brain will not be the same | Lara Boyd | TEDxVancouver

You Don't Need to Worry About Your Future (This Will Encourage You)

Change Your Life – One Tiny Step at a Time

Should You Raid Kyogre Now or Wait for Shadow & Primal Kyogre in Pokémon GO?

33 Life Lessons That Will Improve Your Life Forever

What happens inside your body when you exercise?

How Well Do You Know Your Food? | The Urban Guide

Help Your YouTube Videos Stand Out & Keep Viewers Watching (Creator Basics)

How To Heal Your Eyesight Naturally | Vishen Lakhiani

Hello Hello! Can You Clap Your Hands? | Original Kids Song | Super Simple Songs

How playing sports benefits your body ... and your brain - Leah Lagos and Jaspal Ricky Singh

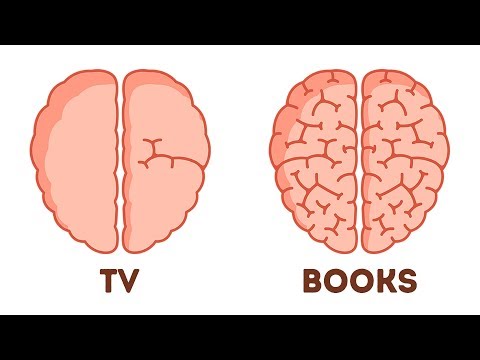

9 Proofs You Can Increase Your Brain Power

The Ugly Truth About Coffee’s Effects On Your Body

Why breaking up can help your relationship

When You Help The Homeless

my Super is making sure you do your lesson #duolingo #brawlstars #edgar

Helping A Handsome German Guy Look More Attractive

How to Help Baby Crawl: 7 Tips to Help Teach Your Baby To Crawl!

12 Ways to Protect Your Home While You’re Away

Should you awaken or refine your equipment? [Rise of Kingdoms]

What Happens If You Hold Your Pee In For Too Long

Best Ways To Teach Your Baby to Talk (Simple, stress-free strategies!)

Комментарии

0:04:58

0:04:58

0:05:20

0:05:20

0:14:24

0:14:24

0:17:04

0:17:04

0:11:31

0:11:31

0:11:32

0:11:32

0:42:25

0:42:25

0:02:33

0:02:33

0:00:30

0:00:30

0:02:03

0:02:03

0:08:37

0:08:37

0:01:32

0:01:32

0:03:47

0:03:47

0:05:28

0:05:28

0:06:36

0:06:36

0:00:27

0:00:27

0:00:46

0:00:46

0:00:10

0:00:10

0:00:53

0:00:53

0:08:10

0:08:10

0:07:50

0:07:50

0:17:39

0:17:39

0:03:05

0:03:05

0:10:09

0:10:09