filmov

tv

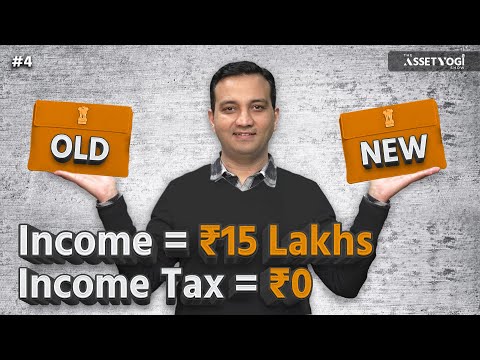

Old Tax Regime vs New Tax Regime: Which one Saves More Tax after Budget 2024?

Показать описание

With recent updates from the Finance Minister in her Budget 2024 Speech offering more incentives to switch from the Old Tax Regime to the New Tax regime, it becomes essential to know which Income Tax Regime will save you more taxes at your current Income Levels.

So, the answer lies in one key number--- Total Deductions that you can claim, which can help you decide between the Old and the New Tax Regime.

Watch the video for Details.

👉 Rise of Waaree Renewables from Penny Stock to Multibagger

👉 Subscribe to ET Money English

👉 Subscribe to ET Money Hindi

👉 Follow us on:

So, the answer lies in one key number--- Total Deductions that you can claim, which can help you decide between the Old and the New Tax Regime.

Watch the video for Details.

👉 Rise of Waaree Renewables from Penny Stock to Multibagger

👉 Subscribe to ET Money English

👉 Subscribe to ET Money Hindi

👉 Follow us on:

New Income Tax Slab 2023-24 | New Tax Regime vs Old Tax Regime [with Calculator]

Which is the best tax regime for you? | Money Psychology

Old vs New Regime | Which is better? Tax Saving Options | Income Tax Planning Guide 2024

Comparison of Old Tax Regime v/s New Tax regime

New Tax Regime vs Old Tax Regime: Which Is Better? | Economy | UPSC

New Tax Regime vs Old Tax regime Which is Better? Income Tax Calculation Examples

Old Vs New Tax Regime (Part 1)

New Income Tax Slabs 2024-25 | New Tax Regime vs Old Tax Regime Calculation | Budget 2024 Analysis

Old Tax Regime Vs New Tax: What's The Best For Salaried Employees?

Old vs New Tax Regime 2024: Which is Better? #incometax #tamil #newregime #newtaxregime

Old vs new tax regime: Which one should YOU choose? | Old vs new tax regime 2023

Best Tax Regime according to your salary | Old vs New Tax Regime , Which one saves you more money?

2024 Income Tax Saving and Tax Planning Guide | New vs Old Regime | Assetyogi Show #4

Old Tax vs New Tax Regime | Which Is More Beneficial After Budget 2023?

New Tax Regime vs Old Tax Regime 2023 In Telugu - Which Is Better | Tax Saving Tips |With Calculator

New Vs Old Tax Regime Malayalam | E filing Malayalam AY 2024-25 |CA Subin VR

New Tax Regime vs Old Tax Regime: Which One Is Better for You in 2024?

New Tax Regime vs Old Tax Regime 2024-25 | Income Tax New vs Old Tax Regime Which is Better 2023-24

Old Tax Regime vs. New Tax Regime: Complete Income Tax Calculation & Savings Guide

Calculate INCOME TAX for 2024! | Ankur Warikoo Hindi

Old Tax Regime vs New Tax Regime with Updated Calculator

How to Pay Zero Tax in 2024 | Old Vs New Income Tax Regime

2024 Income TAX Saving Tips | Old vs New Tax Regime with Calculation

Old Tax Regime vs New Tax Regime: Which one Saves More Tax after Budget 2024?

Комментарии

0:13:35

0:13:35

0:12:34

0:12:34

0:12:38

0:12:38

0:00:20

0:00:20

0:14:37

0:14:37

0:11:53

0:11:53

0:08:04

0:08:04

0:11:02

0:11:02

0:05:34

0:05:34

0:15:14

0:15:14

0:13:30

0:13:30

0:15:28

0:15:28

0:22:57

0:22:57

0:06:41

0:06:41

0:16:59

0:16:59

0:05:24

0:05:24

0:00:27

0:00:27

0:10:27

0:10:27

0:44:04

0:44:04

0:18:31

0:18:31

0:08:37

0:08:37

0:16:25

0:16:25

0:12:14

0:12:14

0:04:20

0:04:20