filmov

tv

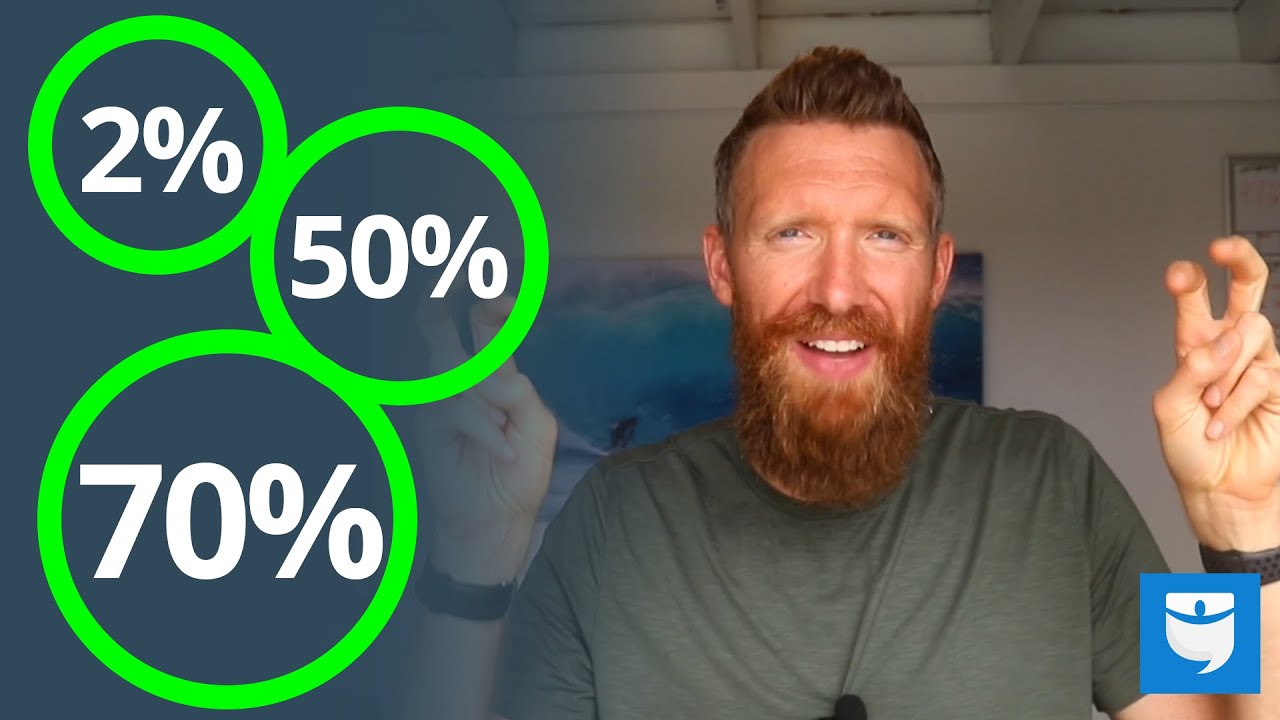

Real Estate Investing Rules You MUST Know (The 2%, 50% & 70% Rules)

Показать описание

If you're getting started in real estate investing, then you need to know about these 3 rules of thumb (The 2% Rule, 50% Rule, & 70% Rule)!

These rules are basic math equations geared to help you quickly estimate the cash flow of potential real estate investment properties!

In this video, Brandon breaks down each rule with examples, for you to know how to use each one. But, rules are meant to be broken.

Brandon not only demonstrates how to use these rules but also why they aren't always true.

We hope you enjoy this video and if you do, make sure to LIKE, Subscribe, & leave a comment!

___________________________________

Real Estate Investing Rules You MUST Know (The 2%, 50% & 70% Rules)

Real Estate Investing in 2024 (6 'Rules' You Can't Ignore)

The New Real Estate Investing Rule You Must Know (No More 1% Rule)

The 3 Golden Rules to Real Estate Investing (2020)

3 Golden Rules of Real Estate Investing

9 Rules For Successful Real Estate Investing

Real Estate Investing For Beginners - Ultimate Guide 2024

Rental Property Investing 101 - Getting Started in 8 Steps

The Rules of investing

The 5 Golden Rules of Real Estate Investing

1% Rule for Property Investing in South Africa

Morris Invest: What is the 1% Rule for Real Estate Investing?

5 Golden Rules of Real Estate Investing

Warren Buffett: Why Real Estate Is a LOUSY Investment?

Master the Six Basic Rules of Investing – Robert Kiyosaki

How To Become A Millionaire Through Real Estate Investing (Newbies!)

How Much Cash Flow Should Your Rental Properties Produce?

5 Basic Rules To Start Investing In Real Estate

Top 5 Rules for Real Estate Investing

Property investing in South Africa 1% rule

How to Analyze a Rental Property (No Calculators or Spreadsheets Needed!)

Is The 1% Rule Ruining Real Estate Investing?

What Is The 1% rule | Real Estate Investing

5 Ways Rich People Make Money With Debt

Комментарии

0:10:31

0:10:31

0:40:20

0:40:20

0:13:56

0:13:56

0:05:43

0:05:43

0:00:26

0:00:26

0:15:18

0:15:18

0:18:49

0:18:49

0:08:17

0:08:17

0:01:00

0:01:00

0:12:35

0:12:35

0:10:31

0:10:31

0:11:02

0:11:02

0:11:09

0:11:09

0:04:51

0:04:51

0:15:01

0:15:01

0:10:05

0:10:05

0:05:53

0:05:53

0:08:48

0:08:48

0:22:15

0:22:15

0:02:44

0:02:44

0:35:11

0:35:11

0:54:21

0:54:21

0:04:05

0:04:05

0:11:08

0:11:08