filmov

tv

The Largest Mortgage Meltdown In American History Happening Right Now

Показать описание

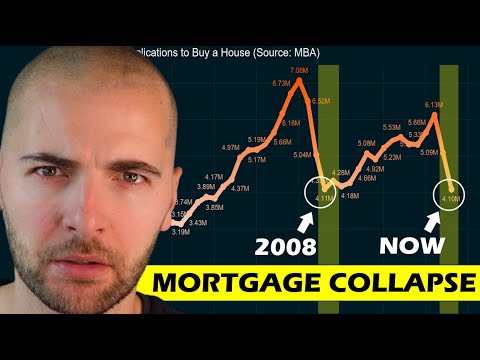

Many people in finance have been trying to predict where the next major crisis will begin. We remember that in 2008, during the Great Recession, we saw the consequences of the collapse in bank lending tied to residential real estate, which triggered a domino effect that not only shook the US economy but also had global ramifications. Since then, numerous experts have attempted to identify the next potential economic bubble, but so far, no one has been correct. Not since 2008 have we experienced anything close to this. However, there are now new signs of an emerging crisis that everyone seems to be brushing off. This looming threat could potentially have a more devastating impact than the 2008 crisis, possibly even rivaling some of the worst economic storms America has had to endure. And it's origin story is actually pretty easy to recognize.

The Largest Mortgage Meltdown In American History Happening Right Now

The biggest Mortgage Collapse in US History is happening right now.

The Mortgage Meltdown with Journalist Michael Hudson

Another Great 'Mortgage Meltdown' in Residential (w/ Logan Mohtashami)

Scott Nelson - From Mortgage Crisis to Market Meltdown

What are Mortgage-Backed Securities? (2008 Financial Crisis Explained)

How it Happened - The 2008 Financial Crisis: Crash Course Economics #12

How is the mortgage crisis affecting you?

China's mortgage boycott: Could the property market crumble? | Counting the Cost

There's a mortgage REIT meltdown—Here's what's happening

The Biggest Mortgage Collapse since 2008 just got worse.

The 2020 Mortgage Crisis Explained

U.S. Home Mortgage Delinquencies Reach Highest Level Since 2011

Why is UK Facing a New Mortgage Crisis?

The UK Mortgage Crisis Is Here - Will This Crash The Market?

Mortgage costs hit highest level in 15 years passing mini-budget peak

Mortgage-backed securities are ‘at the center of this particular’ banking crisis: Strategist

The Subprime Mortgage Crisis - Causes and Lessons Learned: Module 4 of 5

Are we on the verge of a serious mortgage crisis? ...The Leader #podcast

SVB Collapse = Lower Mortgage Interest Rates | Dave Ramsey

Britain’s Mortgage Crisis!

Who are Britain's Biggest Mortgage Lenders?

Session 2: Managing Mortgage Debt During a Financial Crisis

Why Warren Buffett Said No to Lehman and AIG in 2008

Комментарии

0:15:13

0:15:13

0:16:08

0:16:08

0:35:35

0:35:35

0:52:22

0:52:22

0:56:46

0:56:46

0:20:29

0:20:29

0:11:25

0:11:25

0:00:27

0:00:27

0:25:31

0:25:31

0:04:11

0:04:11

0:55:46

0:55:46

0:14:44

0:14:44

0:00:52

0:00:52

0:12:52

0:12:52

0:13:31

0:13:31

0:00:39

0:00:39

0:04:33

0:04:33

0:14:15

0:14:15

0:11:54

0:11:54

0:00:49

0:00:49

0:24:57

0:24:57

0:00:57

0:00:57

1:27:45

1:27:45

0:05:03

0:05:03