filmov

tv

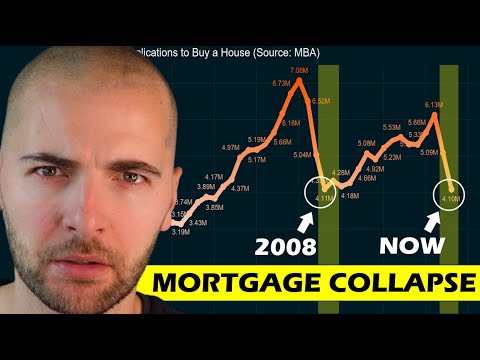

The biggest Mortgage Collapse in US History is happening right now.

Показать описание

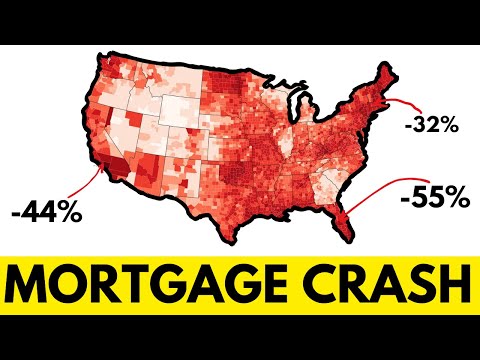

Homebuyer demand measured by mortgage applications just took the biggest plunge in 30 years. With mortgage applications to buy a house now down 19% YoY and resting below the lows of the 2008 housing crash.

This crash in homebuyer demand suggests that the spring 2024 housing market will be a ghost town. And that sellers on the US Housing Market could be forced to lower prices. And that many people in the real estate industry could also be laid off.

Especially in housing markets like Florida, Texas, and Tennessee, where home prices look to be on the decline in 2024. Especially in cities like Sarasota, Austin, and Nashville. Where homes for sale has spiked and home prices are now trending down.

---

DISCLAIMER: This video content is intended only for informational, educational, and entertainment purposes. Neither Reventure Consulting or Nicholas Gerli are registered financial advisors. Your use of Reventure Consulting's YouTube channel and your reliance on any information on the channel is solely at your own risk. Moreover, the use of the Internet (including, but not limited to, YouTube, E-Mail, and Instagram) for communications with Reventure Consulting does not establish a formal business relationship.

This crash in homebuyer demand suggests that the spring 2024 housing market will be a ghost town. And that sellers on the US Housing Market could be forced to lower prices. And that many people in the real estate industry could also be laid off.

Especially in housing markets like Florida, Texas, and Tennessee, where home prices look to be on the decline in 2024. Especially in cities like Sarasota, Austin, and Nashville. Where homes for sale has spiked and home prices are now trending down.

---

DISCLAIMER: This video content is intended only for informational, educational, and entertainment purposes. Neither Reventure Consulting or Nicholas Gerli are registered financial advisors. Your use of Reventure Consulting's YouTube channel and your reliance on any information on the channel is solely at your own risk. Moreover, the use of the Internet (including, but not limited to, YouTube, E-Mail, and Instagram) for communications with Reventure Consulting does not establish a formal business relationship.

Комментарии

0:16:08

0:16:08

0:55:46

0:55:46

0:11:25

0:11:25

0:08:20

0:08:20

0:15:13

0:15:13

0:11:25

0:11:25

0:00:27

0:00:27

0:08:12

0:08:12

0:13:31

0:13:31

0:14:44

0:14:44

0:20:29

0:20:29

0:12:52

0:12:52

0:45:22

0:45:22

0:25:31

0:25:31

0:00:49

0:00:49

0:12:58

0:12:58

0:03:03

0:03:03

0:09:58

0:09:58

0:09:09

0:09:09

0:05:03

0:05:03

0:00:39

0:00:39

0:07:38

0:07:38

0:52:54

0:52:54

1:30:20

1:30:20