filmov

tv

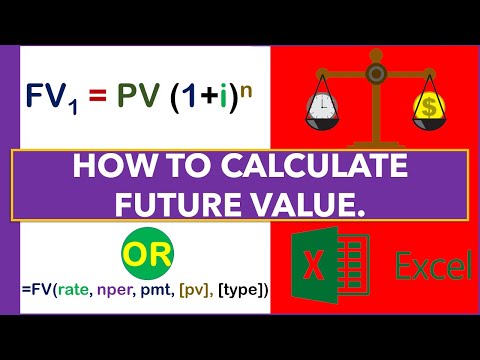

How to Calculate the Future Value of a Lump Sum Investment | Episode 38

Показать описание

If you're deciding to invest a lump-sum over a period of time you can quickly determine what the future value of that investment would be. In this brief video I'll show you how to calculate the future value of a lump-sum investment.

To view additional video lectures as well as other materials access the following links:

How to Calculate the Future Value of a Lump Sum Investment | Episode 38

How To Calculate The Future Value of an Ordinary Annuity

How to Calculate the Future Value in Excel

Warren Buffett and Charlie Munger on How to Calculate Future Earnings

How to Calculate Future Value and Present Value with BA II Plus Calculator by Texas Instruments

How to Calculate Present Value on Calculator - Easy Way

How to Calculate the Future Value of an Annuity

Annuities - How To Calculate The Future Value of an Annuity Due

Future Prediction LULC using Google Earth Engine , IDRISI Selva V.17 , QGIS Molusce plugin , Terrset

How to Calculate the Future Value (FV) of Multiple Cash Flows

How to Calculate the Intrinsic Value of a Stock in 2023 (Full Example)

Calculate Future Value of Monthly Investment of 60 for 5 years

How to calculate future value of monthly investment?

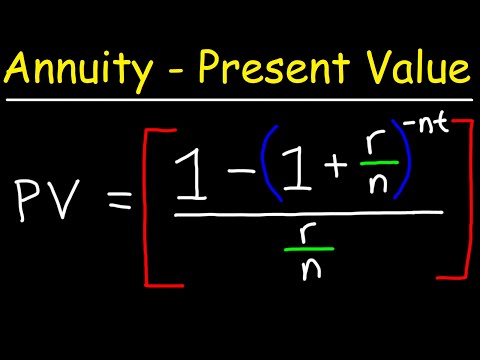

How To Calculate The Present Value of an Annuity

How to Calculate the Future Value and Present Value Factors Using Simple Calculator( with a trick)

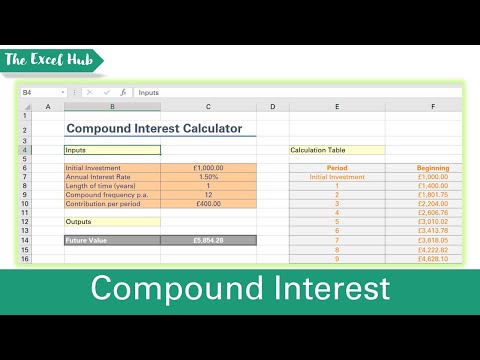

Calculate Future Value in Excel ( *FV Function* )

How to Calculate Present Value for Compounding Quarterly

Calculate Future Value Of Investment - Excel Formula FV

How to Calculate PVAF using simple calculator

How to Calculate Future Value Factor - 30 Second CRE Tutorials

How to Calculate Profit or Loss on Futures Contracts

how to calculate future value of current investments!!! [Personal finance Thursday]

Compound Interest Calculator In Excel - Calculate Savings Using FV Function

Calculate Future Value of Semi Annual Annuity Discrete Functions

Комментарии

0:04:43

0:04:43

0:10:03

0:10:03

0:00:23

0:00:23

0:03:04

0:03:04

0:04:25

0:04:25

0:03:25

0:03:25

0:09:51

0:09:51

0:12:17

0:12:17

0:49:18

0:49:18

0:05:10

0:05:10

0:12:07

0:12:07

0:05:45

0:05:45

0:07:24

0:07:24

0:16:15

0:16:15

0:06:59

0:06:59

0:13:33

0:13:33

0:03:58

0:03:58

0:06:02

0:06:02

0:00:47

0:00:47

0:00:31

0:00:31

0:02:25

0:02:25

0:00:26

0:00:26

0:06:08

0:06:08

0:05:20

0:05:20