filmov

tv

NPV vs. IRR

Показать описание

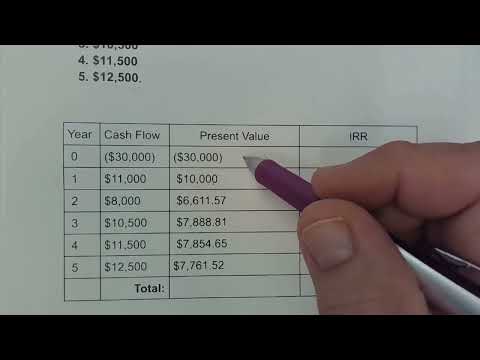

When it comes to capital budgeting, there are various approaches to evaluating a single investment or ranking mutually exclusive ventures. According to a survey conducted by Graham and Harvey (2001), Net Present Value (NPV) and Internal Rate of Return (IRR) are among the most common techniques used in practice.

There are a few differences between IRR and NPV that are worth mentioning. To begin with, it is not appropriate to rank projects using IRR — reinvesting at the same rate as IRR is unrealistic. Though, reinvesting at the same rate as the opportunity cost of capital implied by the NPV calculations is economically realistic. Hence, ranking projects based on their Net Present Value is deemed reasonable.

👇🏻Follow us on YouTube

👇🏻Connect with us on our social media platforms:

👇🏻Prepare yourself for a career in finance with our comprehensive program👇🏻

Get in touch about the training at:

Comment, like, share, and subscribe! We will be happy to hear from you and will get back to you!

#NpvVsIrr #NPV #IRR #NetPresentValue #InternalRateOfReturn #Comparison #CompareNpvAndIrrMethods #NpvMethod #IrrMethod

NPV vs. IRR

NPV and IRR explained

NPV vs IRR Explained

🔴 3 Minutes! Internal Rate of Return IRR Explained with Internal Rate of Return Example

NPV vs. IRR (Calculations for CFA® Exams)

NPV vs IRR - Find Out Which is Better?

IRR vs. NPV - Which To Use in Real Estate [& Why]

NPV vs IRR | Internal Rate of Return | Net present Value | Capital Budgeting notes

11% IRR deal in Hillcrest, KZN

How to Calculate NPV and IRR in Excel

What is Internal Rate of Return (IRR)?

CFA Level 1 2022 NPV vs. IRR - Corporate Issuers (Uses of capital) | Wall Street Notes

NPV vs IRR - Net Present Value and Internal Rate of Return Explained in Hindi

What is the internal rate of return or IRR? IRR is your NPV breakeven discount factor.

CFA® Level I Corporate Finance - NPV and IRR

Capital Budgeting (7) - NPV Vs IRR & Indifference Rate - CMA/CA Inter - FM | CMA Final (SFM)

IRR vs. NPV - Commercial Real Estate

Net Present Value (NPV) vs Internal Rate of Return (IRR)

NPV vs. IRR [CPA Prep]

3 Techniques for Deciding Whether to Accept a Project

NPV and IRR | Understand FINANCE in 2 minutes

Difference Between Net Present Value and Internal Rate of Return

NPV And IRR Explained | BA II Plus

NPV vs IRR Differences, Similarities, Conflicts, Which One Is Best #11 Capital Budgeting FM

Комментарии

0:07:27

0:07:27

0:06:48

0:06:48

0:09:17

0:09:17

0:03:27

0:03:27

0:22:19

0:22:19

0:14:03

0:14:03

0:10:39

0:10:39

0:04:26

0:04:26

0:12:43

0:12:43

0:04:28

0:04:28

0:03:56

0:03:56

0:02:04

0:02:04

0:11:32

0:11:32

0:00:55

0:00:55

0:08:52

0:08:52

0:28:01

0:28:01

0:05:39

0:05:39

0:08:54

0:08:54

0:05:00

0:05:00

0:00:40

0:00:40

0:02:39

0:02:39

0:02:55

0:02:55

0:08:03

0:08:03

0:16:08

0:16:08