filmov

tv

Relationship Between IRR, NPV, and Discount Rate Explained in 1 Minute

Показать описание

Some Great Resources:

Just a short and easy explanation of the relationship between internal rate of return (irr), net present value (npv), and the discount rate

Just a short and easy explanation of the relationship between internal rate of return (irr), net present value (npv), and the discount rate

NPV and IRR explained

Relationship Between NPV and IRR Decision Rules

Relationship Between IRR, NPV, and Discount Rate Explained in 1 Minute

🔴 3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example

NPV vs IRR | Internal Rate of Return | Net present Value | Capital Budgeting notes

NPV vs. IRR

NPV vs IRR - Net Present Value and Internal Rate of Return Explained in Hindi

NPV vs IRR Explained

relationship between the NPV and IRR using the NPV Profile

What is Internal Rate of Return (IRR)?

IRR vs ROI vs NPV: Different Type of Returns

Internal Rate of Return (IRR)

Capital Budgeting Techniques in English - NPV, IRR , Payback Period and PI, accounting

Excel - Relationship between PV, FV and NPV and IRR

IRR vs. NPV - Which To Use in Real Estate [& Why]

NPV vs IRR - Find Out Which is Better?

WACC vs IRR

#5 Internal Rate of Return (IRR) - Investment Decision - Financial Management ~ B.COM / CMA / CA

Net Present Value - NPV, Profitability Index - PI, & Internal Rate of Return - IRR Using Excel

NPV And IRR Explained | What Is NPV | What Is IRR

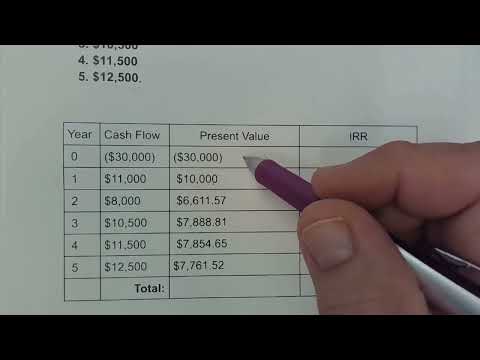

How to Calculate a Project's NPV?

Project Return Forecasting with FV, NPV and IRR | Project Management Key Concepts

NPV and IRR and Maximum IRR Deviation

(17 of 20) Ch.9 - IRR vs NPV approach when comparing 2 projects

Комментарии

0:06:48

0:06:48

0:05:53

0:05:53

0:01:01

0:01:01

0:03:27

0:03:27

0:04:26

0:04:26

0:07:27

0:07:27

0:11:32

0:11:32

0:09:17

0:09:17

0:05:16

0:05:16

0:03:56

0:03:56

0:03:28

0:03:28

0:04:46

0:04:46

0:29:50

0:29:50

0:09:11

0:09:11

0:10:39

0:10:39

0:14:03

0:14:03

0:05:32

0:05:32

0:13:38

0:13:38

0:18:22

0:18:22

0:15:05

0:15:05

0:05:13

0:05:13

0:10:09

0:10:09

0:05:36

0:05:36

0:06:20

0:06:20