filmov

tv

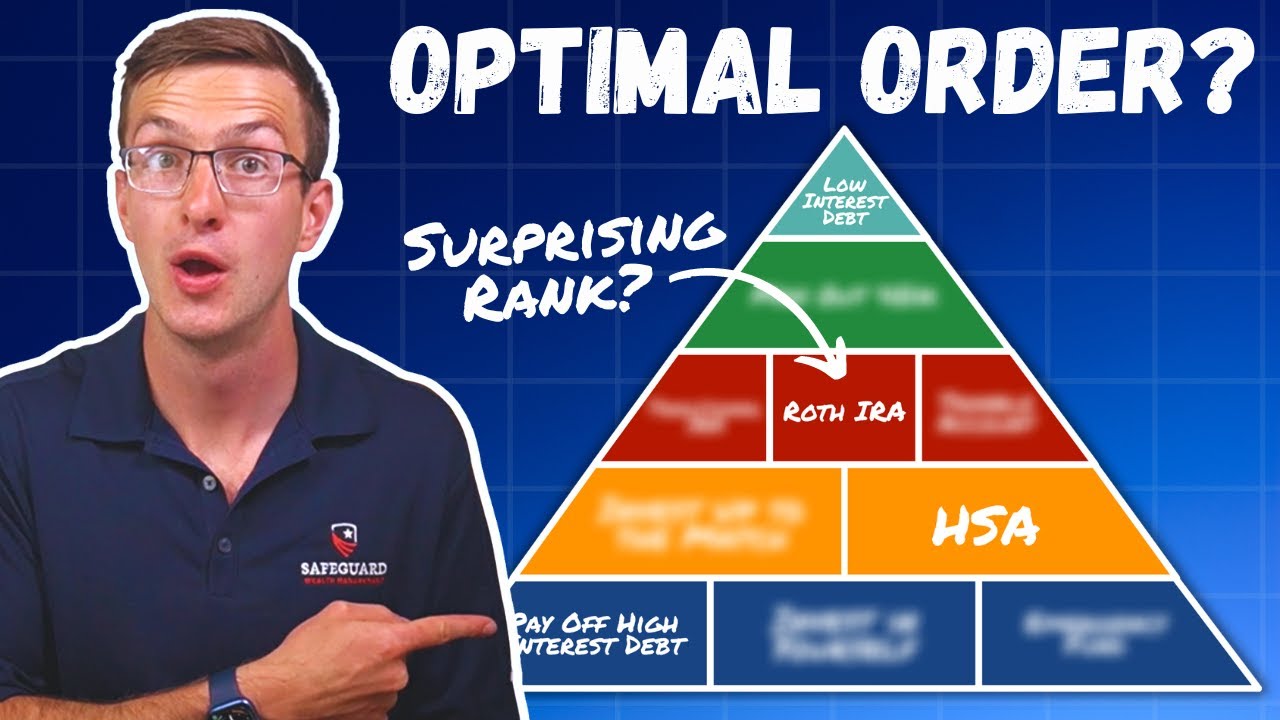

FINANCIAL PLANNER EXPLAINS: Optimal Order of Investing for Retirement

Показать описание

0:00 The Optimal Order for Investing for Retirement

0:32 The Problem with a Laddered Order

1:03 The Optimal Order Pyramid

1:38 #1 - Pay Down High Interest Debt

2:27 #2 - Protect Against Emergencies

3:12 #3 - The Highest ROI You Have

5:13 #4 - Supercharging Your 401k

6:32 #5 - Triple Tax Savings Account

8:09 #6 - The Tax Rate Decision

10:58 #7 - Maxing Contributions

11:28 #8 - Becoming Debt Free

- - - - - - - - - - - - - - - - - - - - - - - -

Always remember, "You Don't Need More Money; You Need a Better Plan"

FINANCIAL PLANNER EXPLAINS: Optimal Order of Investing for Retirement

Optimal Order For Investing Your Money

FINANCIAL ADVISOR Explains: Retirement Plans for Beginners (401k, IRA, Roth 401k/IRA, 403b) 2024

A financial planner explains the importance of buying a home

The Regrets of An Accounting Major @zoeunlimited

What Is a Financial Advisor?

Financial Planner Explains Who / When / Why Should You Incorporate?

How I spent my $200k lawyer salary #shorts

Financial expert explains how shaky stock market affects your money

Financial Planning & Analysis Explained In 5 Minutes

Financial Planner explains how to live (well) with debt

Advisors, Start Your Meetings With These Questions. Financial Advisor Training.

Finance Professor Explains: Should you pay a financial advisor?

What Does a Financial Planner Do? - Financial Planning Explained - Retirement Planning

Financial Planner Explains 3 Hidden Mortgage Tips + How To Prep Home Purchase

How much money is in your bank account? 🤔💰 #shorts #finance #interview

Robert Kiyosaki: This is the Best Investment Now!🔥📈 #money #investing #finance #robertkiyosaki

What RICH PEOPLE Know About 401k’s That YOU DON’T 🚨

Financial Planning 101 (By Age) 2023 Edition

How To Manage Your Money (50/30/20 Rule)

3 Fidelity Index Funds That Will Make You RICH!

Should You Pay Off Your Mortgage Early or Invest? | Financial Advisor Explains

The #1 Mistake People Make When They Use A Financial Advisor. Retirement Planning

ACCOUNTANT EXPLAINS: Money Habits Keeping You Poor

Комментарии

0:13:21

0:13:21

0:10:26

0:10:26

0:15:36

0:15:36

0:01:39

0:01:39

0:00:37

0:00:37

0:04:08

0:04:08

0:18:31

0:18:31

0:00:50

0:00:50

0:03:07

0:03:07

0:04:51

0:04:51

0:24:59

0:24:59

0:04:39

0:04:39

0:06:06

0:06:06

0:02:46

0:02:46

0:16:50

0:16:50

0:00:38

0:00:38

0:01:00

0:01:00

0:00:47

0:00:47

0:45:10

0:45:10

0:07:08

0:07:08

0:00:51

0:00:51

0:12:50

0:12:50

0:07:16

0:07:16

0:08:06

0:08:06