filmov

tv

5 Golden Rules of Real Estate Investing

Показать описание

Thank you for watching!

Thach Nguyen has come a long way since arriving in America at age 4 with his parents, four brothers, and sister in 1975. Focus, drive, determination, and great mentors paved the way for him to go from a homeless refugee to a multi-millionaire.

Thach is the CEO & Founder of Thach Real Estate Group and principal of Springboard to Wealth. He is not only a seasoned realtor, investor, coach, author, and speaker, but also a proud ambassador of the American Dream. During his 30 years in the real estate industry, he has built more than 300 homes, townhouses, multifamily units and completed over 100 flips, and owns over 100 rental properties giving him over $100,000 a month in passive income. Thach and his team have assisted more than 1,500 families to create their own American Dream of home ownership, ranking him in the Top 1% of all real estate professionals nationwide.

5 Golden Rules of Real Estate Investing

5 Golden Porting Rules - real detailed porting tech!

5 golden rules for Pro grade porting. What are they?

5 golden porting rules - #1

5 Golden Rules of Money: Dare to dream different | Monika Halan | TEDxHansrajCollege

The 5 Golden Rules of Real Estate Investing

5 golden rules for starting your day perfectly | Daniel Hoffmann | TEDxFHNW

FOOD: Rule #1 of Doggy Dan's 5 Golden Rules - Why You Need To Control Your Dog's Food

The 5 GOLDEN RULES for Losing Fat **DO THESE**

5 GOLDEN RULES for Safety

The 5 GOLDEN RULES for Building Muscle! (95% of your gains come from these)

Golden Rules Of Accounts In Hindi | Types Of Accounts | Personal, Real And Nominal Account |

5 Golden Rules to Happiness

ACCOUNTING CLASS MALAYALAM/GOLDEN RULES OF ACCOUNTING/NOMINAL ACCOUNT/+ 1 ACCOUNTANCY

5 Golden Rules That Will Help You Stay Focused.

5 Golden Rules Of Welding

5 Golden Rules For Great Photos

5 Golden Rules Of Gambling

5 Golden Rules For Beginner Tennis Players

5 Safety Golden Rules in Design & Technology

5 Golden Rules of Game Cards Graphic Design You MUST OBEY

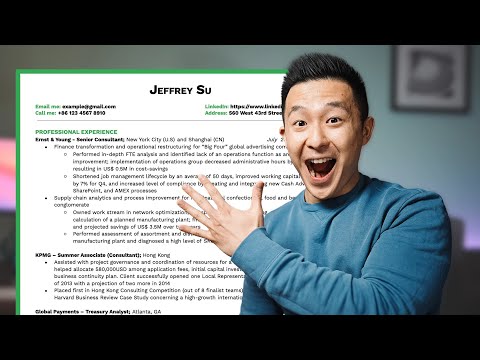

Write an Incredible Resume: 5 Golden Rules!

Golden Rules of Accounts | Rules of Debit and Credit |#2 Journal Entries Accounting | Class 11

Rules of debit and credit in accounting - Golden rules with example journal entries

Комментарии

0:11:09

0:11:09

0:13:16

0:13:16

0:14:24

0:14:24

0:17:17

0:17:17

0:16:18

0:16:18

0:12:35

0:12:35

0:13:18

0:13:18

0:14:04

0:14:04

0:13:21

0:13:21

0:00:40

0:00:40

0:13:06

0:13:06

0:08:43

0:08:43

0:08:27

0:08:27

0:17:50

0:17:50

0:04:34

0:04:34

0:04:39

0:04:39

0:11:43

0:11:43

0:18:21

0:18:21

0:10:13

0:10:13

0:02:47

0:02:47

0:11:27

0:11:27

0:08:37

0:08:37

0:42:08

0:42:08

0:07:44

0:07:44