filmov

tv

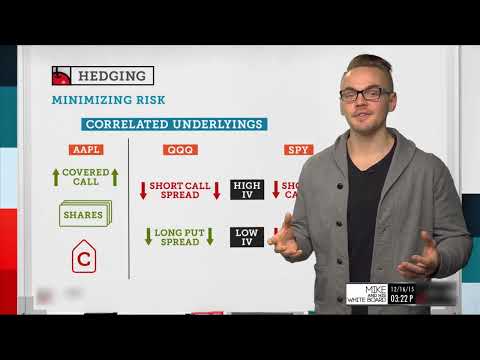

How to Hedge Call or Put Options | Options Trading Strategies

Показать описание

Hedging your positions can save you from a lot of emotion & discouragement! It protects your premium from sudden turns in the market. Make sure to understand this concept before buying naked calls & puts!

My Studio Equipment

Disclaimer: This content on this channel has been prepared for entertainment purposes only and is not intended to be used to make investing decisions.You should never invest in the securities of any companies talked about on this channel. Consult a financial professional before making any financial decisions.

#options #hedge #optionstrategy

How to Hedge Call or Put Options | Options Trading Strategies

How To Hedge Yourself In Uncertain Market Times

What are Call and Put Options? How to Hedge Portfolio Against Risk?

Hedging in Option Trading? How to Hedge Your Positions in Stock Market?

Hedging Explained - The Insurance of Investing

How to hedge your portfolio? | Safeguard using futures and options | CA Rachana Ranade

How I hedge a Synthetic Long

How to Hedge Your Positions | Options Trading Concepts

Hedging with Jorge #Episode 60: Put options explained using a car insurance analogy

Benefits of Hedging

#How to use Hedging Strategy

Banknifty option selling Hedging strategy

SIMPLEST WAY TO HEDGE IN FOREX

Option Hedging vs Option Buying #optiontrading #trading #banknifty #tradewithvikas

Hedge trade | future with call option | #stockmarket #trading

How to Hedge a Trade Using Options [Long Call Condor HEDGE]

Banknifty option buying Hedging strategy 2500+ profit

Hedge Your Portfolio Like A Pro

How to Hedge Against a Volatility Increase?

How To Use Hedge ❓👍

Forex Hedging Strategy part 1

Call Options for Beginners

HADGE POSITION #nifty #banknifty #stockmarket #trading #grow

How do you hedge a bet? | Sports Betting 101: What is a Hedge Bet & How to Hedge Bets

Комментарии

0:15:04

0:15:04

0:00:41

0:00:41

0:17:18

0:17:18

0:16:39

0:16:39

0:12:35

0:12:35

0:15:03

0:15:03

0:02:06

0:02:06

0:13:53

0:13:53

0:07:41

0:07:41

0:01:00

0:01:00

0:00:16

0:00:16

0:00:13

0:00:13

0:01:01

0:01:01

0:00:21

0:00:21

0:00:21

0:00:21

0:02:52

0:02:52

0:00:16

0:00:16

0:10:07

0:10:07

0:01:23

0:01:23

0:00:38

0:00:38

0:00:55

0:00:55

0:01:00

0:01:00

0:00:15

0:00:15

0:00:32

0:00:32