filmov

tv

A faster way to calculate portfolio risk, and remember it too | Financial Modeling Tutorial

Показать описание

A financial modeling tutorial on calculating portfolio risk using a bordered covariance matrix instead of formula notation for portfolio variance and portfolio standard deviation using Excel in Quant 101.

For the video transcript and Excel formulas see:

For the outline to the series see:

Zoom to the section you are interested in:

01:18 - Outline

01:53 - Step 1 - The Problem with Portfolio Risk

03:30 - Step 2 - Calculate Portfolio Variance

12:05 - Step 3 - Derive Portfolio Standard Deviation

13:04 - Step 4 - Portfolio Risk and Rebalancing

15:34 - Step 5 - Next: Covariance matrix

See what else you can learn at:

Happy Learning!

For the video transcript and Excel formulas see:

For the outline to the series see:

Zoom to the section you are interested in:

01:18 - Outline

01:53 - Step 1 - The Problem with Portfolio Risk

03:30 - Step 2 - Calculate Portfolio Variance

12:05 - Step 3 - Derive Portfolio Standard Deviation

13:04 - Step 4 - Portfolio Risk and Rebalancing

15:34 - Step 5 - Next: Covariance matrix

See what else you can learn at:

Happy Learning!

How I learned to Calculate Extremely Fast

How to Calculate Faster than a Calculator - Mental Maths #1

How To Calculate Faster than a Calculator

How to Calculate Faster than a Calculator - Mental Maths #2| Addition and Subtraction

How to Calculate Faster than a Calculator - Mental Math #1

How to Calculate Faster than a Calculator - Mental Math #1

How to Count Money Fast CAD $ RMB ¥ THB ฿

The Fastest Way To Find Waldo

How to find the correct number of squares in the fastest way possible | #maths #mathematics

How to Calculate Faster than a Calculator - Mental Math #2

2 Digit Multiplication easily | Brain Games | Brain Development

How to Calculate Faster than a Calculator. Mental Maths-6 (50k Subscribers special)

A faster way to calculate ⅔ height above plate (HAP) measurements

Finger Mathematics - How to calculate Faster than a calculator Mental maths - 10

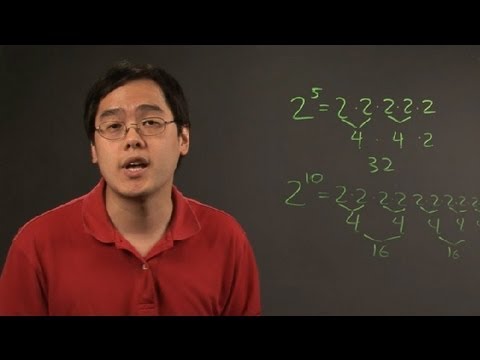

How to Compute a Number With a Very High Exponent : Trigonometry & Other Math

A QUICK Way to Find Your WHY | Simon Sinek

The Fastest Way to Learn Multiplication Facts

The PMP Fast Track - the FASTEST way to get up to speed for your PMP Exam

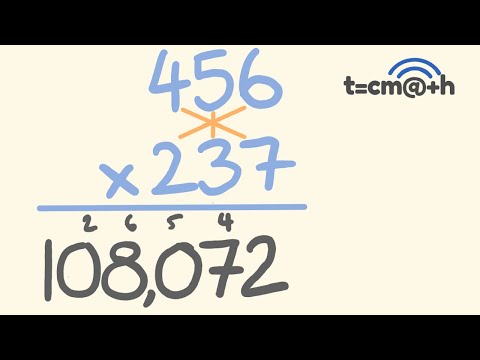

How to multiply ANY numbers the fast way - Fast Math Trick

How to calculate faster than a calculator #math #tutor #subtraction #shorttrick #percentage

How fast can you solve a Rubik’s Cube?? 🤔

How to multiply 2-digit numbers fast with a trick

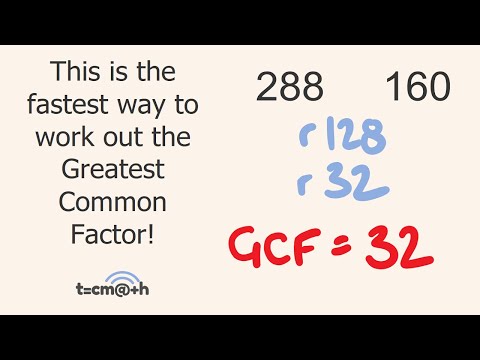

Greatest Common Factor Trick GCF

How to Calculate Faster than a Calculator - 5 (Mental division) by mathOgenius

Комментарии

0:05:18

0:05:18

0:05:42

0:05:42

0:00:30

0:00:30

0:08:00

0:08:00

0:05:05

0:05:05

0:07:20

0:07:20

0:01:58

0:01:58

0:01:01

0:01:01

0:00:28

0:00:28

0:10:29

0:10:29

0:05:49

0:05:49

0:10:29

0:10:29

0:00:33

0:00:33

0:13:33

0:13:33

0:01:49

0:01:49

0:02:23

0:02:23

0:06:04

0:06:04

0:34:29

0:34:29

0:08:16

0:08:16

0:00:34

0:00:34

0:00:18

0:00:18

0:01:00

0:01:00

0:08:11

0:08:11

0:11:07

0:11:07