filmov

tv

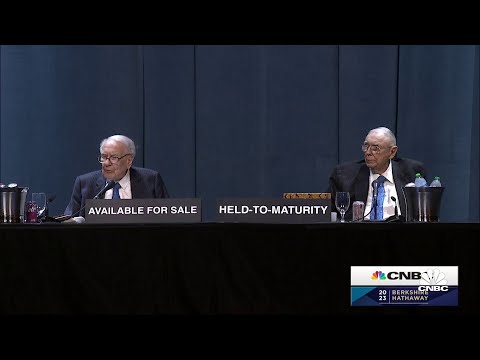

Warren Buffett: American Debt Is Totally Out Of Control

Показать описание

Warren Buffett doesn't often share his views on the risks associated with very high debt levels, but in this video, he explains why too much debt may be risky for the United States as time goes on.

Warren Buffett: American Debt Is Totally Out Of Control

Warren Buffett on the US debt ceiling

Warren Buffett: US debt isn't a problem.

Warren Buffett's Eye-Opening Analogy of US Debt

Warren Buffett's Perspective on USA Debt

Warren Buffett: Could the US default on its bonds?

Warren Buffett: There's no option for any reserve currency other than the U.S. dollar

Warren Buffett on government debt.

Warren Buffett says 'America will Not Default on its Debt' (2020)

Warren Buffett Explains the 2008 Financial Crisis

Why Warren Buffett Said No to Lehman and AIG in 2008

WARREN BUFFETT-DEBT CEILING AS A WEAPON?

13 year old asks Warren Buffett about the U.S dollar losing its reserve currency status😮

📉💡 Warren Buffett's | US Debt Crisis

How to Fix the National Debt, by Warren Buffett.

Warren Buffett's Last Warning: U.S. Debt is Out of Control

Warren Buffet explains how one could've turned $114 into $400,000 by investing in S&P 500 i...

'Why I Fire People Every Day' - Warren Buffett

Warren Buffett: The Debt Ceiling Argument Is Really Stupid

Warren Buffett on debt and trade deficits (2001)

Warren Buffett on fixing National Debt in just 5 minutes #Warrenbuffett #success #wealth #shorts

Warren Buffett on banking crisis fallout and why he sold most of his bank stocks except one

Should we reduce the Federal debt? || Warren Buffett #investing #shorts #debt #warrenbuffett

IS THIS WHY MOST AMERICANS ARE IN DEBT? | WARREN BUFFETT | @DIY_KRISSY.

Комментарии

0:09:03

0:09:03

0:05:34

0:05:34

0:03:37

0:03:37

0:04:25

0:04:25

0:10:38

0:10:38

0:02:36

0:02:36

0:05:22

0:05:22

0:00:24

0:00:24

0:02:39

0:02:39

0:05:31

0:05:31

0:05:03

0:05:03

0:00:32

0:00:32

0:05:58

0:05:58

0:00:55

0:00:55

0:00:41

0:00:41

0:06:11

0:06:11

0:00:50

0:00:50

0:04:23

0:04:23

0:13:14

0:13:14

0:06:02

0:06:02

0:00:41

0:00:41

0:02:05

0:02:05

0:00:41

0:00:41

0:00:29

0:00:29