filmov

tv

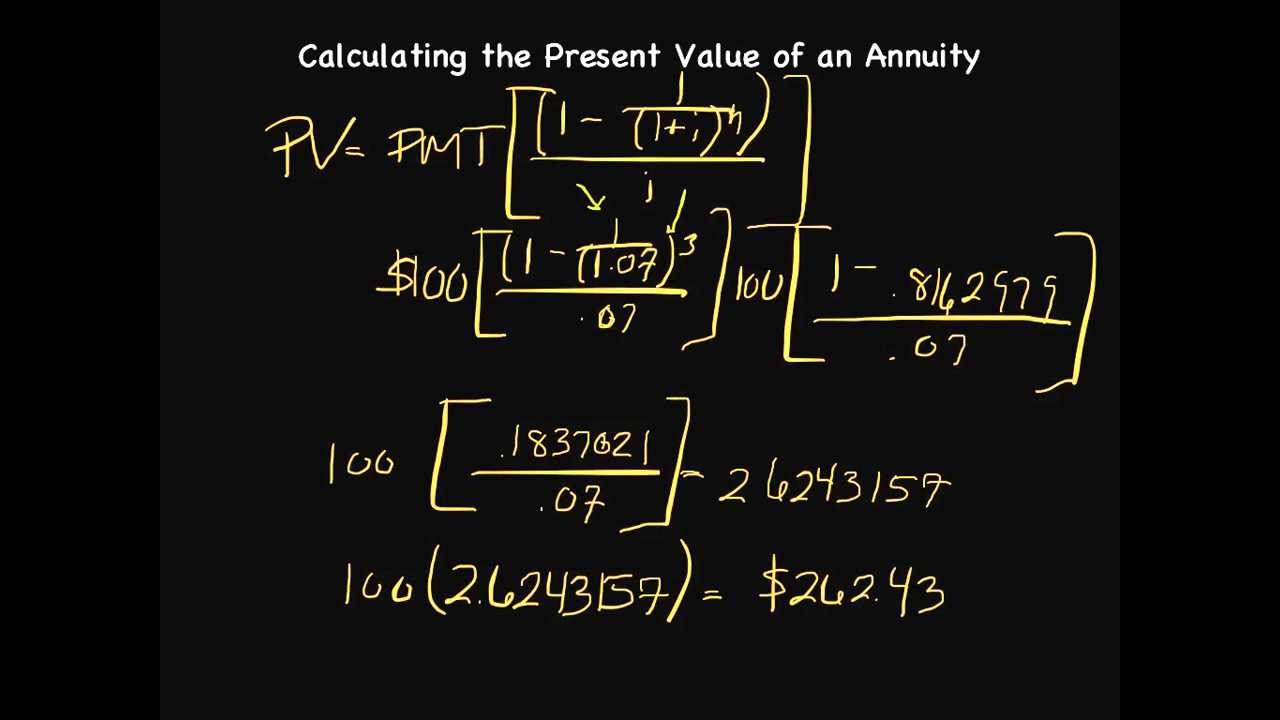

How to Calculate the Present Value of an Annuity

Показать описание

In this video, I show how to calculate the present value of an annuity. In addition to converting the series of payments via the traditional discounting method, I'll show how to solve the problem utilizing a handy equation.

How to Calculate Present Value on Calculator - Easy Way

How to Calculate Present Value

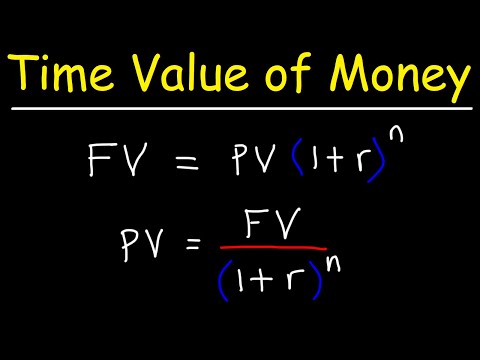

Time Value of Money - Present Value vs Future Value

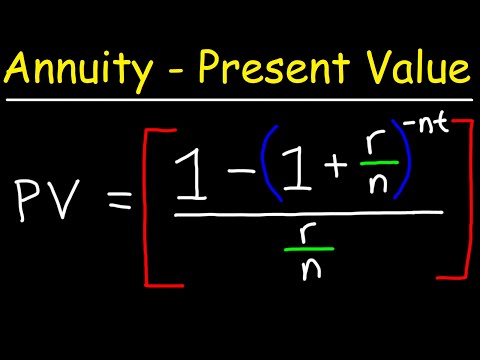

How To Calculate The Present Value of an Annuity

How to Calculate the Present Value of an Annuity

How to Calculate Present value factor, factoring and constant on calculator Easy way

How to Calculate Net Present Value

How to Calculate a Project's NPV?

How to Calculate Present Value of a Perpetuity | Time Value of Money Explained

How to Calculate Net Present Value

How to calculate present value of a bond

Episode 166: How to Calculate the Present Value

How to Calculate Present Value of An Ordinary Annuity on Calculator

How to Calculate PVAF using simple calculator

How to Calculate the Current Price of a Bond

How to Calculate NPV (Net Present Value) in Excel

Spreadsheets for Finance: How to Calculate Present Value

How to Calculate Future Value and Present Value with BA II Plus Calculator by Texas Instruments

How to Calculate the Future Value of a Lump Sum Investment | Episode 38

How to Calculate Net Present Value in Excel

Calculate the Present Value for Multiple Cash Flows (Intermediate Accounting I #3)

How to the Calculate Present Value of a Whole Life Insurance Policy : Life Insurance & More

How to calculate Present Value Factors (Simple Method) !!

Three Ways to Calculate Present Value (PV) in Excel

Комментарии

0:03:25

0:03:25

0:05:54

0:05:54

0:05:14

0:05:14

0:16:15

0:16:15

0:10:13

0:10:13

0:02:10

0:02:10

0:01:55

0:01:55

0:05:13

0:05:13

1:23:40

1:23:40

0:16:01

0:16:01

0:03:30

0:03:30

0:05:09

0:05:09

0:03:25

0:03:25

0:00:47

0:00:47

0:02:20

0:02:20

0:02:56

0:02:56

0:12:10

0:12:10

0:04:25

0:04:25

0:04:43

0:04:43

0:03:15

0:03:15

0:05:35

0:05:35

0:01:58

0:01:58

0:01:01

0:01:01

0:06:22

0:06:22