filmov

tv

The Biggest Mortgage Crash In American History

Показать описание

Right now, the typical monthly home payment for fresh home buyers in America is $2890. That's almost double what it was before 2020, and it's spiked by nearly 15% in just the past year. This sharp rise is a major reason why many believe we're in a housing bubble. Experts consistently point to this figure to illustrate the significant surge in relative prices.

But here's something important to understand about the real estate market: the sticker price you see isn't the whole story. Unlike buying most things, purchasing a home typically involves a 30-year mortgage. On top of that, there are additional costs like taxes, insurance, and, perhaps most significantly, interest. All of these factors contribute to the actual amount people pay each month—the mortgage bill.

CNBC Clip

But here's something important to understand about the real estate market: the sticker price you see isn't the whole story. Unlike buying most things, purchasing a home typically involves a 30-year mortgage. On top of that, there are additional costs like taxes, insurance, and, perhaps most significantly, interest. All of these factors contribute to the actual amount people pay each month—the mortgage bill.

CNBC Clip

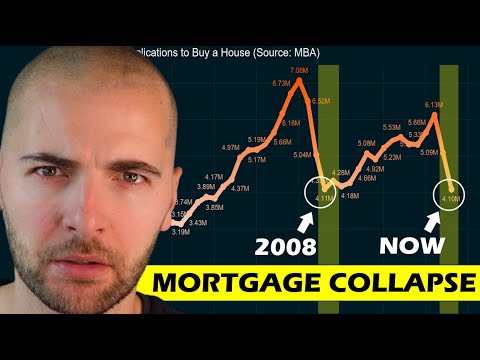

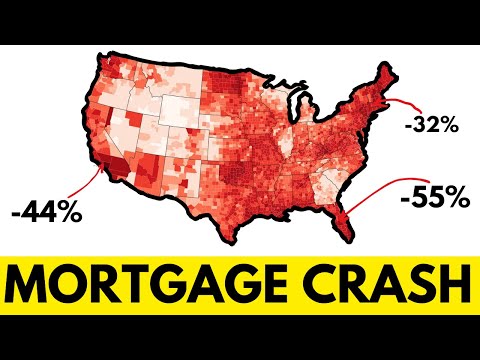

The biggest Mortgage Collapse in US History is happening right now.

The Biggest Mortgage Collapse since 2008 just got worse.

The Biggest Mortgage Crash In American History

California on verge of collapse. Housing crisis causing mass homelessness.

How it Happened - The 2008 Financial Crisis: Crash Course Economics #12

The Mortgage Crisis is HERE. Coming to YOUR Housing Market in Early 2022.

Mortgage Rates SURGE. 2022 Home Price Declines COMING SOON (in these Cities)?

The Largest Mortgage Meltdown In American History Happening Right Now

BIG Drop in Mortgage Rates as Silicon Valley Bank Collapses

The UK Mortgage Crisis Is Here - Will This Crash The Market?

Is the 2023 US Housing Market DOOMED? (Wells Fargo Abandoning Mortgage Business)

Mortgage costs hit highest level in 15 years passing mini-budget peak

Housing market: Mortgage rates pass 6% highest since 2008 crash | Rush Hour

Banks Predict MORTGAGE CRASH in 2022 (US Housing Market is NOT PREPARED)

China's mortgage boycott: Could the property market crumble? | Counting the Cost

The Fed Just Started a MORTGAGE DISASTER in the 2022 Housing Market

The 2008 Financial Crisis - 5 Minute History Lesson

Mortgage Rates EXPLODE. 50% Price Declines Coming?

The Mortgage Market Just FLIPPED! Russia, Ukraine & Jerome Powell CRASH Interest Rates

Mortgage Rates JUMP to 5.25%: Highest Rates Since 2009

Home Prices & Mortgage Rates COLLAPSE (Housing Deflation is Here)

The US Debt Crisis (explained)

How the 2008 financial crisis crashed the economy and changed the world

The 2020 Housing Crash | The Eviction & Mortgage Crisis

Комментарии

0:16:08

0:16:08

0:55:46

0:55:46

0:08:20

0:08:20

0:19:31

0:19:31

0:11:25

0:11:25

0:45:22

0:45:22

0:14:17

0:14:17

0:15:13

0:15:13

0:11:25

0:11:25

0:13:31

0:13:31

0:00:49

0:00:49

0:00:39

0:00:39

0:03:03

0:03:03

0:11:08

0:11:08

0:25:31

0:25:31

0:10:22

0:10:22

0:05:35

0:05:35

0:13:01

0:13:01

0:49:31

0:49:31

0:12:48

0:12:48

0:09:09

0:09:09

0:09:30

0:09:30

0:08:12

0:08:12

0:17:05

0:17:05