filmov

tv

Commodity Taxes

Показать описание

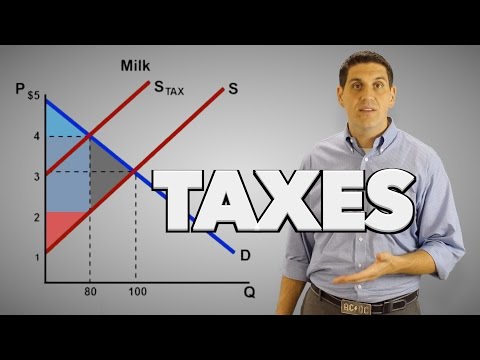

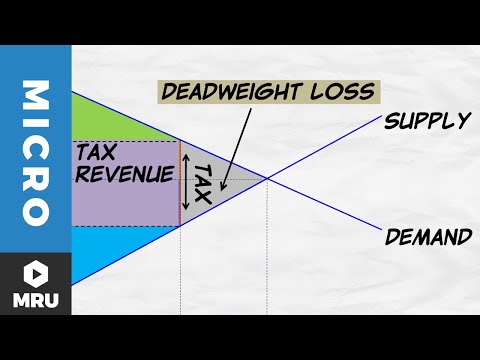

In this video we cover taxes and tax revenue and subsidies on goods. We discuss commodity taxes, including who pays the tax and lost gains from trade, also called deadweight loss. We’ll take a look at the tax wedge and apply what we learn to the example of Social Security taxes.

00:00 Intro

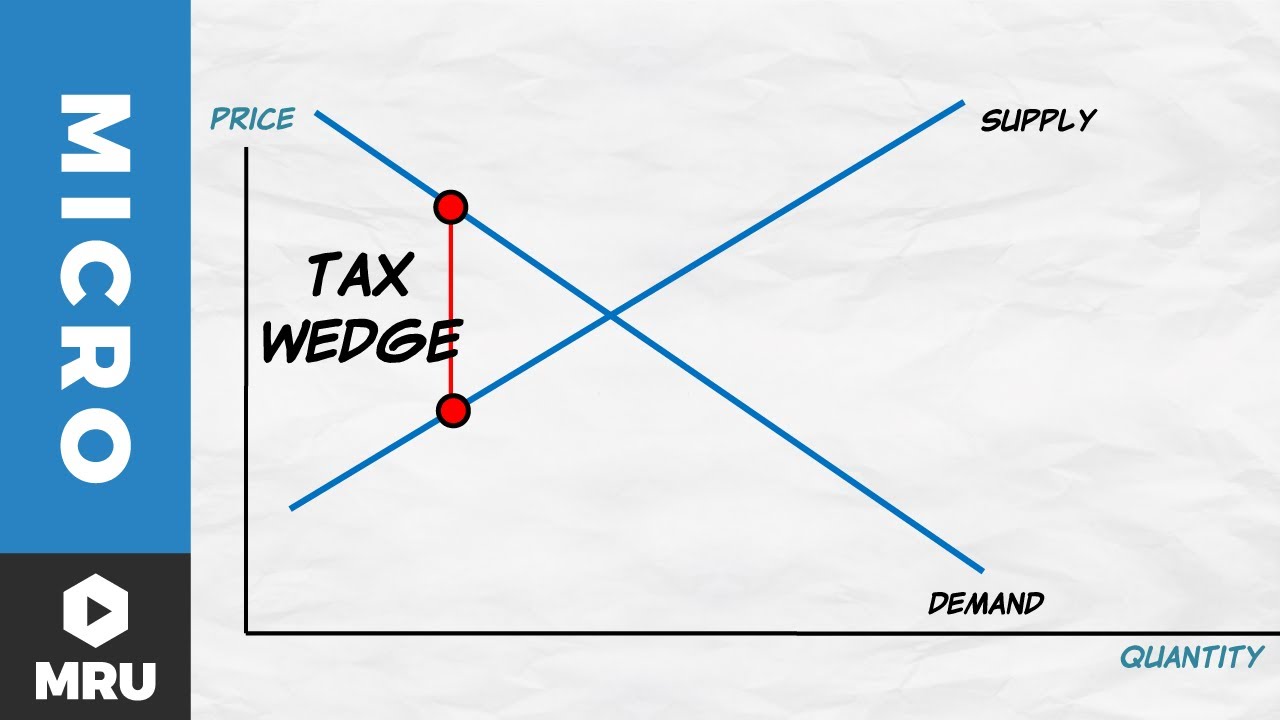

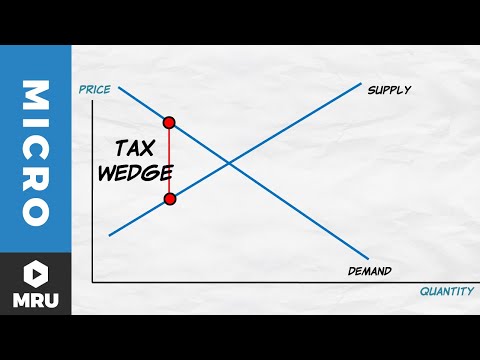

00:35 Three important ideas about commodity taxation

02:00 Who pays the tax? Tax "on" sellers

03:54 Tax "on" buyers

06:50 The tax "wedge"

08:38 Tax wedge example – Social Security Taxes

00:00 Intro

00:35 Three important ideas about commodity taxation

02:00 Who pays the tax? Tax "on" sellers

03:54 Tax "on" buyers

06:50 The tax "wedge"

08:38 Tax wedge example – Social Security Taxes

Commodity Taxes

Taxes on Producers- Micro Topic 2.8

MIT 14.41 Lecture 19: Optimal Commodity Taxation, Optimal Income Taxes, Tax-Benefit Linkages

Impact of a Commodity Tax

Optimal Commodity Taxation: Numerical Example I

Commodity Trading: Charges, Taxation, and Long-Term vs Short-Term Strategies | Episode 6

Tax Revenue and Deadweight Loss

Commodity taxation rules

Sanctions Effect: Profit Of Russian Companies In 2024 Declined By 6.9%

Tax Reporting of Commodity Wages

Economic Effects of a Commodity Tax

Commodity close-up: Farmers and Taxes

Commodity Trading: Understanding the tax-related risks for home and host countries

Taxes Before Coins #sumer #egypt #taxes #money #coins #commodity #history #ancient #shorts

Paying Corporate & Commodity Taxes & Levies Online – Tax & Revenue Administration

Defining Commodity Tax, Incidence of Tax, and Tax Revenue

NUP leader Kyagulanyi proposes how to curb high commodity prices

How to calculate Excise Tax and determine Who Bears the Burden of the Tax

Incidence of Commodity Taxes . B. A PART III. ( Public Finance)

COMMODITIES CCT AND COMMODITY TRANSACTION

Commodity Codes Explained

What is PMEX? How to Trade & Invest in PMEX | Commodity Market Explained for PSX Investors

Commodity Returns and Taxes

How Renaissance Used Options To Dodge Taxes #Shorts

Комментарии

0:10:31

0:10:31

0:05:58

0:05:58

0:59:48

0:59:48

0:08:15

0:08:15

0:06:59

0:06:59

0:03:41

0:03:41

0:11:31

0:11:31

0:02:18

0:02:18

0:10:08

0:10:08

0:03:10

0:03:10

0:14:44

0:14:44

0:00:41

0:00:41

1:14:31

1:14:31

0:00:12

0:00:12

0:04:08

0:04:08

0:05:17

0:05:17

0:02:30

0:02:30

0:06:25

0:06:25

0:12:56

0:12:56

0:01:39

0:01:39

0:03:33

0:03:33

0:04:18

0:04:18

0:17:59

0:17:59

0:00:50

0:00:50