filmov

tv

Top 5 Reasons to Convert a Sole Proprietorship to an LLC!

Показать описание

JOIN THE TAX-FREE WEALTH CHALLENGE NOW! OCTOBER 14-18, 2024!

Learn the rich's tax secrets with my new book! Click the link below

Set up your LLC with BetterLegal and get $100 OFF

Taking the Next Step:

We earn commissions if you shop through the links below.

My Tax Strategy Programs:

Check out these links Below!

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#taxes #taxfreeliving #taxexpert #taxreduction #llc

Learn the rich's tax secrets with my new book! Click the link below

Set up your LLC with BetterLegal and get $100 OFF

Taking the Next Step:

We earn commissions if you shop through the links below.

My Tax Strategy Programs:

Check out these links Below!

*Disclaimer: I am not a financial advisor nor am I an attorney. This information is for entertainment purposes only. It is highly recommended that you speak with a tax professional or tax attorney before performing any of the strategies mentioned in this video. Thank you.

#taxes #taxfreeliving #taxexpert #taxreduction #llc

Top5 Reasons People Convert to Islam- Part5 #shorts #islamic_video #convertmuslim #converttoislam

Top 5 Reasons People Convert to Islam | Australian Reaction #jimbs #islam #quran #thereisnoclash

Top 5 Reasons to Convert a Sole Proprietorship to an LLC!

Unstoppable Spread of Islam! - Here's why Millions Convert!

10 European Countries Where MUSLIMS RAPIDLY Convert To CHRISTIANITY EVERY DAY

Top 5 Reasons Why You Should Convert Your Bike to Electric #Electricbike #Ecofriendly #ebike

Joe Rogan shares a crazy muslim convert story

She is New Convert to Islam || Learning How to Pray ☪️️

Convert gets emotional when learning to Pray || Convert to Islam☪️️

Bad Reasons to Convert and Stay Orthodox (Pencils & Prayer Ropes)

What Helps Protestants Convert to Catholicism? (#AskBishopBarron)

ROTH IRA: The Best Age to Convert IRA to ROTH IRA

Why Would A Protestant Christian Convert to Eastern Orthodox Christianity?

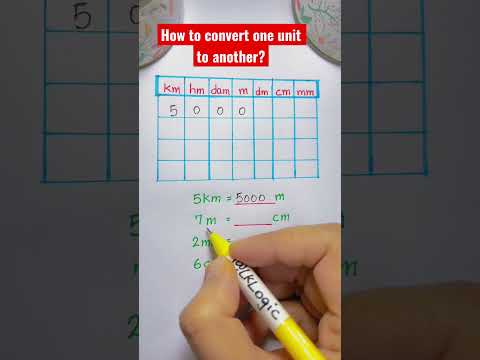

How to convert from one unit to another?

Unit Conversion | Conversion of Unit | How to Convert Units ( km, m, kg, g, cm, mm ) #shorts #units

5 Reasons NOT To Convert Your Acoustic Drums Into Electronic Drums

How to convert normal inverter to Solar inverter | how to make solar inverter | solar system #shorts

how to convert your handwriting to a text automatically in samsung notes on your Tablet S7 FE? 🍉

How to convert Fraction to a Decimal? #math #tutor #youtube #shorts #mathtrick #learning

Convert Hindu Arabic to Roman Numerals/Roman Number Trick #math #shorts #artikipathshala #shortsfeed

11 Month of hardwork to convert A dream into reality LAMBORGHINI TERZO🔥 #lamborghini #tannadhaval

How Did SPAIN Convert From An ISLAMIC Country To CHRISTIAN

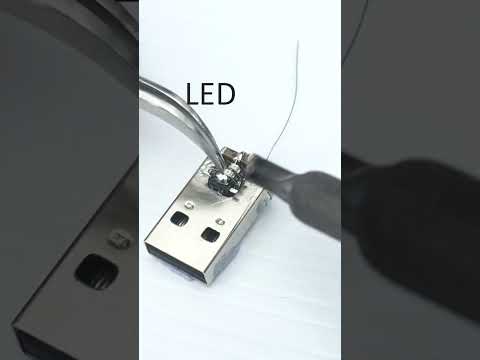

Never Buy Batteries Again: How to Convert Your Batteries to USB Charging

Hack for all ages | convert mixed fraction to improper fraction #math #shorts #mathematics #maths

Комментарии

0:00:41

0:00:41

0:10:58

0:10:58

0:15:48

0:15:48

0:14:22

0:14:22

0:22:36

0:22:36

0:00:46

0:00:46

0:00:34

0:00:34

0:00:12

0:00:12

0:00:47

0:00:47

0:15:28

0:15:28

0:02:41

0:02:41

0:02:56

0:02:56

0:05:36

0:05:36

0:00:44

0:00:44

0:00:29

0:00:29

0:12:19

0:12:19

0:00:21

0:00:21

0:00:17

0:00:17

0:00:29

0:00:29

0:00:16

0:00:16

0:00:59

0:00:59

0:13:14

0:13:14

0:01:00

0:01:00

0:00:23

0:00:23