filmov

tv

4 Ways to Generate Regular Income after Retirement | 6 Principles of Retirement Income Generation

Показать описание

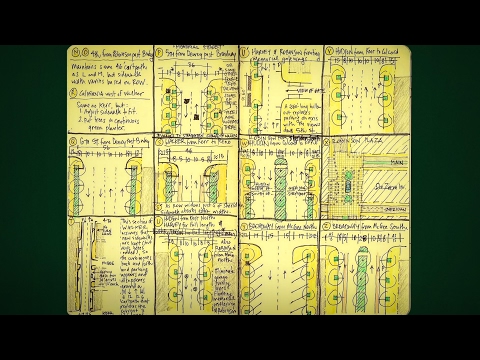

4 Proven Ways To Make SUPERIOR Designs (With Examples)

4 ways to make a city more walkable | Jeff Speck

The ONLY 4 ways to MAKE BILLIONS as a service based business..

4 Things That Will Make ANY Man DANGEROUS

4 Proven Ways To Make Money

4 Ways To Make Your Chord Progression Sound Better (Beginner Piano Lesson)

4 ways to build a human company in the age of machines | Tim Leberecht

4 Ways To Create Numbered Lists In Excel - Dynamic And Professional

4 Remote Ways To Make Money Online In 2024 ($1200+/Day) WORLDWIDE

How to Make Slime WITHOUT Borax! 4 Ways!

Fallout 4 - How to Power and Build the Signal Interceptor (The Molecular Level Quest)

4 Ways To Make Yourself Invisible

4 Ways To Make Your Presentation More Interesting

Create 4 Steps Rectangular Infographic Slide in PowerPoint

Starting The #1 Laziest Way to Make Money on YouTube For Beginners

4 Tips to Make Intermittent FASTING Easier

How to make an origami tetrahedron from a strip of paper #shorts

Laziest Way to Make Money Online for Beginners WITHOUT doing any work ($2500/WEEK)

4 Ingredients! No knead bread! Everyone can make this homemade bread!

How to make naruto darts 🎯that can be converted from 4 blades to 8 blades #vvvreview #diy #origami...

How to build an attic room in The Sims 4 #shorts #sims4

12 Fashion Items Making You Look WAY OLDER!

4 Amazing ideas for Fun or Simple Ways to Make a Boats

4 Ways to Make Cheaper Meat Taste GREAT

Комментарии

0:06:35

0:06:35

0:18:38

0:18:38

0:14:24

0:14:24

0:08:03

0:08:03

0:04:35

0:04:35

0:07:14

0:07:14

0:11:45

0:11:45

0:09:48

0:09:48

0:11:59

0:11:59

0:04:04

0:04:04

0:03:20

0:03:20

0:04:58

0:04:58

0:06:54

0:06:54

0:07:09

0:07:09

0:26:38

0:26:38

0:00:30

0:00:30

0:00:33

0:00:33

0:24:10

0:24:10

0:03:04

0:03:04

0:00:44

0:00:44

0:00:42

0:00:42

0:11:17

0:11:17

0:07:34

0:07:34

0:19:43

0:19:43