filmov

tv

How Does SIP Work in Mutual Funds? | SIP For Beginners

Показать описание

How Does SIP Work in Mutual Funds? | SIP For Beginners

The SIP facility allows you to invest a fixed amount of money at predefined intervals in the mutual fund scheme of your choice. When you invest a fixed amount of money in equity mutual fund schemes at regular intervals without timing the stock market you end up investing at different stock market levels. You will be able to purchase more equity mutual fund units when the stock market is down and lesser units when the market is high for the same amount. Step-Up SIP helps you build a bigger corpus than a regular SIP and reach major financial goals faster.

We also have a Kannada, Tamil, Telugu & a Malayalam channel

Please subscribe here:

Follow us on:

#groww #mutualfund

Disclaimer: These are not any recommendations for any funds or stocks and are meant only for educational purposes.

The SIP facility allows you to invest a fixed amount of money at predefined intervals in the mutual fund scheme of your choice. When you invest a fixed amount of money in equity mutual fund schemes at regular intervals without timing the stock market you end up investing at different stock market levels. You will be able to purchase more equity mutual fund units when the stock market is down and lesser units when the market is high for the same amount. Step-Up SIP helps you build a bigger corpus than a regular SIP and reach major financial goals faster.

We also have a Kannada, Tamil, Telugu & a Malayalam channel

Please subscribe here:

Follow us on:

#groww #mutualfund

Disclaimer: These are not any recommendations for any funds or stocks and are meant only for educational purposes.

How Does SIP Work in Mutual Funds? | SIP For Beginners

Everything about SIP Malayalam 💯| what is Mutual Fund? | How to find best Mutual fund?|what is SIP?...

What is SIP?

SIP KYA HAI? SIP vs LUMPSUM EXPLAINED! | Ankur Warikoo Hindi

How to Start SIP & How SIP works? With Real Life Experience | SIP for Beginners

SIP Investment for Beginners | Mutual Funds through SIP | What is SIP? | D Entrepreneur Tamil

Understand SIP in UNDER 2 minutes

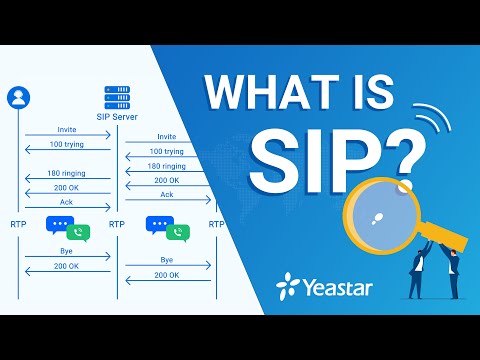

What is a SIP Protocol and How Does it Work?

How SIP Works in Voip Step by Step

SIP Trunking vs VoIP - Key Differences, Pros & Cons

What is SIP?

What is SIP & its Benefit? How Does SIP Work in Mutual Funds?

What is SIP (Systematic Investment Plan) | FinShort#36

What is SIP and How it Works? #taxlama #shorts #shortvideo #sip #investment

How compounding works in SIP? | Understanding compounding in Mutual Funds| Yadnya Investment

Earn Extra Money on Investment | SIP in Mutual Funds & ETFs | How to be Rich from Stock Market?

Easy way to earn more returns than SIP | Buy the Dip Strategy | @PrateekSinghLearnApp

Lumpsum or SIP, which is better? | CA Rachana Ranade

How to Earn Big Money from Share Market by SIP Investment | Stock Market Compounding Income

How To Build Wealth Using SIP in Mutual Funds | SIP Investment in Hindi | Investing in Mutual Funds

How to Invest in SIP Mutual Funds | Investing in SIP is Safe | SIP for beginners in Tamil

How to invest your First Rs.5000 SIP in Mutual Fund ?

How does SIP work and the 5 different types of SIP?

Prefer This Over SIP

Комментарии

0:15:57

0:15:57

0:10:23

0:10:23

0:05:14

0:05:14

0:18:37

0:18:37

0:15:52

0:15:52

0:08:55

0:08:55

0:01:41

0:01:41

0:04:52

0:04:52

0:01:57

0:01:57

0:10:25

0:10:25

0:05:09

0:05:09

0:05:30

0:05:30

0:00:37

0:00:37

0:01:00

0:01:00

0:05:53

0:05:53

0:36:54

0:36:54

0:09:51

0:09:51

0:19:01

0:19:01

0:24:01

0:24:01

0:11:17

0:11:17

0:13:44

0:13:44

0:09:33

0:09:33

0:00:25

0:00:25

0:00:44

0:00:44