filmov

tv

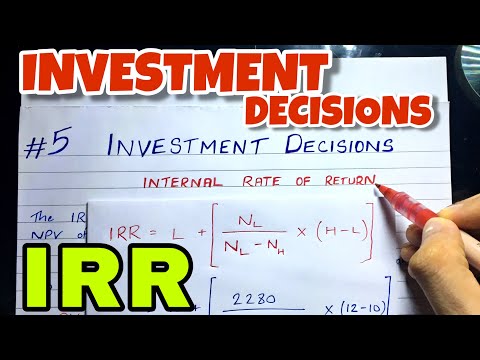

Internal Rate of Return (IRR)

Показать описание

⏱️TIMESTAMPS⏱️

0:00 Introduction to IRR

0:37 NPV calculation

1:07 NPV and IRR relationship

2:08 IRR definition

2:51 Internal Rate of Return example

3:44 NPV IRR WACC summary

In a calculation of Net Present Value, we take future values and convert them one by one to present values, using a discount rate or weighted average cost of capital, which in this example is set at 20%. The further out in the future the nominal amount, the lower the present value equivalent. To get to NPV, you now simply sum the present value amounts. The Net Present Value in this example is $35.

So how do NPV and IRR relate to each other? With NPV, you start off quantifying the nominal cash flows over the years for your project. You use the discount rate (also called WACC or hurdle rate) to calculate present values of the estimated project cash flows. The last step is to calculate the Net Present Value (or NPV) by summing the discounted cash flows.

IRR basically swaps steps 2 and 3. Just like in the NPV calculation, you start off quantifying the nominal cash flows over the years for your project. You then set the Net Present Value in the formula at zero. You can now calculate IRR, which is the output variable or dependent variable.

Here are the steps to use in the NPV formula. Step 1: start with the nominal cash flows. Step 2: apply the WACC or discount rate as an input variable. Step 3: Calculate NPV as the dependent variable.

Here are the steps to use when you want to determine Internal Rate of Return. Step 1: start with the nominal cash flows. Step 2: set NPV to zero. Step 3: Calculate IRR as the output variable.

Philip de Vroe (The Finance Storyteller) aims to make strategy, #finance and leadership enjoyable and easier to understand. Learn the business and accounting vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better #investing decisions. Philip delivers #financetraining in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

Комментарии

0:03:27

0:03:27

0:03:56

0:03:56

0:04:46

0:04:46

0:06:08

0:06:08

0:13:38

0:13:38

0:08:31

0:08:31

0:08:23

0:08:23

0:20:43

0:20:43

3:10:24

3:10:24

0:07:06

0:07:06

0:00:27

0:00:27

0:00:55

0:00:55

0:10:00

0:10:00

0:21:08

0:21:08

0:09:05

0:09:05

0:02:22

0:02:22

0:02:50

0:02:50

0:06:02

0:06:02

0:05:49

0:05:49

0:23:13

0:23:13

0:18:22

0:18:22

0:04:32

0:04:32

0:00:23

0:00:23

0:02:55

0:02:55