filmov

tv

Why is UK Facing a New Mortgage Crisis?

Показать описание

A look at why mortgage rates are rising, going back to financial crisis of 2009. Why that sowed seeds for a period of ultra low interest rates, which are now changing rapidly.

Text version

About

Text version

About

Why is UK Facing a New Mortgage Crisis?

Riot police separate far-right and counter protesters in several UK cities

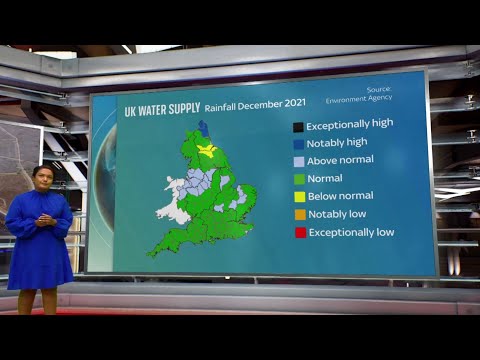

Why is the UK facing a drought?

Why is the UK facing a 'supply crisis'?

Is the UK facing a financial crisis?

Why the UK is Facing a Tomato Shortage in 2023

Why UK 🇬🇧 is going Bankrupt? : Detailed Economic Case Study

UK Faces A Pizza Crisis Due To Scarcity Of Tomatoes Across Europe

UK economy: are we still facing a recession? Expert explains

The UK Is Facing A Severe Gas Crisis. What Does This Signify For The Rest Of The World? | Swarajya

Food failure: why is UK facing shortages and high prices?

Is the UK facing a rise in knife crime? - BBC Newsnight

UK heatwave: One of the wettest parts of UK faces hosepipe ban

France vs UK - Who Faces The Biggest Economic Problems?

Which UK cities could face a local COVID-19 lockdown?

UK protests: Violent disorder breaks out across the country

Sunak: UK faces 'profound economic challenge'

Delta variant: Is the UK facing a fourth wave of coronavirus infections? | DW News

Construction in the UK faces a downturn

'Uncomfortable' watching Angela Carini face Imane Khelif in Olympic boxing match

Is The UK Facing a Financial Crisis?

UK faces challenges one year into Brexit | DW News

Budget 2023: UK facing 'lost decade' for living standards - IFS

UK Face Mask 🇬🇧

Комментарии

0:12:52

0:12:52

0:15:11

0:15:11

0:02:33

0:02:33

0:02:12

0:02:12

0:03:25

0:03:25

0:00:37

0:00:37

0:20:37

0:20:37

0:01:45

0:01:45

0:26:39

0:26:39

0:04:11

0:04:11

0:08:06

0:08:06

0:05:46

0:05:46

0:03:50

0:03:50

0:10:00

0:10:00

0:02:41

0:02:41

0:02:27

0:02:27

0:01:24

0:01:24

0:04:10

0:04:10

0:02:40

0:02:40

0:02:42

0:02:42

0:09:41

0:09:41

0:03:59

0:03:59

0:04:17

0:04:17

0:00:20

0:00:20