filmov

tv

Buying Puts as a Hedge for a Long Position

Показать описание

My Opinion On Hedging Using Put Options

Buying Puts as a Hedge for a Long Position

Hedging a Long Stock Position with Options

Hedging Strategy: Buying a Put and Buying a Stock ☔

How to Hedge Call or Put Options | Options Trading Strategies

How to Make Money Buying Put Options for Beginners

Buying a Stock with PUT Protection with Options... Is it the SMART THING to DO? 👈

Hedging Positions l Powerful Options Strategies

Black Swan Hedge: Your Ultimate Market Protector!

How to Hedge your Portfolio Against Risk: Long Put Option Strategy Guide

How to use Put Options to Make Money and Hedge a portfolio

Hedge Your Portfolio Like A Pro

Option Trade: How To Hedge Your Portfolio With Put Options In DIA

How To Use Options Like A PRO (Hedge Fund Strategy)

BUYING PUT OPTIONS MISTAKE TO AVOID! | BUYING PUTS - (EP. 112)

Best Put Option to Buy NOW (Use this Options Play to Hedge Your Portfolio)

Hedge a stock portfolio with E-mini S&P 500 futures and options

How I hedge a Synthetic Long

Why Hedge a Stock Position When You Can Just Sell the Shares?

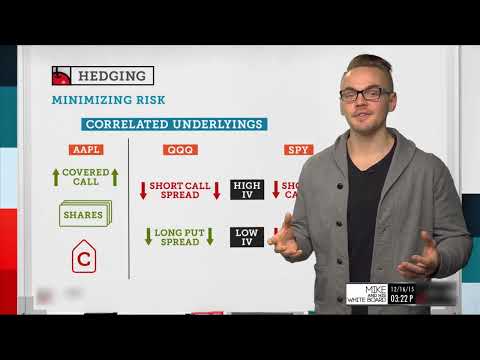

How to Hedge Your Positions | Options Trading Concepts

How to hedge stock portfolio - Hedge with Options in SPY

Hedging in Option Trading? How to Hedge Your Positions in Stock Market?

Hedging Explained - The Insurance of Investing

How to hedge your portfolio? | Safeguard using futures and options | CA Rachana Ranade

Комментарии

0:03:06

0:03:06

0:07:24

0:07:24

0:10:40

0:10:40

0:08:50

0:08:50

0:15:04

0:15:04

0:12:57

0:12:57

0:11:02

0:11:02

0:07:56

0:07:56

0:12:04

0:12:04

0:08:31

0:08:31

0:09:57

0:09:57

0:10:07

0:10:07

0:03:44

0:03:44

0:20:47

0:20:47

0:11:37

0:11:37

0:08:15

0:08:15

0:32:35

0:32:35

0:02:06

0:02:06

0:08:14

0:08:14

0:13:53

0:13:53

0:12:09

0:12:09

0:16:39

0:16:39

0:12:35

0:12:35

0:15:03

0:15:03